Banks jack up lending rate for govt to record high

Govt raised Rs1.14tr through sale of T-bills to meet its expenditures

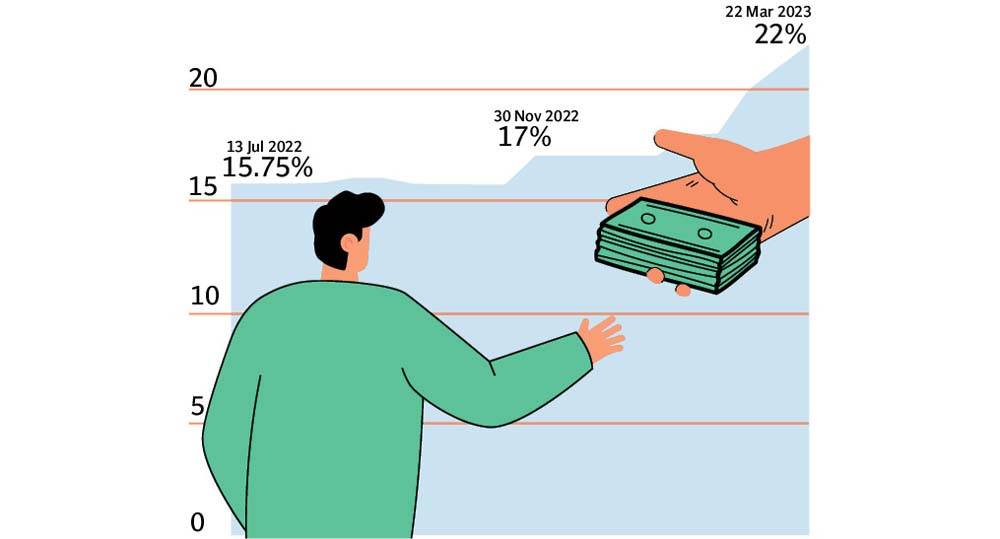

The cost of running the crisis-hit economy has spiked as commercial banks have jacked up the price of lending to the cash-strapped government by one percentage point to a new all-time high at 22%.

The State Bank of Pakistan (SBP) reported that the government raised domestic debt worth Rs1.14 trillion through the sale of mostly three-month treasury bills (T-bills) to banks. It also raised some financing through the six-month and 12-month papers.

Financial institutions increased the cost of lending (cut-off yields on T-bills) to a new high on expectations the central bank would further hike its benchmark policy rate by one percentage point to 21% in the forthcoming monetary policy meeting on April 4, 2023.

The commercial banks’ financing rate had been around 15.71% for three-month bills in November 2022, suggested the available data.

The government had targeted to borrow Rs900 billion through the auction of sovereign debt securities to commercial banks. It would utilise the borrowed funds to return the maturing debt of Rs255 billion to the banks and use the remaining amount to meet growing expenditures including interest payment on the outstanding debt.

Interest payment has become the largest expenditure for the government and it is expected to eat up almost 50% of the total revenue collection this year. Each time the central bank increases its key policy rate, the size of interest payment by the government also rises.

Global ratings agency Moody’s Investors Service said in late February “Pakistan has very weak debt affordability (foreign debt in particular). Moody’s estimates that interest payments will increase to around 50% of the government revenue in fiscal 2023.”

Various experts estimate that a one-percentage-point increase in policy rate will push up interest payment in the range of Rs100-200 billion per year.

Market reports suggest the central bank is set to increase the benchmark lending rate by one percentage point on the recommendation of International Monetary Fund (IMF) for reviving its $6.5 billion loan programme.

The resumption of the programme will also unlock billions of dollars of financing by other multilateral and bilateral creditors.

Earlier, the donors had pledged over $9 billion in flood-relief for Pakistan.

Media reports suggest the central bank had increased its policy rate by an aggressive three percentage points to an all-time high at 20% on the IMF’s recommendation.

The central bank, however, dismissed the notion, saying that it jacked up the rate to control the soaring inflation.

Experts are of the view that a further policy rate hike will prove ineffective as the supply-side inflation (like increase in energy prices) is beyond the central bank’s control.

The government’s reliance on domestic debt has soared significantly in recent times in the absence of foreign debt.

According to the central bank data, the government has borrowed almost Rs19 trillion (83% of total deposits) from commercial banks over a period of time to finance its fiscal deficit.

The government’s other big expenditures include paying monthly pensions and salaries to state employees, defence spending, feeding the loss-making state-owned enterprises (SOEs) and social spending under the Benazir Income Support Programme (BISP).

design: Ibrahim Yahya

In addition to these, the rehabilitation and reconstruction of flood-hit areas has emerged as a big expenditure in the wake of 2022 floods that pushed one-third of the country under water and displaced 33 million people.

In recent weeks, the government has drawn up a plan to get direct financing from banks without holding competitive bidding to swiftly meet its ever-growing expenditures. The IMF, however, has barred the government from direct borrowing and called for raising debt in the traditional way of auctioning the papers.

T-bill auction results

The government on Thursday raised Rs949.46 billion through the sale of three-month T-bills at a cut-off yield of 21.99% compared to 20.99% in the previous auction held on March 8, 2023.

It borrowed another Rs15.50 billion against six-month T-bills at a cut-off yield of 21.99% compared to 20.84%, an increase of 114 basis points.

The government also acquired Rs151 billion against 12-month papers at a cut-off yield of 21.48% compared to 20.98% earlier, a rise of 50 basis points. It raised another Rs24.91 billion from banks through non-competitive bidding, the data suggested.

Published in The Express Tribune, March 24th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ