PSX edges lower in lacklustre trading

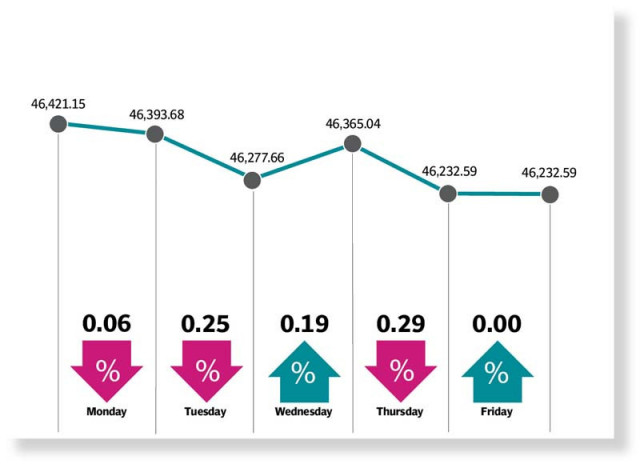

KSE-100 index falls by 0.4% week-on-week, settles at 46,233 points

Pakistan Stock Exchange (PSX) remained bearish in the outgoing week, where investors displayed lack of interest in market activity fearing an increase in consumer gas prices and resorted to profit-taking.

It came despite positive developments on the economic and political scene. The rupee continued to gain strength against the US dollar, standing below 288/$ at the end of the shortened week on Thursday.

In addition, the Election Commission released the constituency delimitation lists, which was seen as a major step towards general elections early next year.

At the beginning of the week on Monday, the bourse dropped slightly as a poor economic outlook and concerns over a shortfall in external financing deterred investors.

Next day, the market continued its losing streak with modest losses, which was attributed to the global equity sell-off and a downturn in international crude oil prices.

Read PSX leads in global markets

On Wednesday, however, the KSE-100 index notched up marginal gains of 0.19%, led by investors’ interest in stocks of exploration and production (E&P) and fertiliser companies. On the last day of the trading week, the PSX fell by around 130 points, ignoring the gains of the previous session. Trading remained dull as investors lacked the much-needed optimism and preferred to slash their stockholdings ahead of a long weekend.

The stock market closed at 46,233 points, shedding 189 points, or 0.4% week-on-week (WoW). JS Global analyst Muhammad Waqas Ghani, in his market review, wrote that the KSE-100 had a bearish start to the week.

The rupee continued to display a persistent uptrend, concluding the trading week at Rs289 in the open market with 2.1% WoW gains.

“This positive performance came on the back of efforts by the State Bank of Pakistan (SBP), which implemented measures to oversee the forex market and enforce regulations against unauthorised currency operators,” he added.

On the political front, the Election Commission of Pakistan (ECP) released preliminary constituency delimitation lists, based on the recently completed census. “This significant move paved the way for the upcoming general elections scheduled for the last week of January 2024.”

On the economic front, the Economic Affairs Division (EAD) disclosed that the country obtained loans totalling $3.21 billion from multiple sources during 2MFY24. “This represents a significant increase compared to $439 million borrowed in the same period of last year.”

According to SBP’s data, foreign investors remitted $49.2 million in profits and dividends during 2MFY24, a 45% year-on-year (YoY) jump likely due to relaxed capital controls, the JS analyst added.

Arif Habib Limited, in its market summary, said the bourse exhibited lacklustre activity, remaining relatively unchanged, as investors were anticipating an increase in gas prices. “This anticipation, coupled with profit-taking, contributed to the subdued market performance,” it said.

The market remained dull despite the rupee’s appreciation by Rs4.02, or 1.4%, to 287.74/$.

Sector-wise negative contribution came from technology and communication (176 points), commercial banks (170 points), automobile assemblers (59 points), fertiliser (34 points) and investment banks/ investment companies/ securities companies (30 points). Positive contribution came from cement (85 points), oil and gas exploration companies (52 points) and power generation and distribution (46 points).

Stock buying by foreigners continued during the week, which came in at $0.19 million compared to net buying of $0.29 million last week. Major buying was witnessed in commercial banks ($1.54 million), the AHL report added.

Published in The Express Tribune, October 1st, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ