Wholesale, retail trade slows

High inflation, weakened demand result in 4.5% contraction in services sector

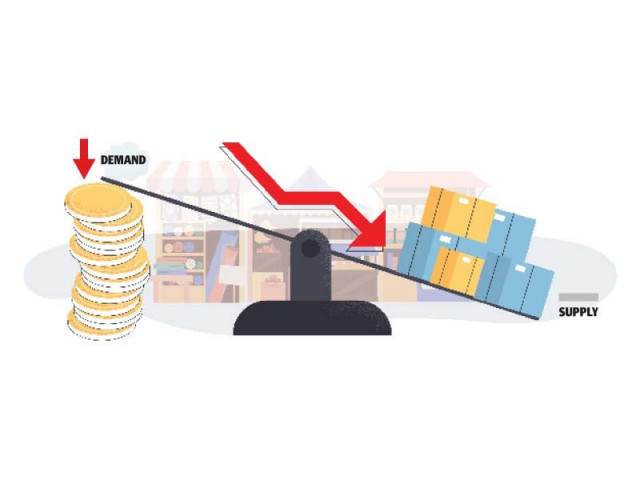

Pakistan’s services sector, a key component of the country’s economy, has suffered a significant blow as wholesale and retail trade experience a notable slowdown. The adverse effects of high inflation and weakened demand have taken a toll on this crucial sector, resulting in a year-on-year contraction of 4.5%.

Adding to the woes, the general government sector has also experienced a steep decline of 7.8% year-on-year in FY2023. These setbacks have collectively resulted in a meagre growth rate of only 0.9% for the services sector, which holds a weightage of 58.6%. This latest development raises concerns about the overall economic outlook and highlights the challenges faced by Pakistan’s services industry.

According to a report by Arsalan Siddiqui, the Research Head of Optimus Capital Management, the muted growth in the services sector can be attributed to the contraction of wholesale and retail trade. “The high inflationary environment and demand slowdown have contracted wholesale and retail trade, which holds an 18.0% weight in the overall services sector, by 4.5% year-on-year,” he stated in his research report. Speaking to The Express Tribune, Siddiqui noted that changes in consumer spending patterns can be observed in local supermarkets, as inflation affects their financial situation.

Additionally, based on provisional data, industrial demand has also contracted, impacting the wholesale sector significantly.

“In FY2023, industrial output fell by 2.9% year-on-year, primarily due to an 8.0% plunge in large-scale manufacturing (LSM) growth,” he said. Siddiqui expects the LSM figures for FY2023 to be lower than the estimates provided by the National Accounts Committee (NAC) due to a continuous depressed manufacturing outlook for the fourth quarter of FY2023, low demand, import letters of credit (LCs) restrictions, and a global slowdown. The LSM figures for the first nine months of FY2023 have already shown an 8.1% year-on-year decline.

The economic downturn, characterised by high inflation and historically high interest rates, is a significant factor behind the subdued industrial demand. Siddiqui estimates that if the base year for inflation is taken as 2020, it may have surged by up to 70%, while salaries of consumers may have only increased by 10%. He points out the lack of an effective system to accurately gauge monthly incomes, as well as the presence of a large undocumented economy, which further complicates the situation.

The National Accounts Committee (NAC) approved provisional GDP figures of 0.29% year-on-year in FY2023, slightly revising upward the FY2022 growth to 6.10% year-on-year. Despite the decline in economic activities in the industrial sector by 2.9%, growth in agriculture at 1.5% year-on-year and services at 0.9% year-on-year supported the overall growth in FY2023.

Livestock, which accounts for 14.4% of the overall GDP mix, recorded a growth of 3.9% year-on-year, surpassing the previous FY17-22 average of 2.9%. This helped offset the adverse impact of the decline in crop output caused by floods, with crops holding a 7.7% weight in GDP and experiencing a 2.5% output reduction, particularly in cotton, which declined by 34% year-on-year in the first ten months of FY2023, as reported by the Pakistan Cotton Ginners’ Association (PCGA). However, Siddiqui anticipates some support from wheat production, which is expected to reach around 27.0 million tonnes in FY2023.

While the provisional growth figures are higher than expected, Siddiqui suggests they may be revised downward once the data for the fourth quarter of FY2023 becomes fully available.

“Nevertheless, we may continue to see low economic activities in FY2024 amid a depressed external and fiscal outlook,” said Siddiqui.

Published in The Express Tribune, May 26th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ