Rupee hits historic low as import pressure mounts

More demand for dollar comes from payments to airlines, profit repatriation

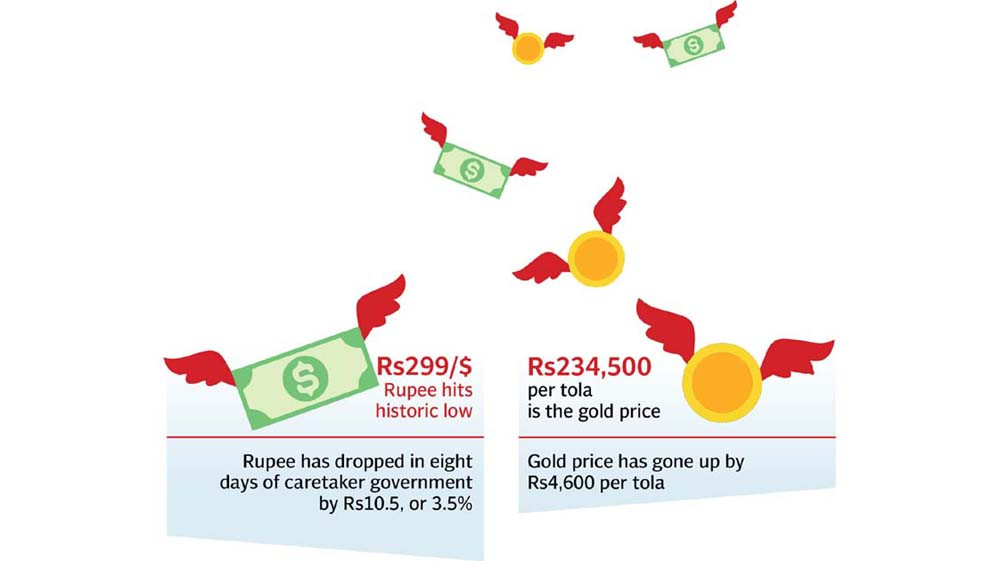

Pakistani currency hit a new historic low at Rs299 against the US dollar in the inter-bank market on Tuesday, making imports further expensive and requiring more resources to repay foreign debt.

According to State Bank of Pakistan’s (SBP) data, the currency depreciated by 0.63%, or Rs1.88, to Rs299.01 against the greenback.

Talking to The Express Tribune, Arif Habib Limited CEO Shahid Ali Habib said the rupee came under increasing pressure owing to the rise in demand for the US dollar for clearing import backlog.

“Besides, additional demand is coming from…resumption of pending payments to the international airlines providing their services in Pakistan and the repatriation of dividend income by foreign investors to their headquarters abroad,” he said.

Such payments had come to a partial halt earlier due to a foreign exchange crisis. Forex reserves have now improved to two months of import cover at around $8 billion after cumulative inflows of $4.2 billion in June and July 2023 from the International Monetary Fund (IMF) and friendly countries. With the latest dip, the currency has cumulatively lost 3.52%, or Rs10.52, in the first eight days of the caretaker government, proving true the recent speculation that the rupee would come under a new round of depreciation.

The currency has weakened to the historic low partly due to the strengthening of the greenback against peer currencies globally. The US dollar has spiked to more than two-month high after global portfolio investors poured significant investments into US treasury bills to take benefit of the rising rate of return.

The new rupee low is just eight paisa above the prior low of Rs298.93/$ hit after the arrest of former prime minister Imran Khan and the subsequent deterioration of the law and order situation in May 2023.

Arif Habib Limited reported that the rupee also touched an all-time low in the open market where it reached Rs313/$, widening the difference between exchange rates in the inter-bank and retail markets to Rs14 (around 4.5%). It breached the IMF’s loan condition of maintaining the gap at 1.25% (around Rs4).

The Exchange Companies Association of Pakistan (ECAP), a body of currency dealers, reported that the rupee depreciated by only Rs2 to Rs306/$ in the open market, indicating a wide difference between its price and the one reported by AHL Research.

Market talk suggests the rupee-dollar exchange rate will test Rs300/$ in inter-bank dealings under the ongoing round of depreciation.

Habib added that the currency should stabilise around current levels “ahead of expected fresh foreign currency inflows from multilateral institutions.”

design: Ibrahim Yahya

“I don’t see any appreciation of the rupee amid high demand for the dollar.”

Another analyst said the currency further depreciated because of the increase in demand for dollars to finance the current account deficit in July and later.

The current account recorded a deficit of over $800 million in July after remaining in surplus in the prior four months (March-June), totalling $1.55 billion.

ECAP President Malik Bostan said the rupee continued to face mounted pressure in the open market as “it is following in the footsteps of the inter-bank market in a bid to narrow the difference between exchange rates.”

An analyst, however, differed with Bostan’s view and said the situation was the other way round. It was the inter-bank market which was following the open market to reduce the difference.

Bostan added that the previous PDM government had control over banks in order to avoid currency speculation. “The element of speculation cannot be ruled out these days considering the caretaker government has yet to get hold over the happenings.”

Pakistan is projected to arrange $15-16 billion in current fiscal year to finance the current account deficit, repay foreign debt and make interest payments.

Gold hits 3-month high

Gold price hit a three-month high at Rs234,500 per tola (11.66 grams) on Tuesday mainly due to rupee depreciation in the open market. The All Pakistan Saraf Gems and Jewellers Association reported that the commodity maintained its uptrend for the seventh consecutive working day, rising by Rs4,600 on Tuesday. In the past seven working days, bullion has surged by almost 6%, or Rs12,700 per tola.

Association President Haji Haroon Rasheed Chand said gold continued to rise on demand coming from the investor community. “People are parking their savings in the safe-haven asset to avoid the impact of rupee devaluation,” he said.

Published in The Express Tribune, August 23rd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ