‘Turkey’s intl debt sales could hit record in 2024’

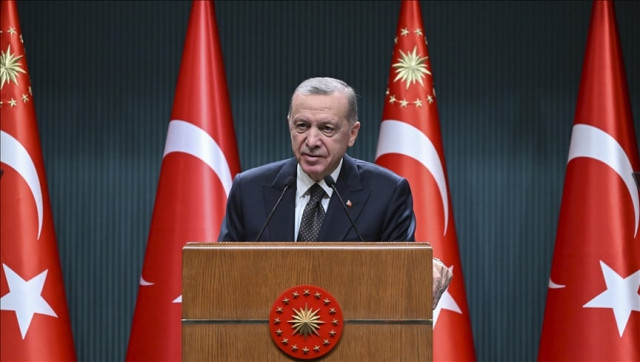

President Tayyip Erdogan’s move back towards orthodox monetary policies began luring back international capital.

Turkey’s pivot back to orthodox fiscal policies could pay off with record debt issuance and the continued return of foreign investors in 2024, JPMorgan Managing Director Stefan Weiler told Reuters.

International investors had fled Turkey amid years of low interest rates, despite soaring inflation, as well as a complex web of financial regulations and foreign exchange controls.

But after a surprisingly strong election victory in May, President Tayyip Erdogan’s move back towards orthodox monetary policies began luring back international capital.

Read Global investors plan to pour $7.1b into Turkey

“From our side, we see Turkiye as a potential big story for next year,” Weiler, the head of JPMorgan’s CEEMEA debt capital markets, told Reuters. He added that he could easily see issuance from the country exceed $25 billion next year.

The key interest rate, which stood at 8.5% pre-election, now stands at 40%, with another hike to 42.5% expected later on Thursday.

Published in The Express Tribune, December 22nd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ