New BRICS, new voice for Global South

Clear divisions over the Middle East crisis underscore the pressing need for an alternative to the US-led world order

This week was an eventful one for the ever-escalating crisis in the Middle East, with a few critical

developments on both the Gaza and Red Sea fronts. The International Court of Justice took up a case

brought forth by BRICS member South Africa to prevent the genocide of Palestinians in Gaza at the

hands of Israel. The first two days of proceedings, which saw the legal representatives of South Africa

and Israel present their opening arguments, drew contrasting reactions from the ‘West and the rest’.

While much of the Global South and sympathetic voices in the Western nations hailed South Africa,

some key governments from the Global North rejected outright the main premise of the case. Germany,

declared its intention to intervene on Israel's behalf as a third party in the ICJ and dismissed the

accusation of genocide while affirming its support for Israel's right to self-defence. The United States

and Canada, similarly, announced that believed the case was ‘baseless’, even as Israel’s brutal offensive

in Gaza has claimed more than 23,000 lives, over 10,000 of them children.

Meanwhile, in response to for months of attacks by Houthi forces on Red Sea shipping, the United

States and United Kingdom launched dozens of air strikes across Yemen in what marked a serious

escalation in the conflict. US President Joe Biden held up the strikes as a “clear message that the United

States and our partners will not tolerate attacks on our personnel or allow hostile actors to imperil

freedom of navigation." The leaders of Yemen’s Houthi forces vowed to continue their attacks on

shipping for as long as Israel’s war on Gaza continues while threatening that “all American-British

interests have become legitimate targets for the Yemeni armed forces.”

As with the proceedings in ICJ, the reactions to the strikes by the US and the UK highlighted the sharp

split between the West and the region. While the nations seen as part of the US-led world order framed

the development as ‘defensive’ and tried to isolate it from Israel’s war in Gaza, Middle Eastern nations,

including Saudi Arabia, Egypt and Iran voiced grave apprehension and called for avoiding escalation.

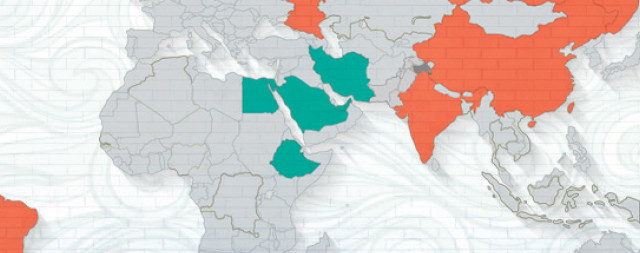

This month, Saudi Arabia, Egypt and Iran, along with the United Arab Emirates and Ethiopia, formally

became part of the BRICS bloc, accepting the invitation extended to them by the five titular members at

last year’s summit in Johannesburg. Together, the 10 nations now represent 45 per cent of the world’s

population and, with a combined economy worth over $28.5 trillion, account for roughly 28 per cent of

the global economy. With the inclusion of the new members, they will also be producing about 44 per

cent of the world's crude oil.

Political divergences

While most of the analytical output on the potential and future of BRICS has focused on economy and

trade implications, the timing of developments in ongoing conflict in the Middle East draws sharp

attention towards the expanded grouping’s political impact. Under the US-led Western world order, the

Global South has often found itself a silent spectator to unilateral geopolitical actions. A mix of

militarism and economic ‘carrots and sticks’ have left many nations with no choice but to face the fallout, such as in the case of American intervention in Iraq and Afghanistan. Issues that have been the

direct result of those ill-thought out wars continue to plague both those countries and their neighbours

to this day.

Similar unilateralism appears evident in the Israel-Palestine and Red Sea crisis – despite calls for tackling

the root of the issue, the United States has been upping the ante. Both Washington and other Western

governments have also sought to compartmentalise the two even though those issues and many others

that plague the Middle East and the rest of the Muslim world remain interconnected.

A recent opinion piece for China Daily by Sri Lankan analyst Maya Majueran, which explored the positive

political influence an expanded BRICS can wield, touched upon this aspect. Washington and its Western

allies, Majueran wrote, have long imposed their own policies and values on other nations under pretext

of promoting and safeguarding democracy and human rights. “Worse, they have been bullying some

emerging market and developing economies, forcing them to take sides in disputes with countries that

don't adhere to the Western-centric ideology and policies.”

These double standards, the analyst pointed out, were starkly evident from the contrast between US

support for Israeli aggression and the pressure Washington put on Global South nations to condemn

Russia’s actions in Ukraine. The BRICS, so far, appear to be focused on bringing about a ‘fairer’ world

order for the Global South, Majueran argued. “The Global South wants to improve the existing world

order because it is unfair and Western-centric,” he wrote.

Global economic overhaul

One tool the United States has frequently used to keep global governments in line with its geopolitical

and geoeconomic aims has been its currency. The US dollar, the Sri Lankan analyst wrote, has allowed

Washington to perpetuate its hegemony. The sanctions and trade restrictions the US placed on nearly

40 countries that run counter to American objectives have resulted in immense hardships for nearly half

of the world’s population.

BRICS discussions to bring about an alternative currency for global trade transactions could result in

potent counter to what Majueran termed the ‘weaponisation of the US dollar’. “If BRICS' plan to adopt a

common currency to conduct global trade is successful… it could break the dollar's global hegemony and

make it easy for emerging economies to conduct free trade in currencies other than the dollar,” he

suggested.

In an interview with Sputnik a few days after Iran formally joined BRICS, the country’s deputy foreign

minister voiced interest in an alternative to the dollar. “We are interested in creating a unified currency

in the BRICS group, and this could be very effective,” Mahdi Safari said. “By using national currencies,

the process of eliminating the use of the dollar in commercial exchanges begins, and we are interested

in continuing this process,” he added.

BRICS members Russia and Iran have already officially abandoned the SWIFT payment system for cross-

border transactions. Instead, the two countries will initiate payments to settle international trade using

direct transfers between the banks of both countries.

An article carried by the UAE state-owned English-language daily The National anticipated more bilateral

trade in local currencies following the inclusion of new members into BRICS. “The implication we are

watching closely from the addition of Saudi Arabia, the UAE and Egypt to BRICS is the potential for more

bilateral trade in local currencies, particularly following the UAE and India's agreement reached in July,

and Egypt being in similar discussions with India already,” the article quoted Carla Slim, an economist at

Standard Chartered Bank, as saying. India has already started purchasing UAE oil in Indian rupees.

The article also expected that calls for overhauling the international monetary system and developing a

US dollar alternative would grow with BRICS expansion – “…even if less relevant today, the emergence

of BRICS common currency can act as a major harbinger in diversifying risks away from the stronghold of

the dollar,” it quoted Dubai-based professor of finance Ullas Rao as saying.

Infusion of finance

Up until last year, analysts, especially in Western publications, consistently downplayed the potential of

BRICS and emphasised how its five titular member nations, collectively, had failed to live up to economic

expectations. The formal inclusion of oil- and finance-rich Saudi Arabia and the UAE could allow the

grouping to challenge that perception and enable it to empower new economic initiatives, such as the

New Development Bank.

“The image of Brics in the past was of a financially vulnerable group, beholden to the global political

superpowers. The financial power of Saudi and the UAE as net exporters of capital to the rest of the

world will substantially change that perception,” the National quoted Gary Dugan, chief investment

officer at Dalma Capital, as saying. “Also as a collective, we expect Saudi Arabia and the UAE to be

afforded easier access to the growth markets of the BRICS countries on favourable terms,” he added.

An analysis by the Stimson Center last year explored in particular the impact the UAE could have as a

member of the BRICS, particularly on the NDB initiative, which has faced difficulties particularly due to

Western sanctions against Russia.

“The UAE could inject much-needed liquidity into the NDB,” the analysis noted, adding that the Gulf

nation’s substantial financial resources, including its sovereign wealth fund, could be leveraged to

provide direct capital contributions. “Moreover, the UAE’s expertise in finance and infrastructure

development could be valuable in structuring and managing NDB projects efficiently, attracting more

funding from both within and outside the BRICS alliance,” the analysis added.

Energy factor

With the inclusion of Saudi Arabia, Iran and the UAE, the BRICS grouping can now boast of being a major

player in the world’s energy market. China and India are already the second and third biggest consumers

of oil in the world with strong ties to Gulf countries. The two other new entrants, Egypt and Ethiopia,

also provide BRICS a firm foothold in one of the world’s major shipping corridors, from the Horn of

Africa to the Suez Canal.

Iran’s deputy foreign minister Safari, in his interview with Sputnik, highlighted the positive role the

expanded BRICS could play in terms of energy in particular. “The most important problem is represented

by three issues: the first is energy production, the second is energy transfer, and the third is energy

consumption. I can say that these three issues are being solved by BRICS.”

Experts quoted by the UAE-state-owned The National underscored the influence the expanded BRICS

now had on the world’s oil and energy markets. “The addition of two major oil exporters … will reinforce

their bargaining power and influence in OPEC+ while also offering the space for them to align their

strategies with other BRICS members,” it quoted commodities and emerging markets expert Ehsan

Khoman as saying. By virtue of its influence on OPEC+, the BRICS grouping is poised to become a

powerful voice for the Global South, Khoman added.

“The prospect of Saudi Arabia, the UAE, Iran and Egypt joining BRICS creates new mechanisms that

forces a degree of political co-operation by all the countries,” said Ayham Kamel, another expert quoted

in the article. “The Arab countries are looking for improving their global geopolitical influence and

appear committed to avoiding detachment from the West,” he stressed, however.

As the BRICS contain many members that overlap with the G20, they may work in tandem in the future,

a BBC article quoted Dr Irene Mia from the International Institute for Strategic Studies as saying.

"Together, they might push for more money for developing nations to tackle climate change, or to

reduce the power of the US dollar as the world's currency," she said.

In the case of UAE in particular, the Stimson Center analysis noted that membership in the BRICS did in

no way mean a detachment from the West. “The UAE wants to maintain its strong ties with the US while

simultaneously exploring new avenues for collaboration and engagement with BRICS nations,” it stated.

“The UAE remains a vital US security partner in the Middle East. However, the Emirates appears to be

recalibrating its economic diplomacy to expand its political and economic leverage in the Global South.”

In a statement issued by the UAE following its formal inclusion into BRICS, the Gulf nations Minister of

State for International Cooperation, Her Excellency Reem Al Hashimy, said: “We are pleased to join the

BRICS group, which the UAE recognizes as a mechanism to promote global peace, stability, and

prosperity.”

“The UAE believes in championing multilateralism and actively contributing to important international

arenas. This includes engaging with BRICS, participating regularly in the G20 process, and hosting the

Conference of the Parties to the UN Framework Convention on Climate Change (COP28) climate

conference in November,” she concluded.

“The UAE stresses that the future of global security and prosperity relies on strong multilateral

partnerships and cooperation on the international level, and a shared commitment to achieving stability

and development.”

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ