RDAs bring in only $141m in Feb

Inflows remain below average receipt of $178m per month

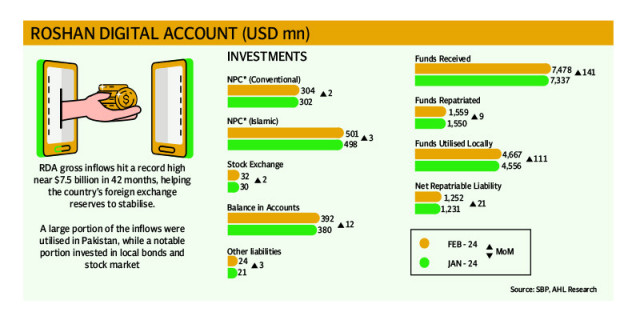

Pakistan received $141 million through Roshan Digital Accounts (RDA) from overseas Pakistanis in February, bringing total inflows to nearly $7.5 billion in the first 42 months of the scheme to date.

Although the latest monthly inflows remained below the average receipt of $178 million per month since the introduction of the accounts in September 2020, they played a significant role in stabilising the country’s foreign exchange reserves and supporting the rupee against the US dollar and other major currencies.

Inflows have consistently lagged below the monthly average since the outbreak of political crisis in the country two years ago. Political upheavals have disrupted domestic economic activities and eroded confidence among expatriates in the national leadership.

Speaking to The Express Tribune, Yousuf Rahman, Head of Research at KASB Securities, anticipates that inflows have the potential to return to near-peak levels of $250 million per month or more, translating into a gross inflow of at least $3 billion annually. He estimates that inflows will gradually improve to their potential level after the successful conclusion of ongoing talks for the last tranche of $1.1 billion and the securing of a new, larger, and longer-tenured package from the International Monetary Fund (IMF), following the completion of the ongoing $3 billion programme in March-April 2024.

The acquisition of a new loan programme could instil confidence in overseas Pakistanis that the country has a solid plan to repay maturing foreign debt on time. This will encourage them to inject more funds into the domestic economy, as the rate of returns on investment instruments designed especially for them remains attractive, he said.

Furthermore, the new loan programme would support policymakers in gradually increasing economic activities and achieving political stability. Both political and economic stability should encourage them to invest their savings in Pakistan, which offers good returns in line with global practices.

Despite previous revisions by the government to increase the rate of return on foreign currency- and rupee-denominated local bonds for overseas Pakistanis, inflows have decreased over time.

RDA data breakdown

According to the State Bank of Pakistan’s (SBP) data, gross inflows increased to $7.48 billion in the month under review from $7.34 billion in the prior month of January 2024.

The breakup of the data suggests that net inflows currently stand at $1.25 billion. Non-resident Pakistanis have withdrawn $1.56 billion out of the total dispatches in the past 42 months and utilised another $4.67 billion in the homeland.

Out of the total repatriable funds amounting to $1.25 billion, they have invested $304 million in conventional Naya Pakistan Certificates (NPC), injected another $501 million in Shariah-compliant NPC, purchased shares worth $32 million at the Pakistan Stock Exchange (PSX), parked $392 million in accounts in banks in Pakistan, while other liabilities stood at $24 million.

Rupee closes stable

The Pakistani currency closed stable at a five-and-a-half-month high of Rs278.63 against the US dollar in the interbank market, maintaining the previous four-day gains on Tuesday.

The currency maintained the closing level for the second successive day amid a one-day extension in the ongoing talks with the IMF for the next tranche of $1.1 billion under the near-completion $3 billion loan programme and for securing a new loan programme once the current programme concludes in March-April 2024.

Additionally, the release of RDA numbers during the day likely encouraged importers and exporters to keep the rupee-dollar parity stable.

According to SBP data, the domestic currency has cumulatively strengthened by 10.21% or Rs28.47 in the past over six months to date compared to the all-time low of Rs307.10/$ hit in the first week of September 2023.

Market talks suggest that the maintenance of the policy rate by the central bank at a record 22% on Monday supported the rupee to remain strong, as any rate cut would have increased demand for the greenback and caused a slight depreciation in the local currency.

The talks of China and other bilateral creditors rolling over deposits worth over $2 billion also supported the rupee to remain steady.

In the open market, the currency extended gains by Rs0.05 on a day-to-day basis, surging to Rs281.15 against the greenback, according to the Exchange Companies Association of Pakistan (ECAP).

Rahman said the high policy rate and high inflation have suppressed aggregate demand in the domestic economy, resulting in low demand for foreign currency for imports compared to better supplies.

Published in The Express Tribune, March 20th, 2024.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ