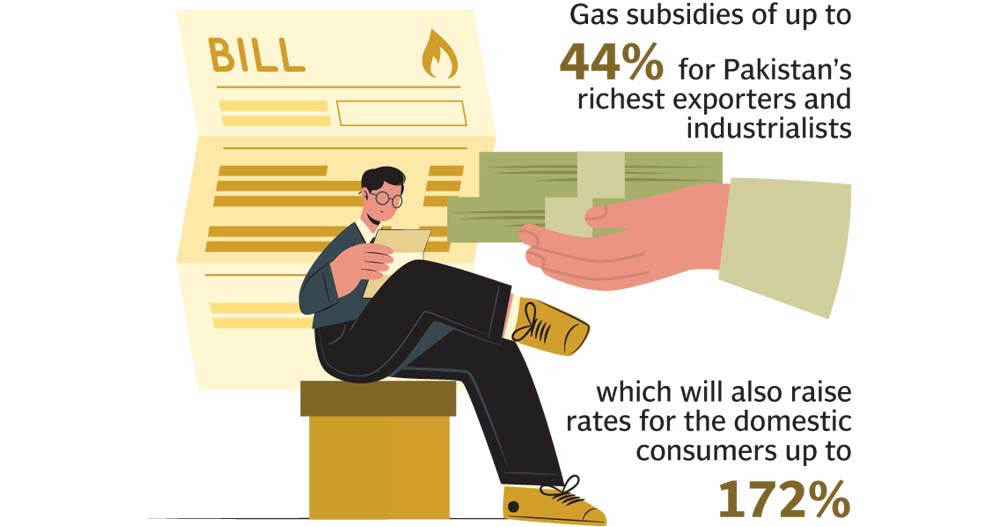

The government has proposed huge hidden gas subsidies of 44% for Pakistan’s richest exporters in the upcoming price revision but would increase rates for domestic consumers up to 172%, underscoring the elite capture of diminishing resources.

The hidden subsidies are in violation of the commitments given to the International Monetary Fund (IMF) and against a decision of the last federal cabinet that wanted an end to the supply of cheap local gas to the self-generation power plants of industries, known as captive power plants.

Official documents of the Ministry of Energy revealed that some categories of domestic consumers and public transport would be paying a price higher than the imported gas price as a result of the upcoming pricing review.

The proposed rates for commercial users and cement manufacturing plants are double than the price for captive power plants.

Read Gas companies prepare for winter supply plan

The richest exporters and the industrialists selling goods in the domestic market may get away with huge hidden subsidies.

Sources said that the government wanted to approve revised gas rates by virtually convening a meeting of the Economic Coordination Committee (ECC) last week. But the idea was shelved and now the meeting will be held after the return of Finance Minister Dr Shamshad Akhtar from China.

The price revision for all categories of gas consumers is essential to prevent the two gas distribution companies – Sui Northern Gas Pipelines Limited (SNGPL) and Sui Southern Gas Company Limited (SSGCL) – from bankruptcy.

The gas sector circular debt has already peaked to Rs2.1 trillion and if prices are not increased another Rs395 billion will be added to the debt just on account of revenue shortfall and LNG supply at low rates in Punjab, according to the Ministry of Energy.

Sources said that the Ministry of Finance had opposed gas subsidy for captive power plants, calling it against a decision of the last cabinet and also commitments given to the IMF.

They said that the finance ministry was in favour of keeping prices for the self-generation industrial power plants at par with RLNG rates.

Ogra has determined total revenue requirements of Rs697 billion for SNGPL and SSGCL for this fiscal year. SNGPL’s requirement is estimated at Rs358 billion while SSGCL’s needs are assessed at Rs339 billion.

The last government was required to increase gas prices with effect from July but it postponed the decision due to political reasons, causing Rs46 billion losses to both companies during the first quarter of this fiscal year.

The respective governments have been increasing gas prices below the companies’ fiscal needs, resulting in accumulation of Rs878 billion arrears. SSGCL’s arrears stand at a maximum Rs450 billion on account of less-than-required increase in gas prices.

The Ministry of Energy has proposed to increase the prices of gas being consumed by exporters from Rs1,100 to Rs2,050 per mmBtu, an increase of Rs950 or 86%.

Due to shortage of local gas, Pakistan imports expensive Liquefied Natural Gas (LNG) and supplies it to the domestic sector in winters and to the industry throughout the year.

The summary of the Ministry of Energy showed that the current cost of imported LNG was Rs3,650 or $12.5 per mmBtu. At current rates, the exporters would get a subsidy of Rs1,600 per mmBtu, which is equal to 44% of the imported gas price.

The subsidy will be paid by charging higher gas rates from domestic consumers having higher consumption, CNG consumers, commercial consumers and cement manufacturers.

design: Ibrahim Yahya

Similarly, for those industrialists that are not exporting goods but have captive plants, it has been proposed to increase gas prices from Rs1,200 to Rs2,600 per mmBtu, an increase of Rs1,400 or 116%.

But still these richest industrialists would get a subsidy of Rs1,050 per mmBtu, which is equal to 29% of the imported gas price.

The maximum Rs1,400 per unit gas price increase for industrialists is much lower than the Rs1,900 per mmbtu increase for domestic consumers of up to 3hm3 consumption.

Another hidden benefit that Pakistan’s richest Punjab-based exporters would get is that as against the current price determination based on 50% local and 50% imported gas, it has been proposed to increase the blend of local gas to 60%.

Currently, there is wide price disparity between the industry operating on SSGCL and SNGPL networks.

Industry operating on SNGPL network consumes 50:50 blend of indigenous and RLNG for nine months and 100% RLNG for three months from December to February, averaging to the current tariff of $9.6/mmBtu.

No increase in gas prices has been proposed for consumers of up to 0.9 hm3 consumption. However, their fixed monthly bill has been increased from Rs10 to Rs400.

The tariffs for the highest domestic consumption are aligned with LPG cost, according to the summary. The previous slab benefits are being maintained up to consumption of 4 hm3 but there will not be previous slab benefits in the last slab of non-protected domestic category.

The fixed monthly charge for consumption up to 1.5 hm3 has been proposed to be increased from Rs460 to Rs1,000 while for consumption of over 1.5 hm3 it has been proposed to increase to Rs2,000 per month.

The gas price for up to 0.25 hm3 consumption is proposed to be increased by 50% to Rs300 per mmbtu, for 0.6 hm 3 consumption to be doubled to Rs600 and for 1 hm3 consumption proposed rate is Rs1,000 per mmbtu –an increase of 150%.

For up to 1.5hm3 consumption, the proposed rate is doubled to Rs1,200 per unit, for up to 2 hm3 consumption it is recommended to be doubled Rs1,600 per mmbtu.

For up to 3 hm3 consumption the maximum increase of 172% is proposed with its rate setting at Rs3,000 per mmbtu.

The rates for the upper two slabs have been proposed to be increased even higher than the LGP and the LNG prices. For 4 hm3 consumption, it is proposed at Rs3,500 per mmbtu and for the highest slab it is recommended at Rs4,000 –much higher than imported gas price to pay for subsidies to the richest.

Published in The Express Tribune, October 18th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1716362850-0/172ndLede-(1)1716362850-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ