Bourse rises modestly on debt settlement hopes

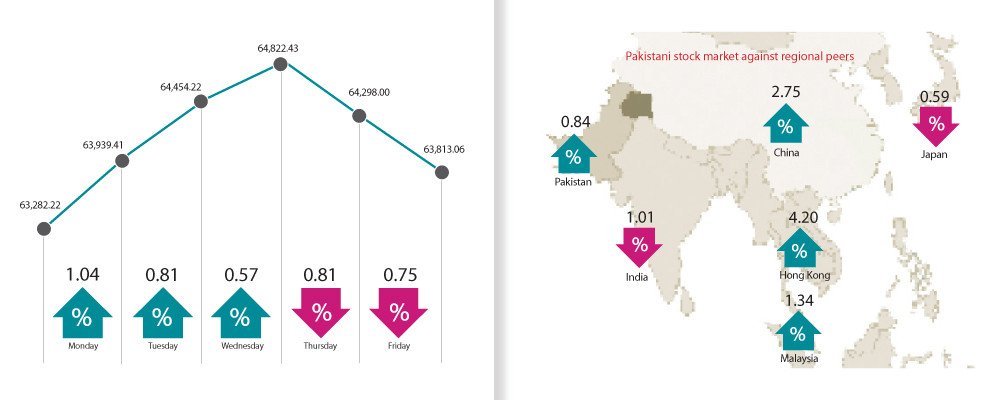

KSE-100 index adds 531 points, or 0.84% WoW, settles at 63,813

Pakistan Stock Exchange (PSX) rose modestly by over 500 points during the outgoing week as investors snapped up stocks of exploration and production (E&P) companies in the hope of hefty dividend payouts and settlement of circular debt in the energy sector.

Pakistani rupee stability and a rise in central bank’s foreign exchange reserves further aided the market’s momentum.

However, pre-poll uncertainty and scepticism about the circular debt reduction plan barred many market players from building their portfolios.

Selling pressure in some sectors prompted investors to resort to profit-booking because of concerns about macroeconomic stability post-general elections.

Uncertainty about the International Monetary Fund’s (IMF) approval of the proposed Rs1.27 trillion circular debt settlement plan and a downbeat industrial earnings outlook amid surging gas tariffs restricted the KSE-100 index’s advance.

At the beginning of the week on Monday, the market opened on a bullish note, fuelled by late-session speculation about government’s resolve to partially settle power-sector circular debt along with restoration of diplomatic ties with Iran.

Stocks continued to rise the following day and notched up significant gains, surpassing the 64,000 barrier in a rally powered by the strengthening rupee and foreign corporate inflows. Bulls maintained their hold on Wednesday as well when the index extended its rally and closed near the 65,000 mark on optimism about the settlement of circular debt.

Next day, the bourse registered losses after giving up earlier gains as investors opted for profit-booking in the wake of uncertainty about the circular debt reduction plan. On Friday, investor speculation about the upcoming monetary policy and worries over the growing circular debt took their toll on the PSX, which shed nearly 500 points.

Overall, the benchmark KSE-100 index climbed 531 points, or 0.84% week-on-week (WoW), and settled at 63,813.06.

JS Global analyst Shagufta Irshad, in her review, wrote that the KSE-100 recorded gains of 0.8% WoW during the outgoing week. Average volumes improved 48% WoW to $73 million. For the equity market, top trending news was the energy sector circular debt while the local media highlighted that the Special Investment Facilitation Council (SIFC) had given directives to approach the IMF for approval of the Rs1.27 trillion circular debt settlement plan, she said.

Of the total amount, Rs556 billion would go to OGDC, Rs126 billion to PPL and Rs29 billion to PSO.

Hopes of hefty dividend payouts by E&P firms led to a “run-up in their stock prices”. Political environment remained heated with aggressive election campaigns by mainstream parties, she said.

On the macro front, the State Bank of Pakistan’s (SBP) reserves rose 3% to $8.3 billion, reflecting that the IMF tranche had been adjusted for debt repayments.

In T-bills and Ijarah Sukuk auctions during the week, the cut-off rates decreased 50, 56 and 62 basis points for three, six and 12-month T-bills and dropped 60 and 120 basis points for one and three-year Sukuk.

The government also announced a reduction in National Savings Scheme rates by 12 to 46 basis points, the JS analyst added.

Arif Habib Limited (AHL), in its report, observed that stocks witnessed a rally at the onset of the week following reports of government’s plans to release Rs1,250 billion to reduce circular debt in the energy chain. However, during mid-week, the market turned red given the Ministry of Finance’s objections to the energy ministry’s draft plan to resolve the circular debt crisis.

Meanwhile, Pakistani rupee closed at 279.59 against the US dollar, strengthening by Rs0.30, or 0.11% WoW. The stock market closed at 63,813, climbing up 531 points, or 0.84% WoW, AHL said.

Sector-wise, positive contributors were oil and gas exploration (319 points), commercial banks (273 points), fertiliser (114 points), cement (30 points) and leather and tanneries (25 points).

During the week, foreign investors sold shares worth $22.7 million compared to net selling of $1.2 million last week, AHL added.

Published in The Express Tribune, January 28th, 2024.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ