PSX dominates global markets

Marks unprecedented surge as KSE-100 rises 4,532 points, or 7.3% WoW

The Pakistan Stock Exchange (PSX) wrapped up the trading week on a historic note as the benchmark KSE-100 index soared to an unprecedented all-time high above 66,000 points.

This record-setting close was fueled by the visit of Caretaker Prime Minister Anwaarul Haq Kakar, who marked the launch of a Rs30 billion Ijara Sukuk.

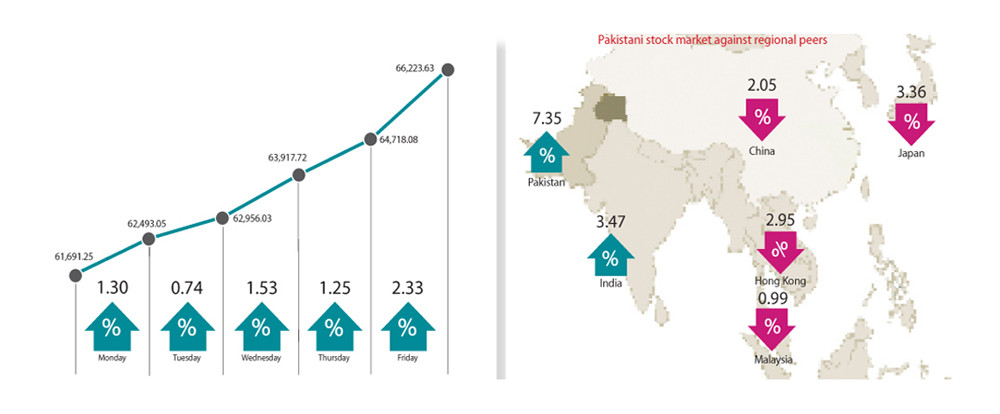

The index witnessed an impressive increase of 4,532 points, or 7.3% week-on-week (WoW), settling at 66,223.63. The remarkable surge was attributed to the outstanding performance of major sectors, including banks, fertilisers, and exploration and production (E&P).

Throughout the week, bullish sentiments dominated the trading floor, bolstered by several encouraging factors. These included anticipation of the International Monetary Fund’s (IMF) executive board meeting on January 11 for the approval of a $700 million loan tranche.

Prime minister’s remarks about the improvement in Pakistan’s fiscal and external accounts, along with extensive participation from foreign investors, high returns, and a stable exchange rate, contributed to the rapid advance of the index.

Monday witnessed the index reaching a record high due to anticipation of a free trade agreement with the Gulf Cooperation Council (GCC) and measures for establishing a sovereign wealth fund.

The following day, the bourse reached close to 63,000 points, driven by a 9% month-on-month rise in oil sales and anticipation surrounding the upcoming release of the IMF loan tranche.

On Wednesday, stocks surged to a new peak fueled by a positive economic outlook and a reduction in external debt, attracting investors’ interest in specific sectors.

The next day, the PSX broke another record amid heavy trading, with news of potential Chinese investment worth $1.5 billion in Pakistan Refinery Limited (PRL), inspiring market players to engage in heavy buying. Additionally, investors were encouraged by the Asian Development Bank’s (ADB) project financing of around $650 million for Pakistan.

Friday’s extraordinary performance propelled the KSE-100 index to a new all-time high above 66,000 points, with significant strength drawn from PM Kakar’s visit for the launch of a Rs30 billion Ijara Sukuk.

JS Research analyst Shagufta Irshad, in her review, remarked that investor participation remained strong at the PSX as average daily turnover stood at 1,026 million shares, up 64% WoW. In this, net foreign buying, once again dominated, accumulating to $11 million during the week.

Read: PSX soars as PM trip gives impetus

On the macro front, the Consumer Price Index (CPI)-based inflation came in at 29% for November 2023 while State Bank’s foreign currency reserves fell $237 million to $7.02 billion owing to debt repayments.

In other news, cement sales remained subdued during November, while urea prices spiked in retail due to pre-buying for Rabi sowing season.

“Pak Suzuki Motor Co (PSMC) depicted a volatile stock price movement after the company shared notice on the bourse regarding minimum price of Rs406 per share for voluntary delisting,” she said.

“The lower-than-expected floor price brought some correction to the stock price, which later recovered.”

On the political front, the Election Commission received funding from the finance ministry for election expenses and it was expected to announce the polls schedule next week, the JS analyst added.

Arif Habib Limited, in its report, noted that the KSE-100 index achieved a significant milestone, reaching a new high of 66k, driven by robust sentiment leading up to the IMF board meeting scheduled for January 11, 2024.

An agreement between Pakistan and Saudi Arabia on investment modalities during the week was expected to pave the way for the signing of a free trade agreement with the GCC in the future, it said.

In other notable events, petroleum sales saw a 9% month-on-month (MoM) jump in November 2023, while urea and DAP offtake showcased healthy growth of 33% and 26% MoM, respectively.

Pakistani rupee closed at 283.87 against the US dollar, appreciating by Rs1.09, or 0.38% WoW. Overall, the market closed at 66,224 points, surging by 4,532 points or +7.3% WoW, marking the highest-ever weekly point-wise return. Moreover, the KSE-100 became the world’s best-performing market on a weekly basis.

Sector-wise positive contribution came from commercial banks (1,704 points), oil and gas exploration companies (997 points), fertiliser (387 points), oil and gas marketing companies (333 points) and power generation (166 points).

Foreigner buying amounted to $11.2 million compared to a net buying of $17.5 million the previous week.

Published in The Express Tribune, December 10th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ