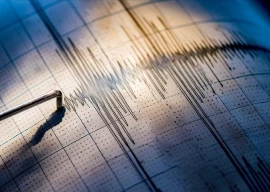

Bulls were back in driving seat at the Pakistan Stock Exchange (PSX) on Thursday as the market surged over 900 points and comfortably crossed the 50,000 barrier over expectations of a decrease in State Bank’s policy rate in the next monetary policy announcement.

Though trading began on a positive note, the KSE-100 index immediately dropped to the intra-day low of 49,436.92 points on speculation that the rupee may continue to depreciate against the dollar.

However, the bourse recouped losses as investors saw a robust rupee recovery and $1.5 billion accord with China for investment in the petroleum sector.

Additionally, the scores of agreements and memoranda of understanding signed during Prime Minister Anwaarul Haq Kakar’s visit to China to attend the Belt and Road Forum revitalised investors’ sentiment, who later lifted the index to the intra-day high of 50,399.92 points.

Read more: Rupee surge, Gulf investment propel PSX higher

Investors’ interest was mainly noted in fertiliser and exploration and production (E&P) sectors, which contributed over 400 points to the index.

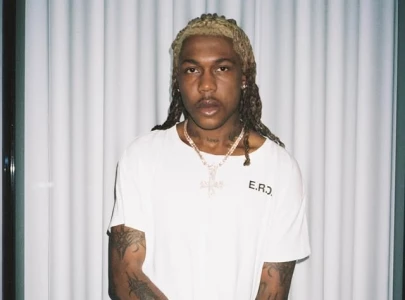

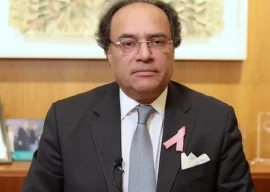

“Bullish activity was witnessed as investors weighed strong rupee recovery and $1.5 billion accord with China for investment in the petroleum sector,” said Arif Habib Corp MD Ahsan Mehanti.

“Oil stocks outperformed on the back of a strong earnings outlook and surging global crude oil prices. Besides, easing political noise and optimism ahead of the release of next IMF loan tranche also played the role of catalysts in bullish close of the market.”

At close, the benchmark KSE-100 index registered a rise of 933.67 points, or 1.89%, and settled at 50,365.15.

Topline Securities, in its market review, stated that Pakistan equities enjoyed a robust upswing as the KSE-100 index surged 1.89%, surpassing the pivotal 50,000 mark.

Also read: PSX surge

Notably, the index was largely propelled by the prevailing positive sentiment in response to Wednesday’s T-bills’ auction. “This auction made the market believe that interest rates have hit their peak and going forward, there will be stability or a potential decrease in rates,” it said.

Fertiliser and E&P sectors stood strong by adding 440 points to the index. However, Rafhan Maize Products, TRG Pakistan and Ibrahim Fibres cumulatively lost 23 points, Topline added.

Arif Habib Limited (AHL) wrote in its report that “it was a big up day for Pakistan equities as the KSE-100 rose 1.89% and KSE-30 gained 2.29%”.

“Blue chips took the lead where top contributors were Pakistan Petroleum Limited (+7.06%), Engro (+4.91%), Hubco (+3.55%), Oil and Gas Development Company (+4.43%) and Pakistan State Oil (+7.5%),” it said. “The 49.3k level remains the line in the sand with the next upside draw of liquidity being seen at the 2017 highs at 53k,” AHL added.

JS Global analyst Muhammad Shuja Qureshi commented that bulls drove the KSE-100 index past the 50,000 level with gains of 934 points.

The rally was broad-based, led by oil and gas and auto sectors, where PSO (+7.5%), Sui Northern Gas Pipelines (+7.5%), Ghandhara Automobiles (+7.1%), Ghandhara Industries (+7.5%), Pak Suzuki (+7.5%) and Sazgar Engineering Works (+7.5%) closed at their respective upper locks.

“The market is expected to continue its positive momentum with intervals of profit-taking,” the analyst added.

Overall trading volumes increased to 427.5 million shares compared with Wednesday’s total of 332.6 million. The value of shares traded during the day was Rs14.6 billion.

Shares of 361 companies were traded. Of these, 255 stocks closed higher, 94 dropped and 12 remained unchanged.

K-Electric was the volume leader with trading in 83.2 million shares, gaining Rs0.29 to close at Rs3.37. It was followed by Pakistan Refinery with 37.7 million shares, gaining Rs0.6 to close at Rs17.47 and WorldCall Telecom with 25.9 million shares, losing Rs0.01 to close at Rs1.28.

Foreign investors were net sellers of shares worth Rs14.5 million, according to the NCCPL.

1732794167-0/barbie-(5)1732794167-0-165x106.webp)

1732520496-0/BeFunky-collage-(86)1732520496-0-165x106.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ