Stocks gain ground in roller-coaster ride

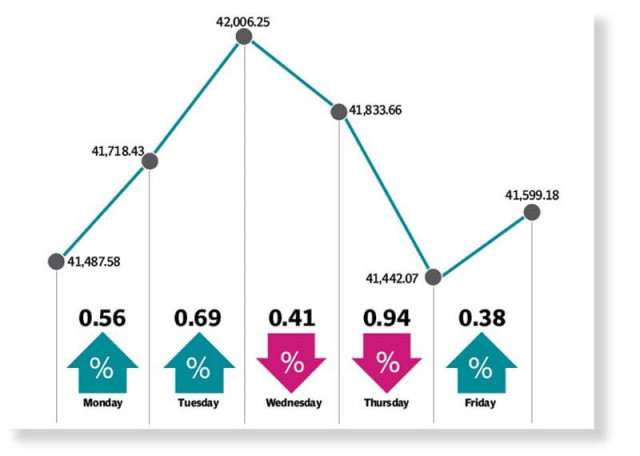

KSE-100 index edges up 112 points, or 0.3%, and settles at 41,599

The outgoing week proved to be a roller-coaster ride for Pakistan Stock Exchange (PSX) as it experienced both bullish momentum and bearish pressure due to a mix of positive and negative developments, which continued to influence direction of the market.

The week kicked off with a range-bound session in the backdrop of political noise but the KSE-100 index notched up gains following International Monetary Fund (IMF)’s denial that it had asked Pakistan to raise fresh financing of $8 billion coupled with the rupee recovery.

In the next session, the bourse managed to gain nearly 300 points and surpassed the 42,000 mark over some clarity on the political front after court granted bail to ex-prime minister Imran Khan’s wife in Al Qadir Trust case.

However, investors’ spirit died down and volatility gripped the bourse on Wednesday as growing political turmoil, rupee’s slump to a one-week low and caution over the fate of IMF’s loan programme kept trading muted and the index ended in the red. The KSE-100 remained stuck in the red zone on Thursday as well over persistent political instability and rupee depreciation. Pre-budget speculation also kept the index in the red.

Finance ministry’s reassurance about the IMF programme helped push the index into the green zone on Friday and the bourse ended the week on a positive note.

The KSE-100 index gained 112 points, or 0.3% week-on-week, and settled at 41,599.

JS Global analyst Amreen Soorani, in her report, noted that after a positive start, the KSE-100 succumbed to the pressure from bears in the second half of the week where initial gains were wiped out with developments on the political and macro landscape. “Trading activity showed that individuals and companies absorbed the net selling reported by insurance companies and mutual funds,” she said.

Among budget-related news, the federal government targets fiscal deficit at 5% of GDP for FY24, with revenue target of Rs9 trillion. On the IMF front, talks continued between the government and IMF officials.

The T-bills auction held during the week was for shorter-tenor papers where the government accepted bids of Rs444 billion, mainly for three-month bills, at flat rates compared to the previous auction, the JS analyst added. Arif Habib Limited, in its report, said that the stock market opened on a positive note after the IMF resident representative dismissed rumours that Pakistan needed to raise $8 billion instead of $6 billion to finance its external debt repayments.

Moreover, political tensions relatively eased after the chaos witnessed a week ago, it said. Additionally, the price of petrol was reduced by Rs12 per litre while the price of high-speed diesel was reduced by Rs30 per litre. Economic numbers showed that the current account posted a surplus of $18 million in April 2023 while the LSM output declined by 8.1% year-on-year during 9MFY23.

Moreover, the State Bank’s forex reserves fell by $72 million to $4.38 billion. Pakistani rupee depreciated against the US dollar by Rs0.74 (0.26%) on a week-on-week basis, closing the week at Rs285.8/$.

In terms of sectors, positive contribution to the bourse came from fertiliser (146 points), commercial banks (64 points), miscellaneous (40 points), chemicals (37 points), and automobile assemblers (21 points). Negative contribution came from cement (84 points), pharmaceuticals (4 points), investment banks/ investment companies (3 points), E&P (2 points) and engineering (2 points)

In terms of stocks, positive contributors were Engro Corp (73 points), United Bank (66 points), Fauji Fertiliser Company (60 points), Pakistan Oilfields (39 points), and Pakistan Services (38 points).

Negative contribution came from Mari Petroleum (21 points), Pakistan Petroleum (17 points), Meezan Bank (13 points), Bank AL Habib (12 points), and Systems Limited (11 points). Foreigners turned net sellers during the week under review as they sold stocks worth $0.6 million as compared to net buying of $1.1 million last week, the AHL report added.

Published in The Express Tribune, May 21st, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ