The government’s policy to trade off a sovereign default with a steep curb on imports, coupled with the high cost of doing business, has caused a contraction of 25% in the output of major industries – a trend that is likely to worsen in the absence of a viable economic plan.

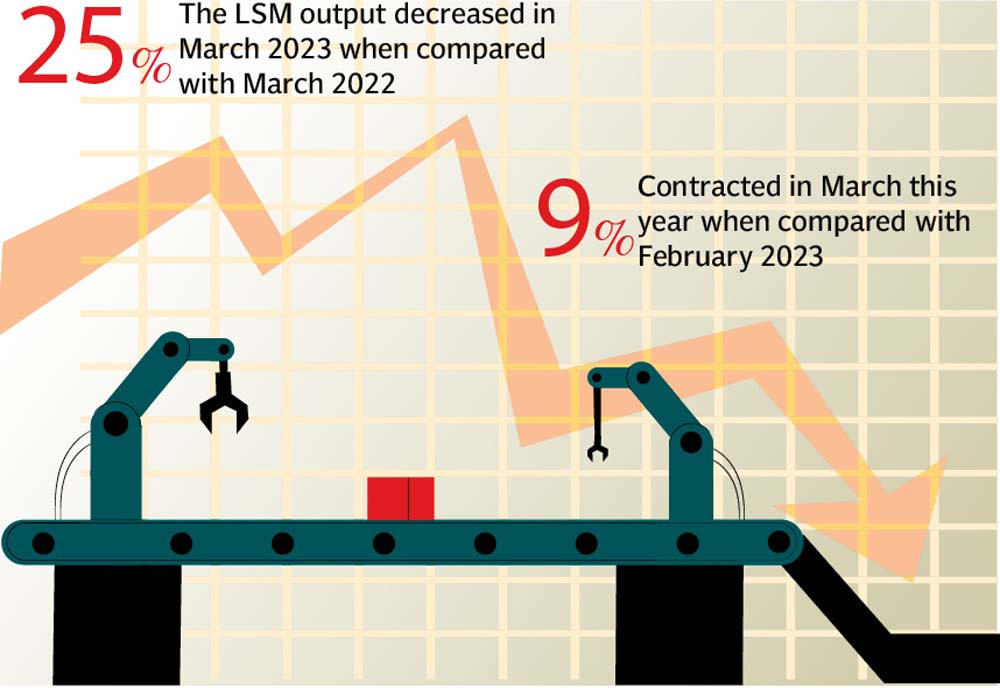

Pakistan Bureau of Statistics (PBS) reported on Monday that output from Large-Scale Manufacturing (LSM) industries dipped 25% in March over a year ago. The pace of contraction doubled two months ago as the severe implications of import curbs have now unfolded.

There is a shortage of imported raw material and intermediary goods. Interest rates are up to a historically high level of 21% and inflation is at a six-decade high standing at 36.4%. With heightened political uncertainty, there is no clarity about the economic outlook of the country.

All these factors have contributed to a massive contraction in the output of the large industrial sector – the country’s second major employer after agriculture and the single largest revenue generating sector.

PBS reported the LSM output figures days before a scheduled meeting of the National Accounts Committee (NAC). The NAC will consider approval of the overall economic growth rate along with sectoral growth figures for the outgoing fiscal year and give its stamp of endorsement to the revised GDP growth figures of the previous fiscal year.

The constant negative growth witnessed in the LSM sector during the current fiscal year indicates that there will also be negative growth in the industrial sector. The agriculture sector is also projected to contract during the current fiscal year due to the devastation caused by the floods in July-August last year.

International financial institutions and the Ministry of Finance have projected an economic growth rate of less than 1%. But Dr Hafiz A Pasha – a renowned economist – has projected negative over 2% GDP growth rate in this fiscal year.

The LSM sector contributes nearly one-tenth to total national output, however, a constant decline in the share and growth of LSM may cause a lot of problems for the government already struggling to create new jobs.

The government is allowing imports now less than the monthly inflows on account of exports and remittances. Imports fell below $3 billion last month, as the government is now sucking dollars from the market to pay off its debts.

Read LSM output drops by 7.75%

Chances for the revival of the International Monetary Fund (IMF) programme have also diminished. As a result, the government does not seem to be in the mood to open trade in the next fiscal year.

Compared to last month’s projection of a current account deficit of $9.2 billion for the next fiscal year, the Ministry of Finance is now contemplating setting the deficit target between $6-$7 billion.

Overall, LSM output shrank 8.1% in the July-March period of this fiscal year, the PBS reported. It also contracted over 9% on a month-on-month basis.

design: Ibrahim Yahya

The big industries faced broad-based contraction, with 18 of the 22 sectors witnessing negative output during the first nine months (July-March) compared to a year ago. Only clothing, leather products, furniture, and other manufacturing sectors saw an increase in production during the first nine months.

The main contributors towards the overall negative growth of 8.1% include the food sector that shrank nearly 9% and the tobacco industry whose output decreased by one-fourth. Similarly, the textile sector’s output also dropped by over 16%.

The production of petroleum products also dropped by one-tenth during the first nine months of the fiscal year.

The two sectors hit hardest by the ban on imports were pharmaceuticals and automobiles, both of which witnessed significant contraction during the first nine months of the current fiscal year. The pharmaceutical sector, also impacted by currency devaluation, saw a 23% dip in output while the production of automobiles was negative by 43% in nine months.

The output of the chemicals sector, non-metallic mineral products, machinery and equipment and transport equipment also shrank during the current fiscal year.

Private sector credit has also gone down after an increase in interest rates. The government is projecting a 21% inflation rate for the next fiscal year, which suggests that interest rates may remain high for some time.

Published in The Express Tribune, May 16th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ