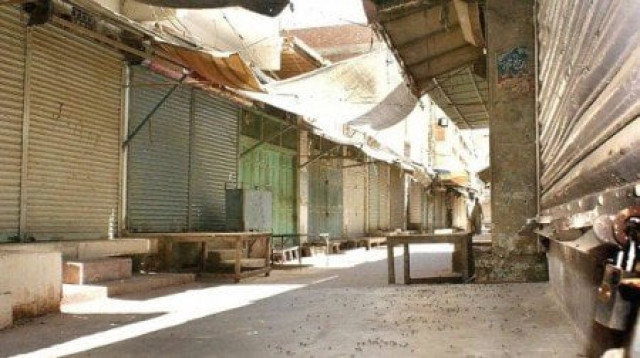

Karachi braces for shutter-down strike

Industrialists, traders and shopkeepers unite to demand relief from soaring power bills

The economic epicenter of Pakistan, Karachi, is on the brink of a significant economic protest as industrialists, traders, and shopkeepers unite to demand respite from the burden of surging power bills. With the caretaker government yet to announce measures to alleviate the crisis, businesses across the city are preparing for a shutter-down strike scheduled for Friday.

In a resounding display of unity, the Karachi Chamber of Commerce and Industry (KCCI), the city’s premier trade body, has issued a strike call, garnering unwavering support from its diverse membership, ranging from major corporations to small-scale traders. The announcement was made by KCCI leader Zubair Motiwala following an extensive meeting that saw participation from hundreds of members, both physically and virtually.

A participant in the meeting shared insights with The Express Tribune, revealing the collective frustration at the federal caretaker government’s lack of a clear strategy to address the pressing issue of inflated power bills. This soaring cost of electricity has inflicted a drastic blow of 25-30% on industrial production expenses since July, significantly hampering economic viability.

Read Petrol price soars to record Rs305 following yet another massive hike

Representatives from all seven industrial zones in Karachi, encompassing areas such as Korangi, Landhi, Super Highway, SITE, and SITE Super Highway, have pledged their wholehearted support to the KCCI’s cause. Additionally, representatives from trade bodies including those from Tariq Road, Aram Bagh, and the gold saraf market near Tower have rallied behind the movement.

Notably, Sindh Governor Kamran Tessori, even while abroad, engaged in an online meeting with KCCI leadership, assuring them of his commitment to raise the issue of inflated bills with the government. He pledged to seek a viable solution upon his return to the homeland.

Earlier, the KCCI had slated a meeting for Monday, aligned with its member businessmen, traders, and shopkeepers, aimed at devising a strategy to compel the government to revoke the recent tariff hike of up to Rs7.50 per unit. However, this gathering was postponed following assurances that the caretaker government was actively engaging with the matter and exploring potential solutions in collaboration with power companies and other stakeholders.

Despite the Caretaker Prime Minister Anwaarul Haq Kakar’s directive for his team to find a solution within 48 hours, these efforts did not yield a viable remedy. Subsequently, Caretaker Finance Minister Shamshad Akhtar stated that reducing utility bills wasn’t feasible due to Pakistan’s engagement in an International Monetary Fund (IMF) $3 billion loan programme, precluding the provision of subsidies and concessions to power consumers.

Also read Nationwide protests erupt against inflated electricity bills

Recalling recent events, the surge in power bills followed the government’s decision to elevate the electricity base tariff by up to Rs7.5 per unit effective from July 1, 2023, as per IMF loan conditions. This tariff hike was intended to alleviate the mounting circular debt, although critics argue that it could exacerbate the issue rather than mitigate it.

Sindh Energy Department Secretary Abu Bakar Ahmed recently revealed that the cost of power production has soared to Rs72 per unit, a staggering escalation from a mere Rs28 per unit just two years ago. This dramatic increase is primarily attributed to the reliance on one of the most expensive fuels – residual fuel oil (RFO).

Talking to The Express Tribune, businessmen have deemed the tariff hike counterproductive, fearing its impact on industries, particularly the export sector. They anticipate diminished competitiveness, reduced export earnings, and heightened economic struggles.

This situation unfolds in the backdrop of Pakistan’s already stagnant economy, grappling with a historic inflation rate of 38% in May 2023 and a record high bank borrowing cost of 22%.

In the view of the business community, an alternative path exists for resource mobilisation, focusing on expanding the taxpayer base, curbing line losses and power theft, and discontinuing exemptions. These measures could effectively narrow the fiscal deficit without exacerbating the financial burden on citizens through increased power tariffs.

Published in The Express Tribune, September 1st, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ