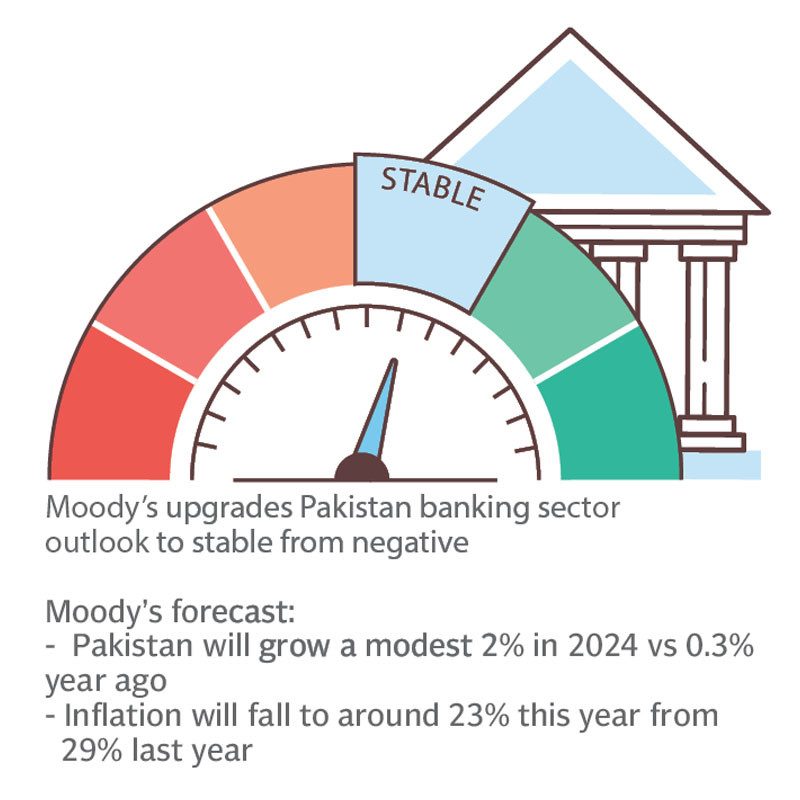

Moody’s Investors Service has upgraded Pakistan’s banking sector outlook to stable (Caa3) from negative, believing the financial institutions’ solid profitability and stable funding and liquidity provide an adequate buffer to withstand the country’s macroeconomic challenges and political turmoil.

The global rating agency maintained “economic and fiscal pressures are easing (on Pakistan)”, projecting the country’s economy would return to modest growth of 2% in the current fiscal year 2023-24 after contrasting 0.3% in the prior fiscal year 2022-23.

Besides, the country’s inflation reading is anticipated to reduce to a monthly average of 23% in FY24 compared to 29% in FY23, it added.

Recovery from the 2022 floods and low base effects will support a modest economic recovery in Pakistan, though challenging external conditions and tight monetary policy will keep growth below potential.

However, high-interest rates and inflation will continue to curb private-sector spending and investment. Furthermore, banks are financing the sovereign’s wide fiscal deficits, “leaving little space to lend to the real economy.”

Pakistani banks remain highly exposed to the government via large holdings of government securities that amount to around half of total banking assets, which links their credit strength to that of the sovereign.

Pakistani authorities have historically supported banks in difficulty, with no depositor losses recorded, and remain willing to do so given banks’ role as the main source of government financing. Deposit insurance of Rs500,000 per depositor covers about 94% of individual depositors and 15% of banks’ total deposits.

“However, the government’s capacity to provide support is constrained by the fiscal challenges that drive its Caa3 rating, which also constrains Pakistani banks’ deposit ratings at this level.”

Moody’s rates the five largest banks in Pakistan namely National Bank of Pakistan, Habib Bank Limited, Allied Bank Limited, United Bank Limited, and MCB Bank Limited. The five banks together account for 46% of system deposits, as of September 2023, and all have baseline credit assessments of Caa3. Islamic banking is evident in Pakistan, with a market share of only 19% of total banking assets as of December 2023.

Government securities account for 51% of Pakistani banks’ total assets and around nine times their equity, among the highest levels for Moody’s-rated banks globally. This exposure links banks’ credit profiles to that of the Caa3 Pakistani sovereign, for which concerns around debt restructuring persist, and banks will remain the main source of government financing over our outlook period.

The problem loans (non-performing loans/NPLs) ratio of the Pakistani banks Moody’s rate rose to 8.5% as of September 2023, up from 7.3% in December 2022, following severe shocks that subdued economic growth and as historically high inflation and interest rates erode borrowers’ repayment capacity. “We expect problem loans to stabilise at around 9% of gross loans, partly because of the banks’ reluctance to lend in this challenging environment (loan growth was flat in 2023). The expected introduction of IFRS 9 accounting standards in 2024 will likely increase provisioning needs.”

Moody’s expects Pakistani banks’ interest revenue – the largest contributor to operating income – to moderate in 2024, with monetary policy beginning to ease as inflation and interest rates gradually recede from 2023 peaks. However, NIMs (4.3% as of September 2023) will remain generally strong in 2024, driven by high investment income from government securities holdings, while banks optimize their cost of funds.

Subdued business and lending activity will keep interest on lending and non-interest income in check. Operating expenses will likely stabilise in line with easing inflation and banks’ cost-control efforts. Persistently elevated tax rates and potentially higher loan-loss provisions will weigh on banks’ bottom-line profitability, with the return on average assets hovering around 3%.

Deepening financial inclusion and remittances from non-resident Pakistanis are broadening domestic deposit inflows. Banks are mainly deposit-funded, with customer deposits accounting for 58% of total assets as of September 2023, and have very low reliance on more volatile market funding (5.6% of tangible assets as of December 2022) given limited access to international debt markets.

However, the cost of funds is rising moderately as high-interest rates have driven a migration to interest-bearing deposits from non-interest-bearing deposits, which were down to 74% of total system deposits as at end-2023 from 75.2% a year earlier.

The introduction of a Treasury Single Account – which requires government deposits to be held at the State Bank of Pakistan – will have only a modest impact on deposit outflows. Banks have sufficient liquidity buffers, with around 12% of assets held as cash and interbank placements and another 51% invested in government securities.

However, the global rating agency estimates that around 40% of banks’ government securities holdings are encumbered, placed as collateral with the central bank with the newly raised liquidity used to buy more government bonds. Pakistani banks have limited reliance on dollar funding and generally run matched currency positions.

Published in The Express Tribune, March 8th, 2024.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ