Stocks inch up over mixed triggers

KSE-100 index adds 14.80 points, settles at 57,077.96

Pakistan Stock Exchange (PSX) on Monday closed with marginal gains amid a range-bound session as uncertainties surrounding the potential hike in industrial gas and power tariffs weighed on investors’ mind, though weaker global crude oil prices provided some support.

Earlier, trading began on a negative note and in the first hour the KSE-100 index touched the intra-day low at 56,738.39 points. The market fluctuated consistently throughout the day with the commencement of futures contract rollover week.

Despite the negative start, the market slowly moved upwards, driven by investor interest in selected sectors. The completion of the International Monetary Fund (IMF)’s first review of the $3 billion standby arrangement, paving the way for the release of second loan tranche of $700 million, as well as additional credit flow from China and bilateral agencies lifted the market.

The bourse reached the intra-day high at 57,309.26 points after midday, but later came down due to some selling pressure. It closed the day with thin gains.

“Stocks closed flat amid pressure over government’s decision to further hike industrial gas and power tariffs under the IMF programme and the slump in global crude oil prices,” said Arif Habib Corp MD Ahsan Mehanti.

“Completion of the IMF’s first review, paving the way for $700 million support, and further credit flow from China and bilateral agencies played the role of catalysts in positive close of the market.”

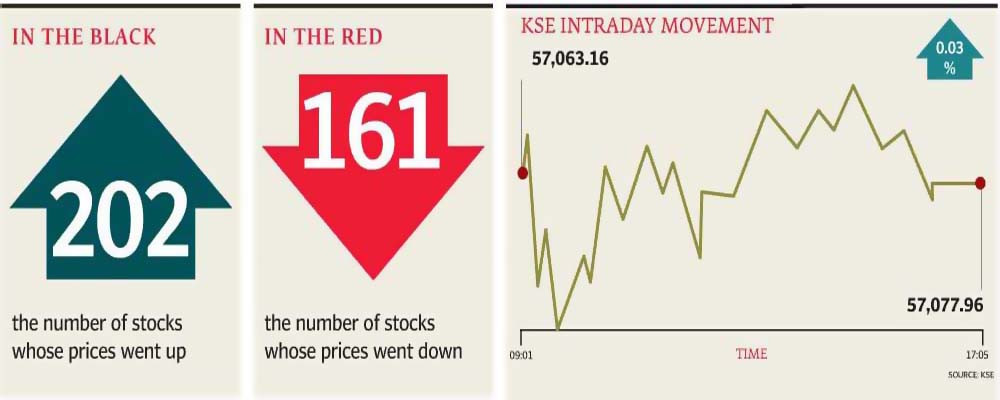

At close, the benchmark KSE-100 index registered gains of 14.80 points, or 0.03%, and settled at 57,077.96.

Topline Securities, in its report, noted that Pakistan equities had an interesting day where bullish and bearish forces fought the whole day to put their rein on market direction and ultimately bulls successfully managed to claim the day.

“Market behaviour can be attributed to the first day of November futures contract rollover week where over Rs18 billion worth of positions will be rolled over by Friday,” it said.

During the day, some profit-taking was observed in cement, exploration and production (E&P), tech, fertiliser and power sectors’ stocks as Lucky Cement, Oil and Gas Development Company, Systems Limited, Engro Corporation, Pakistan Petroleum and Hub Power lost 154 points.

On the flip side, Dawood Hercules, United Bank and Meezan Bank contributed positively by adding 109 points, Topline added.

Arif Habib Limited wrote that the KSE-100 index had a flat session at the start of the week with 48 names advancing and 50 declining.

“With the exception of United Bank (+1.63%) and Meezan Bank (+1.18%), the majority of blue chips closed down,” it said, adding that the biggest drags were Lucky Cement (-2.36%), Oil and Gas Development Co (-1.34%) and Systems Limited (-1.21%).

JS Global analyst Mohammed Waqar Iqbal said that the bourse witnessed range-bound activity on Monday.

“Going forward, we expect range-bound activity to continue as we see no triggers in the coming two weeks. We recommend investors to view any downtrend as an opportunity to buy stocks of the cement and textile sectors,” the analyst added.

Overall trading volumes decreased to 718.3 million shares compared with Friday’s tally of 901.6 million. The value of shares traded during the day was Rs16.7 billion.

Shares of 377 companies were traded. Of these, 202 stocks closed higher, 161 dropped and 14 remained unchanged.

K-Electric was the volume leader with trading in 89.8 million shares, gaining Rs0.26 to close at Rs3.55. It was followed by WorldCall Telecom with 64.6 million shares, gaining Rs0.03 to close at Rs1.62 and Fauji Foods with 50.2 million shares, gaining Rs0.53 to close at Rs9.34.

Foreign investors were net buyers of shares worth Rs445.2 million, according to the NCCPL.

Published in The Express Tribune, November 21st, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ