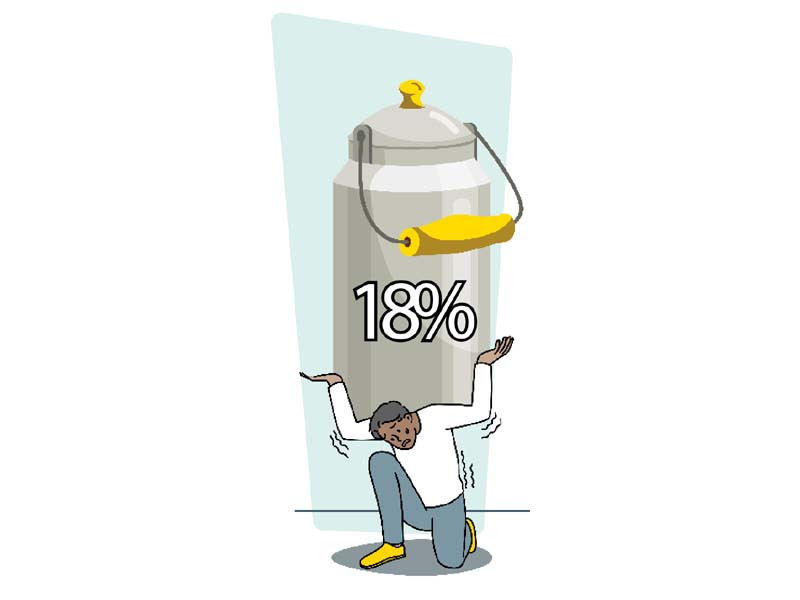

Consumers and the food industry in Pakistan may face higher milk prices as the government considers implementing an 18% sales tax on packaged milk in the upcoming budget. This move comes at a time when the food industry is already struggling due to heavy taxation on juice products.

Sources told The Express Tribune that the Federal Board of Revenue (FBR) has proposed this tax measure, aiming to collect over Rs30 billion annually in additional taxes starting from the fiscal year 2023-24. However, Finance Minister Ishaq Dar has expressed concerns about the impact on consumers, given the country’s historically high inflation.

Implementing such a tax would be a double blow to the food industry, which is still recovering from the imposition of a 10% federal excise duty just five months ago. This duty has negatively affected both businesses and farmers, resulting in reduced demand for products such as mangoes. Interestingly, while Prime Minister Shehbaz Sharif engaged in mango diplomacy with the Turkish President, his government’s taxation policies were causing harm to farmers and the food industry domestically.

Sources reveal that the FBR’s proposal includes abolishing the zero-rating facility for the dairy sector. Currently, milk producers are entitled to claim refunds on the inputs they purchase. Packaged milk is typically sold at around Rs260 per litre, and an 18% tax would amount to an additional cost of Rs46 per litre.

During discussions on withdrawing the zero-rating facility, the finance minister expressed concerns about the potential social repercussions of taxing milk, said the sources. He also considered the implications of imposing an 18% sales tax on loose milk, which could lead milkmen to raise prices for consumers. Given these observations, sources indicate that the government is unlikely to endorse the FBR’s proposal.

The inflation rate in May reached an all-time high of 38%. Imposing taxes on food items, particularly in an election year, could prove costly for the government. The zero rating for the dairy industry was introduced in the 2021-2022 budget to support its growth. Taxation on these products would increase their cost for consumers and potentially lead to reduced demand, impacting dairy farmers and the industry as a whole.

Read Milk is fast becoming a luxury

According to the World Food Programme, Pakistan has one of the highest rates of malnutrition globally, with an estimated 43.7% of children under the age of five experiencing stunted growth, 17% facing wasting, and 31.5% being underweight. Malnutrition poses a significant challenge in Pakistan, particularly in rural areas where access to nutritious food is limited.

The food industry is also protesting against the 10% federal excise duty imposed on fruit juices. Since its implementation in February, the packaged juice industry has witnessed a significant decline in sales. Industry insiders report that around 100,000 tonnes of mangoes, along with other fruits, were purchased from local farmers in 2022 for conversion into pulp. However, this number has now declined by more than 50%, resulting in losses for farmers, according to a key market player.

Fruit pulping units in Punjab are at risk of closure or reduced production capacity due to the decline in demand from juice producers following the imposition of the 10% federal excise duty. Sales and volumes have sharply declined since the Supplementary Budget in February. The juice industry, with an annual turnover of around Rs60 billion and employing over 5,000 individuals, has been adversely affected. Investments and plans for further growth have stalled since the duty was implemented, according to market players.

The formal packaged juice industry contributes approximately Rs16 billion in tax revenues and is currently facing significant challenges. Recently, new Green Field Pulp Plants were established in Sargodha, Jhang, and Multan with an investment of Rs5 billion. These plants convert fruit into pulp, creating skilled industrial employment opportunities and benefiting the rural economy by reducing fruit wastage and generating surplus income.

The fruit value chain in Pakistan already suffers from a lack of proper storage facilities, despite being a major producer of high-quality fruits, some of which are exported. Market players in the value chain are urging the government to withdraw the federal excise duty on the packaged juice sector to revive the industry and support medium-sized fruit growers.

Published in The Express Tribune, June 6th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1731933289-0/BeFunky-collage-(68)1731933289-0-165x106.webp)

1729662874-0/One-Direction-(1)1729662874-0-165x106.webp)

COMMENTS (5)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ