C/A deficit reaches breakeven

Deficit of just $74m signals continuous improvement in Pakistan’s balance of payments

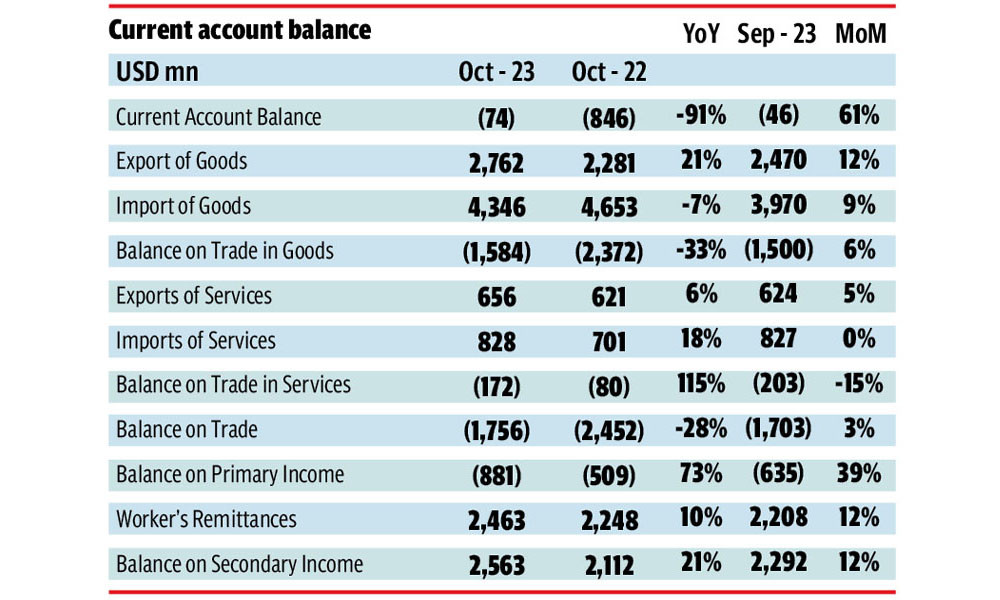

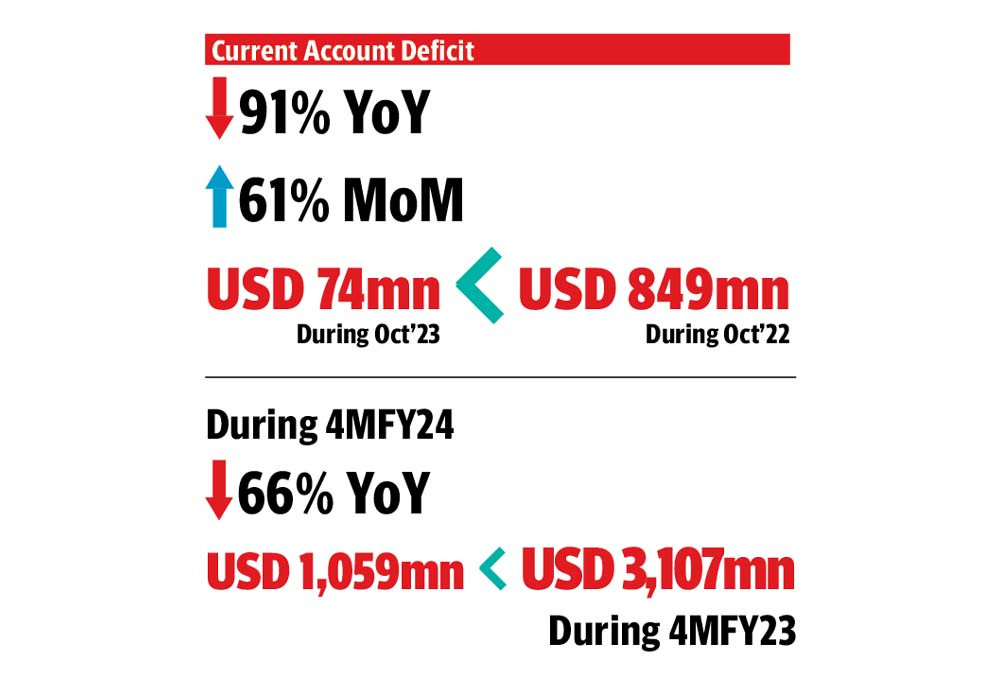

Pakistan’s current account balance hit breakeven for the second consecutive month in October, recording a nominal deficit of $74 million and suggesting that the country’s external economy and the balance of payments situation are continuously improving.

The State Bank of Pakistan (SBP) reported on Monday that the current account deficit stood at $74 million in October 2023, which was slightly higher than the deficit of $46 million in the previous month, showing an increase of 61% month-on-month (MoM).

Talking to The Express Tribune, Pak-Kuwait Investment Company Head of Research Samiullah Tariq remarked “this ($74 million deficit) is largely manageable.”

The central bank has revised up the deficit for September to $46 million from the earlier reported number of $8 million.

The uptick in the monthly deficit came primarily due to a 9% increase in the import of goods, which rose to $4.20 billion in October compared to $3.97 billion in September.

On the other hand, a notable rise of 12% in workers’ remittances to $2.46 billion and an improvement of 12% in export earnings to $2.76 billion in October helped keep the current account deficit at an affordable level. They largely offset the impact of surge in the import of goods to over $4 billion.

Optimus Capital Management analyst Maaz Azam commented that the “growth in remittances and exports kept the current account deficit in check.”

Improvement in imports is a must for giving a fresh boost to the economy because scores of industrial units depend on the purchase of raw material from overseas markets. Pakistan’s low foreign exchange reserves, however, do not allow a liberal import policy as imported goods are mostly consumed locally instead of making a significant contribution to exports.

On a year-on-year basis, the current account deficit contracted 91% in October compared to the same month of last year, according to JS Global Research. The research house described the deficit of $74 million as breakeven.

According to the central bank, the deficit for the first four months (Jul-Oct) of the current fiscal year shrank by a staggering 66% to $1.05 billion compared to $3.10 billion in the same period of the previous year.

“Arranging a nominal amount of less than $100 million a month to finance the deficit stands manageable compared to a current account deficit of over $2 billion a month recorded in some of the months during fiscal year 2021,” Azam pointed out.

“The deficit will remain affordable in the range of $100-200 million a month in the future, considering the country’s low foreign exchange reserves around $7.5 billion that provides less than two months of import cover,” he said.

The analyst cautioned that an increase in the deficit to $400-500 million a month would be troublesome unless Pakistan saw significant foreign currency inflows and an improvement in foreign exchange reserves.

Tariq noted that the current account deficit remained under control despite foreign companies in Pakistan freely repatriating profits and dividends to their headquarters abroad after a gap of almost one and a half year, amid improvement in the foreign currency reserves.

He was of the view that the import of goods at slightly over $4 billion seemed fine and supportive for the revival of economic activities.

He added that inflation reading was expected to come down to 20-22% in the current fiscal year compared to 29% in FY23. This, however, still remains elevated, hindering economic growth.

A potential moderate growth in the range of 2-3% in FY24 is far lower than the required expansion of over 6% for creating job opportunities for a large number of workers entering the workforce every year.

The central bank’s aim to control and keep inflation between 5% and 7% in the next fiscal year will help the economy to turn around and achieve the required growth.

Therefore, controlling inflation and improving export earnings and inflow of workers’ remittances will be the major challenges.

Foreign direct investment

Meanwhile, Arif Habib Limited reported that Pakistan received net foreign direct investment (FDI) of $122 million during October 2023, down 13% compared to $140 million in the same month of last year.

On a month-on-month basis, the FDI in different sectors of the economy dropped 29%. In the first four months of current fiscal year, the net FDI, however, rose 7% to $525 million compared to inflows of $490 million in the corresponding period of last year.

Published in The Express Tribune, November 21st, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ