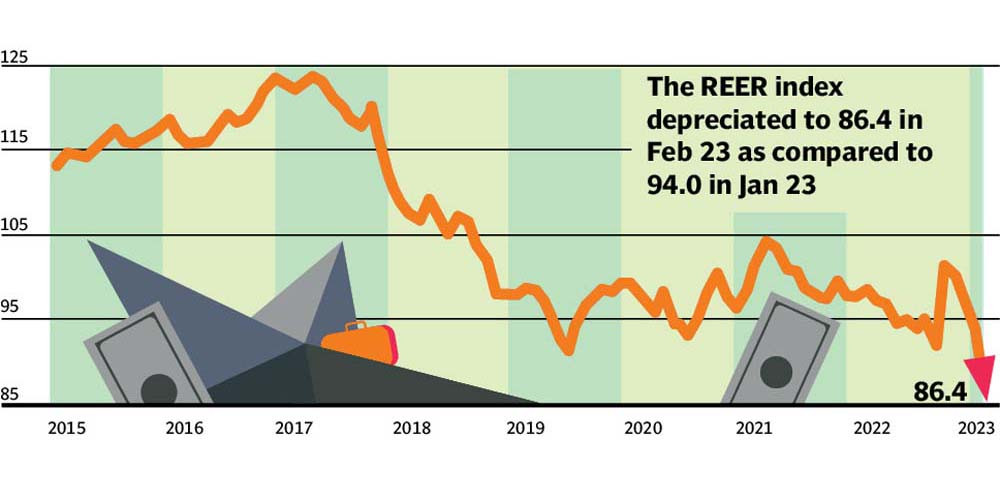

REER depreciates to 86.4 in Feb despite free market exchange rate

Rupee inched up 0.04%, or Rs0.11, to close at Rs283.92 against the US dollar

Pakistan’s currency has hit an all-time low against a basket of currencies of trading partner countries, falling to 84.6 on the index in February, as the market-based exchange rate failed to sustain its fair value.

The currency is considered to be at its fair value when it moves in the range of 95-105 on the index. According to data from the State Bank of Pakistan released on Tuesday, the real effective exchange rate (REER) – the value of the local currency compared to the basket of currencies of trading partner countries – depreciated by 7.52 to 86.4 in February 2023 compared to 93.96 in January 2023. The domestic currency closed at Rs261.50 against the US dollar in the interbank market on February 28, 2023. It closed at Rs267.88/$ on January 31, 2023, according to the central bank data.

The government reinstalled the free-market exchange-rate mechanism on the recommendation of the International Monetary Fund (IMF) to win back its stalled loan program of $6.5 billion and let the rupee find its fair value. The domestic currency, however, failed to sustain at a fair value and got significantly undervalued in the wake of an acute shortage of US dollars in the economy. The historically weak local currency created artificial inflation, but failed to raise the country’s export earnings amid the economic slowdown in the country and export markets in the West.

KASB Securities Head of Research Yousuf Rahman said the REER reading suggests the Pakistani currency has become undervalued. “However, a multi-decade high inflation reading in Pakistan will soon cause the REER to appreciate closer to 100 over the next few months.” To recall, inflation hit a 50-year high at 31.5% in February 2023.

“The REER is calculated by adjusting inflation in the value of the rupee in the country, inflation in the trading partner countries and inflation in common export countries of Pakistan and its trading partner countries,” explained Rahman, adding that, “The inflation reading is estimated to be recorded at 35% in March.”

Usually, food inflation goes up in the holy month of Ramzan, he noted, “This will invite additional inflation in March.”

The inflation reading will remain around 35% in the forthcoming months after Pakistan imposed new taxes worth Rs170 billion, increased the tariff for energy (petrol, power and gas), surged general sales tax (GST) to 18% from 17%, all on the recommendation of the IMF to fix the faltering economy.

design: Ibrahim Yahya

In principle, the weakened currency should have boosted the country’s export. However, the partial ban on imports (including by exporters), massive rupee devaluation, high inflation and the high-interest rate did not allow the country’s export to take up. Secondly, Pakistan’s export market which is, by and large, in US and Europe is facing an economic slowdown and their low purchasing power has caused a decrease in demand for local products in the export markets.

Rahman said Pakistan’s REER should stay around 95-96 on the index to narrow down the wide gap between significantly high imports and sluggish exports. The devastation of the cotton crop in the wake of the summer 2022 widespread floods badly impacted the country’s single largest export sector, the textiles.

Some analysts said the REER indicators have become irrelevant in the case of Pakistan as it is moving down amid the choke of supply of the US dollar in the economy against controlled demand for imports. Rahman, however, said “the revival of the IMF program is the only option to come out of the economic and financial crisis”. It may, however, take time as the government is to take financial commitments worth $6-7 billion from friendly countries to resume the program.

The local currency inched up 0.04%, or Rs0.11, to close at Rs283.92 against the US dollar in the interbank market on Tuesday. Despite the current state of the Pakistani currency, Rahman predicts that the local currency will recover to Rs275/$ after the IMF program is revived.

In conclusion, the reinstatement of the market-based exchange rate in late January has caused Pakistan’s currency to fall to an all-time low against a basket of currencies of trading partner countries. While the weakened currency should have boosted the country’s export, factors such as high inflation, the high-interest rate, and the economic slowdown in the country and export markets in the West did not allow the country’s export to take up. The revival of the IMF program is seen as the only option to come out of the economic and financial crisis, though it may take time as the government seeks financial commitments from friendly countries to resume the program.

Published in The Express Tribune, March 22nd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the st conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ