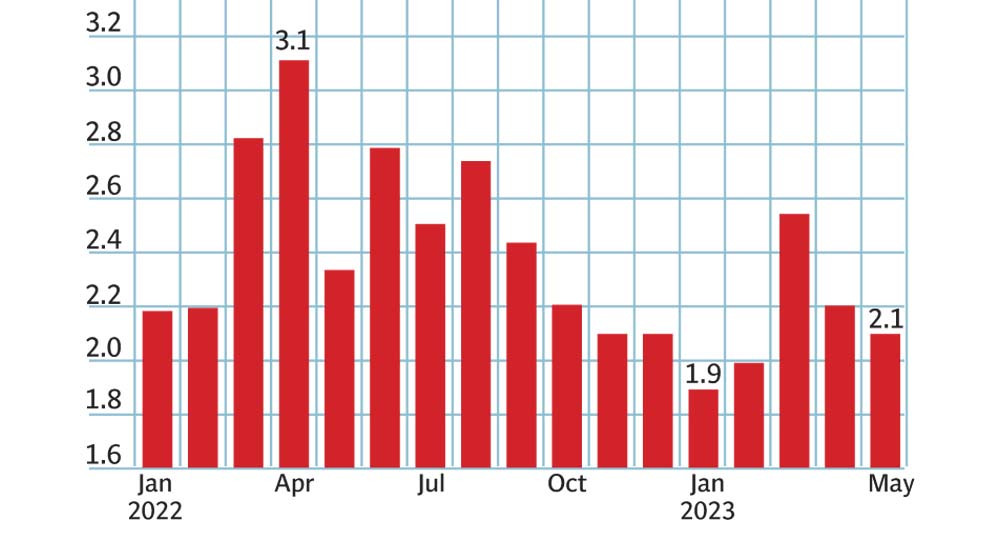

The flow of workers’ remittances to Pakistan experienced a slowdown in May 2023, reaching a three-month low of $2.10 billion. A significant portion of overseas Pakistanis chose to send their funds through informal channels due to the availability of more favourable rupee-dollar exchange rates. The State Bank of Pakistan (SBP), on Tuesday, reported a 10.4% decrease in remittances compared to $2.35 billion received during the same period last year. On a month-on-month basis, the receipts are 4.4% lower compared to the $2.19 billion recorded in the prior month of April 2023.

This decline has widened the gap between the demand and supply of foreign currency in the domestic economy, raising concerns about the country’s ability to meet foreign debt repayments amidst critically low foreign exchange reserves.

Cumulatively, in the first 11-month (Jul-May) of outgoing fiscal year 2023, remittances dropped 13% to $24.83 billion compared to $28.48 billion received in the same period of the last year (11MFY22).

Speaking to the Express Tribune, Head of Research at Arif Habib Limited, Tahir Abbas said the disparity between the interbank and open market exchange rates prompted non-resident Pakistanis to transfer remittances through illegal hawala-hundi channels. “Whenever the gap widens between the two markets, overseas Pakistanis switch to informal channels, where illegal operators offer significantly higher exchange rates compared to the official rates,” he explained. In May, the exchange rate gap reached Rs27, with the interbank market holding at around Rs285/$, while the open market dropped to Rs312/$. Reports even suggested rates as high as Rs315-320/$ in the open market, indicating a much larger gap than reported in the media, he explained.

The drop in remittances was observed across multiple destinations worldwide, including Western countries, this month indicating that the global economic slowdown has impacted dollar inflows to Pakistan. In May, remittances from Saudi Arabia decreased by 4% to $524 million compared to $546 received in the same period last year. The inflows from the United Arab Emirates (UAE) slumped by 23% to $336 million, while those from the United Kingdom (UK) decreased by 14% to $307 million. Similarly, remittances from the European Union (EU) countries shrank by 8% to $249 million, and other countries around the world saw a 14% decline, reaching $430 million. However, remittances from the US experienced a 10% increase, amounting to $257 million in May, compared to $235 million in the same month last year.

design: Ibrahim Yahya

Abbas acknowledged that the decrease in remittances during May was expected, as it typically occurs between the Eidul Fitr and Eidul Azha festivals. Historically, non-resident Pakistanis send significantly higher remittances to support their families during these festivals, which often involve higher expenses due to increased inflation rates and celebrations. He expressed optimism that remittances would improve in June and beyond, as the gap between the exchange rates in the interbank and open markets narrowed. The spread between the interbank and open market shrunk to Rs10 on Tuesday after the central bank tightened dealings with currency dealers in the open market to whom dollars are supplied by commercial banks.

Exchange Companies Association of Pakistan (ECAP), President, Malik Bostan said that efforts were being made by the central bank and exchange companies to reduce the gap between the interbank and open market rates to 1-2% (Rs3-5) through policy initiatives. “This reduction aims to enhance the flow of remittances to Pakistan, going forward,” he said. Bostan’s remarks came after the domestic currency recovered sharply, gaining 2.34%, or Rs 7, against the dollar, resulting in an exchange rate of Rs298/$ in the open market on Tuesday.

Abbas projected that remittances would increase by $300-400 million in June 2023, totalling $2.4-2.5 billion. For the full fiscal year 2023, remittances are estimated to exceed $27 billion, he predicted. In fiscal year 2022, remittances had hit an all-time high at $31.27 billion, according to data from the central bank.

However, Abbas cautioned that short-term measures to narrow the exchange rate gap will not prove effective in the long run. With dwindling foreign exchange reserves, he advised the government to consider long-term measures such as resuming the International Monetary Fund (IMF) loan programme to bring stability to the domestic economy and the rupee-dollar exchange rate. Additionally, offering incentives for formal channels of remittance transfer and increasing returns on investments through Roshan Digital Accounts (RDA) on Naya Pakistan Certificates could also help improve foreign exchange reserves.

Published in The Express Tribune, June 14th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1730806656-0/BeFunky-collage-(23)1730806656-0-165x106.webp)

1730706072-0/Copy-of-Untitled-(2)1730706072-0-270x192.webp)

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ