In a first, PSX crosses 55,000-point barrier

Benchmark KSE-100 index jumps 2,268 points, closes at 55,391

In a record-breaking spree, the Pakistan Stock Exchange (PSX) touched a new peak above the 55,000-point barrier in the outgoing week as investors built extensive positions in attractive sectors in anticipation of a favourable outcome of the first review talks with the International Monetary Fund (IMF).

Market players also took cue from a fall in bond yields and marked improvement in remittances sent home by overseas Pakistanis. A decrease in global crude oil prices aided the market’s advance towards north.

Bank, power, fertiliser, exploration and production (E&P) and auto sectors were in the spotlight where investors bought lucrative stocks to build up their portfolio.

Meanwhile, average trading volumes improved significantly, which indicated extensive interest in the market.

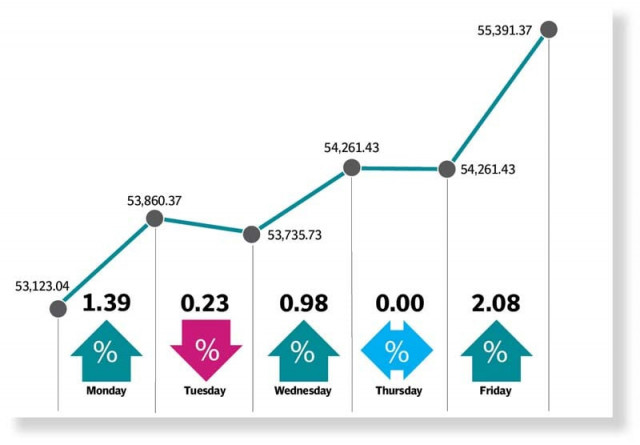

At the beginning of the week, the bourse extended its record-breaking run in a rally driven by robust company results and talks between Pakistan and the IMF under the first review of $3 billion standby arrangement.

However, next day the market came under pressure amid falling rupee and political uncertainty, which put an end to a six-day winning streak.

On Wednesday, the PSX recovered from a short-lived dip and shot up to a new record high as investors expected a positive outcome of the IMF talks and $600 million in loans from China to bridge the financing gap.

Following closure on Thursday on account of Iqbal Day, the market on Friday skyrocketed to a new record high above 55,000 in the backdrop of technical review talks with the IMF, a reduction in bond yields and an increase in remittances.

The benchmark KSE-100 index surged 2,268 points, or 4.3% week-on-week (WoW), and closed at 55,391 at the end of the week.

JS Global analyst Muhammad Waqas Ghani, in his market review, wrote that the KSE-100 index extended its upward momentum reaching new highs and concluded the week at 55,391, marking a 4.3% WoW increase. Average daily volumes picked up to 544 million shares, up 21% WoW.

He pointed out that the focal point was the discussions between the government and the IMF. Regarding fiscal matters, the IMF and the Federal Board of Revenue deliberated on making structural adjustments to tax collection, including the introduction of taxes on agriculture, real estate and retail sectors.

In the energy sector, the IMF expressed concerns over delay in notification for the gas tariff hike. Notably, the Oil and Gas Regulatory Authority (Ogra) eventually announced the tariff hike of 20-150% for residential consumers and 5-193% for industries, effective from November 1, 2023, he said.

In the Pakistan Investment Bonds (PIBs) auction, cut-off yields were reduced up to 180 basis points. During the week, international oil prices (West Texas Intermediate crude) slid below $80 per barrel over waning demand from the US and China.

In other economic news, the inflow of remittances showed a 10% year-on-year increase to $2.46 billion in October 2023, the highest for seven months, the JS analyst added.

Arif Habib Limited, in its report, said that the bourse reached a significant milestone, by surpassing 55,000 points. “The market continued its bullish run, fuelled by first review discussions with the IMF, which were expected to move smoothly,” it said.

Ogra notified a substantial increase in prices of natural gas, an imperative condition for the IMF review. During the week, Pakistani rupee closed at Rs287.03 against the greenback, depreciating Rs2.7, or 0.95% WoW.

Foreigners turned buyers as they bought stocks valuing at $1.3 million compared to net selling of $1.4 million last week. Major buying was witnessed in banks ($1.4 million) and power companies ($1.2 million).

Overall, the sectors contributing positively to the index were commercial banks (447 points), cement (409 points), fertiliser (362 points), power generation and distribution (345 points) and E&P (147 points).

Published in The Express Tribune, November 12th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ