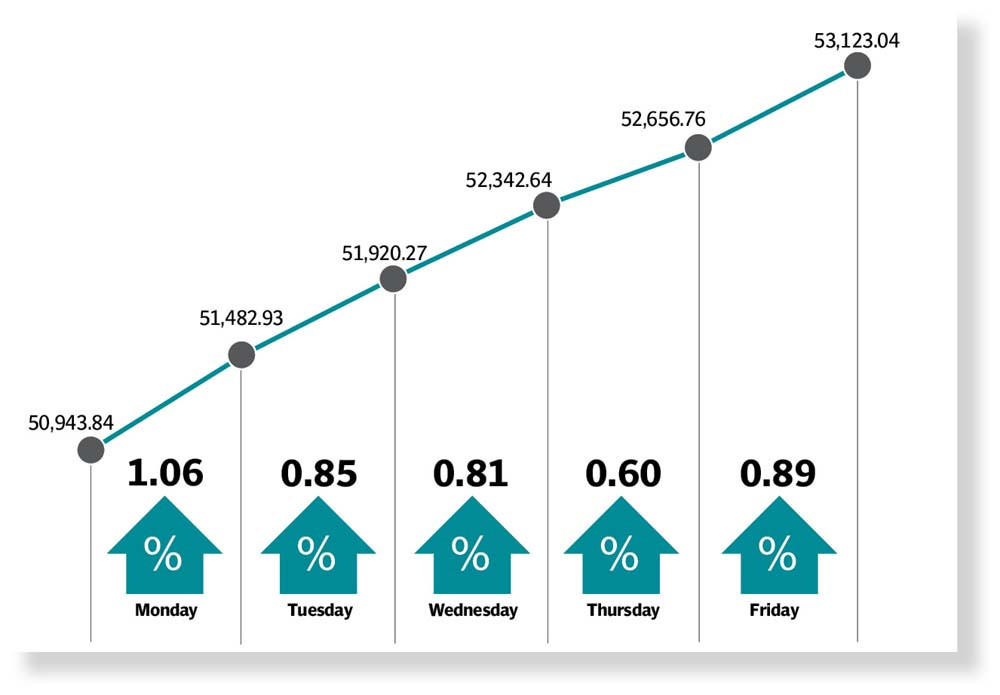

In a remarkable feat, the Pakistan Stock Exchange (PSX) skyrocketed to a record high in the outgoing week as a host of encouraging macroeconomic indicators fuelled investors’ interest who vied to grab shares of attractive companies.

The benchmark KSE-100 index closed above 53,000 points for the first time in the bourse’s history where positive political developments also played their part, soothing investors’ concerns.

During the week, the Election Commission announced the date for polls, which removed apprehensions and signalled political stability in the country.

Among major economic news, the yields of T-bills declined while the State Bank of Pakistan (SBP) left its policy rate unchanged at 22%. Pakistan’s inflation reading for October eased and the trade deficit also narrowed. In addition, the International Monetary Fund’s (IMF) first review began on November 2.

On Monday, the week commenced with a highly bullish activity aided by strong corporate earnings and ahead of IMF review that would unlock the second loan tranche of $700 million.

The market maintained its winning streak next day as well as it reached close to the 52,000 mark, driven by a broad-based rally after the SBP left the policy rate unchanged.

On Wednesday, the PSX marched further upwards on the back of a robust trading activity, strong corporate earnings and government’s discussions regarding progress on China-Pakistan Economic Corridor (CPEC) projects.

Bulls continued to hold their firm grip on Thursday as they snapped up selective stocks following a decline in T-bill yields and easing of crude oil prices in the global market.

Read IMF talks uncover Rs8.5tr gap

On the last day of the trading week, the bourse maintained its bullish momentum where the KSE-100 surged past the 53,000 mark.

The market closed at 53,123 with an increase of 2,179 points, or 4.3% week-on-week (WoW).

JS Global analyst Muhammad Waqas Ghani, in his report, noted that the KSE-100 set a new high at 53,123 compared to the previous record close at 52,876 reached in May 2017.

“Average trading volumes and value also showed a decent increase of 23% and 14% WoW, respectively,” he said.

Following the quarterly result announcements, the analyst pointed out, the market’s attention shifted back to macroeconomic factors. The IMF’s review talks began on November 2 where technical-level talks were expected to end by November 10, followed by policy-level talks scheduled to conclude by November 16.

According to recent data, the Consumer Price Index (CPI) for October 2023 eased to 26.9% - the lowest reading since January 2023.

During the week, trade data was also released, which showed a 35% year-on-year (YoY) decline in trade deficit for 4MFY24. Moreover, the SBP’s reserves remained stable at $7.5 billion.

On the political front, investors responded positively to the announcement of election date, which was set for February 8, 2024, the JS analyst added.

Arif Habib Limited, in its market review, wrote that the week began with the SBP maintaining its policy rate at 22%, which indicated that inflation had peaked and was expected to come down in the near future.

It cited the federal cabinet’s approval of an increase in gas tariffs to meet the IMF’s condition and the International Finance Corporation’s announcement of a $1.5 billion investment strategy for Pakistan, as factors that boosted market sentiment.

The increase in revenue collection to Rs2.8 trillion in 4MFY24 and the narrowing of trade deficit by 4.5% YoY in October also contributed to the momentum.

Additionally, the SBP’s reserves rose by $14 million to $7.5 billion and Pakistani rupee closed at Rs284.31 against the greenback, depreciating Rs3.74, or 1.31% WoW.

Sector-wise, major gainers were commercial banks (375 points), power generation and distribution (354 points), fertiliser (265 points), cement (237 points) and exploration and production (202 points).

Foreigners turned net buyers during the week as they bought stocks worth $1.4 million as compared to net selling of $3.5 million last week, AHL added.

Published in The Express Tribune, November 5th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ