FBR project gets poor rating from lender

Misses World Bank target to increase revenues to 17% of the economy’s size

The tax authorities will miss some key targets under the $400 million World Bank-funded project and will not be able to increase the nation’s revenues to 17% of the size of the economy, as the lender retains the poor performance rating of the project due to a host of issues.

The Washington-based lender has retained the “moderately satisfactory” poor rating of the Federal Board of Revenue (FBR)-administered Pakistan Raises Revenue project after the mid-term review of the loan scheme showed a report released by the lender recently.

The moderately satisfactory rating is assigned to the schemes that are facing implementation delays, although the World Bank has kept the overall project development objective rating at satisfactory.

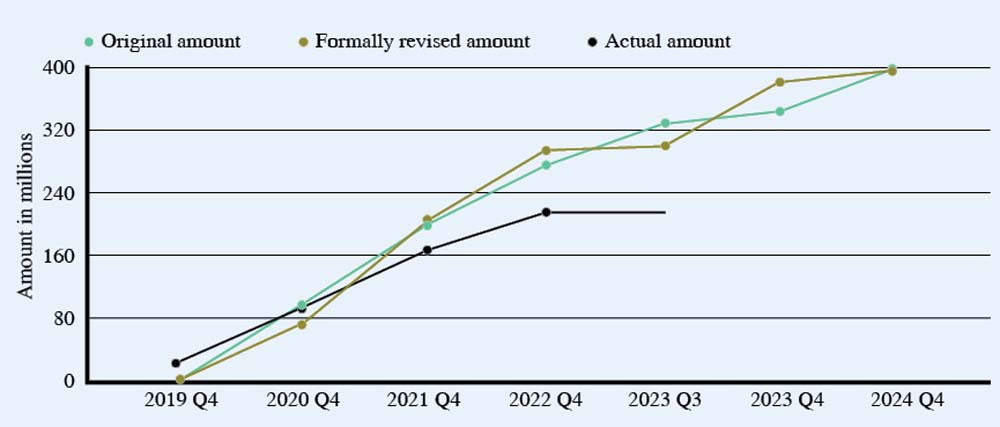

The implementation status and results report of the project showed that, by the third quarter of the fiscal year 2023, $320 million should have been disbursed. The lender, however, released only $210 million – showing $110 million less than the targeted disbursements.

The $400 million loan target was to increase the country’s tax-to-GDP ratio to 17% by June 2024 – a task that the FBR and provincial tax authorities will surely miss. The four provinces hardly contribute 1% of the GDP in taxes and the target had mainly been assigned to the FBR.

The report showed that the total tax-to-GDP ratio is at 10%, which has deteriorated significantly compared to June 2018 when it was 13%.

At a 17% tax-to-GDP ratio, Pakistan would have collected Rs14.3 trillion at today’s economy size. This year’s revised tax target for the FBR is Rs7.640 trillion which is equal to just 9% of the GDP. Low collection, however, means higher borrowing by the federal government.

The FBR’s tax-to-GDP ratio has also deteriorated despite availing the foreign loan in the name of tax reforms. Last month, the FBR tried to divert $6.5 million from the same project to buy 155 luxury vehicles. The FBR defines a luxury vehicle as one with an engine capacity of 1,400cc and above and recently slapped 25% General Sales Tax (GST) on such vehicles.

The FBR is also required to increase the ratio of compliant taxpayers to 3.5 million by June 2024 – a number that currently stands at 3 million.

The World Bank conducted its Mid-Term Review (MTR) of the project from October 17 – November 11, 2022. Following the review, it also proposed a restructuring of outcome and intermediate indicators to support improvements in project performance, according to the report.

There is also no progress in the monitoring and reporting of tax arrears. The report states that “analysis of the arrears not completed”. The June 2024 target is that the FBR will track “tax arrears through a Management Information System, analysed, and at least 60% of collectible arrears at the start of the fiscal year are recovered”.

The FBR is also falling behind the target of resolution of refund claims. As per the report, the programme targets that by June 2024, at least 50% of the refund claims are resolved within three months of their request. The current ratio is only 15%.

The report stated that in June 2018, the FBR staff was not assigned to a specific function with career prospects within the function – an issue that exhibits the bureau’s ill-preparedness. The FBR was required to have “at least 40% of grade 17 officers assigned to a technical stream and receive specialised training. Dedicated units for non-core functions established and staffed with externally hired professionals.” And the progress today is that “technical streams have not been established,” according to the MTR of the loan programme.

The FBR was also required to completely replace its obsolete ICT equipment, have its legacy branded software updated, and active-active private cloud established”. So far, however, this goal has not been achieved. The report stated that “procurement was underway for some hardware and software. PC-1 is being revised, taking into account revised ICT requirements and additional technical support needed”.

The report did, however, note some improvement in the performance in several disbursement-linked indicators; there is a reduction in withholding tax lines from 58 in the fiscal year 2019 to 31 in the last fiscal year. The FBR is required to eliminate 11 more withholding taxes to achieve the end-programme objective.

All four provinces have adopted FBR’s valuation tables for immovable properties and have signed MoUs with the FBR for input adjustments in GST. The FBR also added 462,677 new taxpayers, identified through automated data sharing and ICT-based business intelligence tools, according to the review.

Published in The Express Tribune, March 12th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ