PSX posts thin gains ahead of IMF review

Benchmark KSE-100 index rises 212 points, settles at 50,944

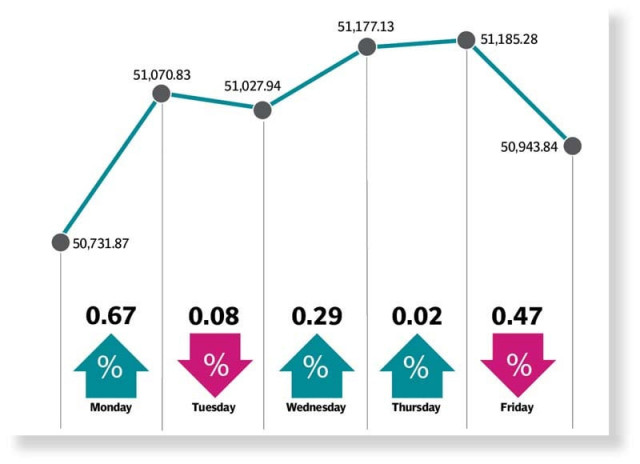

Pakistan Stock Exchange (PSX) recorded gains of just 0.4% in the outgoing week as investors awaited the International Monetary Fund (IMF) review and monetary policy announcement next week.

Investors’ interest was driven by encouraging corporate results, which triggered activity in specific stocks while some results did not meet market expectations, leading to selling pressure.

Continuously depreciating rupee and a significant fall in the State Bank of Pakistan’s (SBP) foreign currency reserves piled pressure on the bourse, which restricted the market’s rapid advance.

At the beginning of the week, the PSX commenced trading on a robust note as it crossed the psychological barrier of 51,000 points owing to investor confidence aided by easing political uncertainties and positive economic data projections.

However, the market lost momentum on Tuesday in a volatile session owing to selling pressure arising from geopolitical tensions and anxiety about the IMF’s review under the $3 billion standby arrangement. On Wednesday, the bourse recovered, driven by earnings announcements and optimism about the IMF review, which would lead to the release of second loan tranche of $700 million.

On Thursday, the KSE-100 index ended nearly flat in range-bound trading as investors’ spirit weakened over depreciation of Pakistani rupee and the decline in foreign currency reserves.

On the last day of the trading week, the index suffered losses as bears took the driving seat ahead of the monetary policy announcement and due to the looming uncertainty surrounding talks with the IMF.

The market closed at 50,944, up 212 points, or 0.42% week-on-week (WoW). In his market review, JS Global analyst Muhammad Waqas Ghani wrote that the KSE-100 index closed the week at 50,944, gaining 0.4% WoW. However, average volumes dropped 10% WoW to 366 million shares.

“Above-expected earnings/ dividends announcement by Bank AL Habib, Fauji Cement, MCB Bank and Pakistan Aluminium Beverage Cans triggered activity in these stocks,” he said.

On the other hand, below-expected earnings and dividend announcement by Fauji Fertiliser Company impacted investors’ sentiment and led to a 3.3% WoW decline in the stock’s price. During the week, the auto assemblers announced 2-3% reduction in car prices to account for the recent appreciation of the rupee.

On the political front, the PML-N supremo returned to Pakistan who cited reduction in government expenditures, increase in tax revenue, rise in exports, IT sector reforms and improving relations with neighbouring countries as top issues on his party’s agenda.

On the macroeconomic front, as the IMF review was approaching fast, the government became more aggressive in pursuing its economic targets and implementing policy measures.

On a similar note, the ECC approved the much-awaited increase in gas prices while the budget deficit contracted to 0.9% of GDP in 1QFY24 from 1% of GDP during the same period of last year.

Pakistan also surpassed its primary surplus criterion set by the IMF, which was reported at 0.4% of GDP for 1QFY24, the JS analyst added. Arif Habib Limited (AHL) commented that the market kicked off trading on a positive note, driven by the approval of gas tariff hike, a significant step towards meeting one of the prerequisites for the IMF’s review scheduled to commence on November 2, 2023.

Notably, the current account deficit was recorded at $8 million for September 2023, down 95% month-on-month. “The momentum was further bolstered by the results season, which contributed to the positive trajectory,” it said.

However, the consistent appreciation of the rupee ended, resulting in the currency closing at Rs280.57 against the greenback, depreciating by Rs1.77, or 0.64% WoW. Moreover, SBP’s reserves decreased $220 million to $7.5 billion, AHL said.

Foreigners turned net sellers as they sold stocks worth $3.47 million compared to net buying of $2.32 million last week, AHL added.

Published in The Express Tribune, October 29th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ