Dar defends policies, blames IMF for crisis

Says devaluation is the mother of all economic problems

Fiscal year 2023 has come to a close, leaving Pakistan grappling with one of the worst economic downturns in recent history. As the country faces multiple challenges, Finance Minister Ishaq Dar, has defended his policies while shifting blame onto the International Monetary Fund (IMF) for the imported stagflation that has wreaked havoc on the economy.

During the unveiling of the Economic Survey 2023 on Thursday, Dar once again stood by his decision to control the rupee-dollar exchange rate, stating that the IMF’s recommended depreciation has only exacerbated imported inflation within the country. “Devaluation is the mother of all economic problems,” he proclaimed.

Dar also questioned the so-called “pundits” who had supported the narrative of allowing the rupee to depreciate in order to boost export earnings. He expressed bewilderment as to why the massive devaluation had failed to deliver the desired results. “I don’t know in which world they live,” he quipped.

Despite the sharp depreciation of the rupee, Pakistan’s export earnings have significantly dropped during the outgoing fiscal year 2023.

Meanwhile, the IMF has once again conditioned the government to relinquish its control over the rupee and allow market forces to determine the exchange rate. This move is seen as a necessary step to revive the stalled $6.5 billion loan programme. The IMF believes that adopting a market-based exchange rate would aid the government in stabilising the faltering economy.

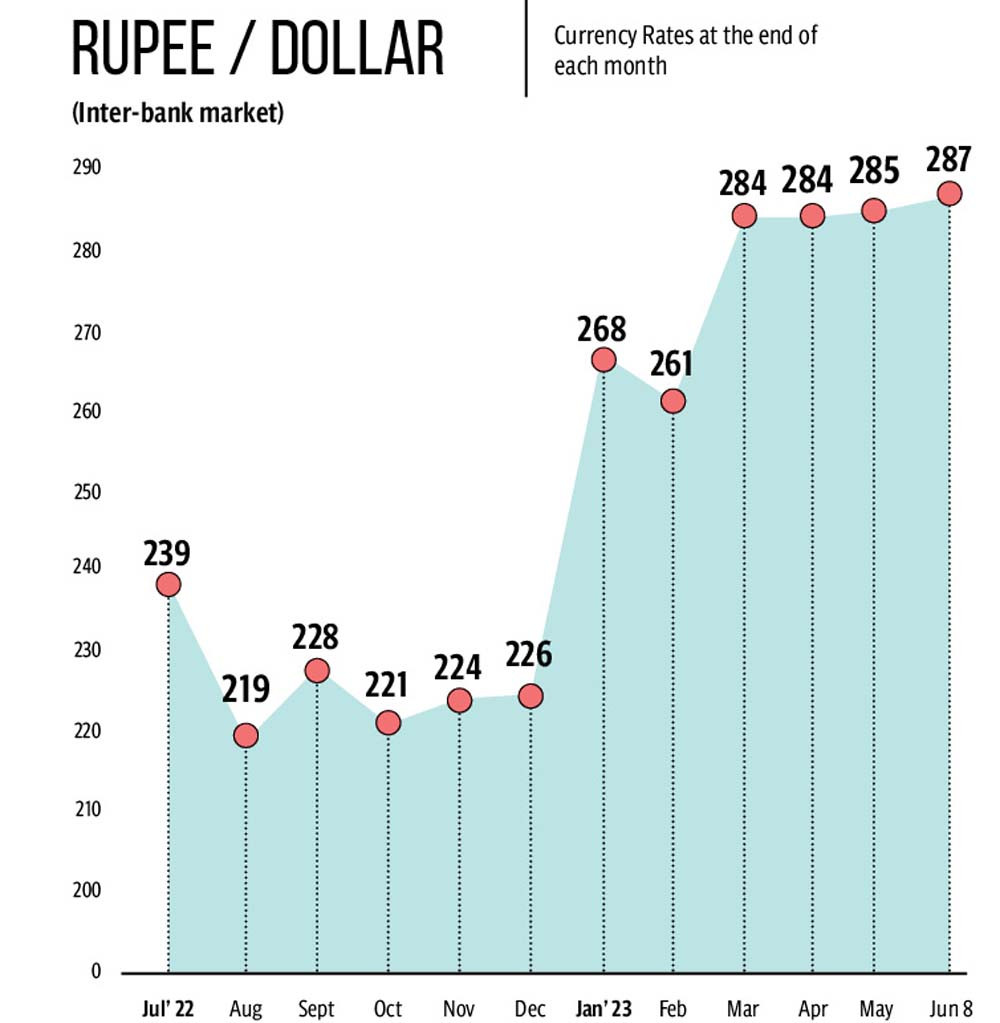

It is worth noting that when Dar returned as finance minister in September 2022, the rupee was hovering around Rs228 against the US dollar. However, it hit an all-time low of Rs299/$ in the inter-bank market on May 11, following the arrest of former Prime Minister Imran Khan and subsequent law and order issues.

In September-October 2022, Dar had asserted that the fair value of the rupee should be in the range of Rs180-200/$. However, the rupee never traded within this range after September 2022. It closed at Rs286.80/$ in the inter-bank market on Thursday, reflecting a massive drop of almost 21% or Rs60 since Dar’s return last September.

During the Economic Survey press conference, Dar squarely placed the blame for rupee devaluation on the IMF. He argued that the devaluation had invited imported inflation, leading the central bank to raise its key policy rate to a record high of 21%. This substantial 7.25 percentage point increase in the rate during the outgoing fiscal year has inflated interest payments on overall debt.

The State Bank of Pakistan (SBP) has also announced on Friday that it will be convening a meeting of the Monetary Policy Committee (MPC) on Monday, June 12, 2023, to make decisions regarding the country’s monetary policy. The central bank is anticipated to maintain its key interest rate at 21%, according to widespread expectations.

In May, inflation reached a six-decade high of 38%. Moreover, the volume of interest payments surged to around 70% of FBR revenue collection in FY23. “Monetary policy has been tightened in the wake of high inflation caused by currency devaluation, which has led to increased interest payments,” Dar explained.

According to Dar, the rupee is currently undervalued artificially and needs to be addressed. He expressed confidence that the currency would eventually recover significantly and cautioned that currency speculators would lose money when the exchange rate appreciates in the future.

Citing a Bloomberg article, Dar referred to the fair value of the rupee, which stands at Rs244/$ according to the international matrix of the real effective exchange rate (REER).

Ismail Iqbal Securities, Head of Research, Fahad Rauf commented on Dar’s dilemma, stating that the finance minister was attempting to save face in light of the failure of his policies. Given that there are no other options left, Dar is reluctantly implementing IMF recommendations in order to revive the loan programme and save the economy from default, he said.

In the midst of these economic challenges, the manufacturing sector holds a dominant position within Pakistan’s industrial sector, contributing 12.01% to the country’s GDP. However, the growth performance of large-scale manufacturing (LSM) during the July-March period of FY2023 was negative, with a decline of 8.11% compared to a growth of 10.61% in the corresponding period last year.

The textile sector, in particular, experienced a significant dip of 16.03% during the July-March period of FY2023, compared to a growth of 3.23% in the same period last year. This decline can be attributed to multiple factors, including a global economic slowdown that has reduced the demand for Pakistani textile products.

Additionally, flood damages have resulted in losses for the cotton industry, which constitutes half of the industry’s required cotton input. Furthermore, the contractionary policy stance, including higher policy rates, increased energy charges, and restrictions on the import of raw materials and machinery, has made it increasingly challenging for businesses to operate and export.

Published in The Express Tribune, June 9th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ