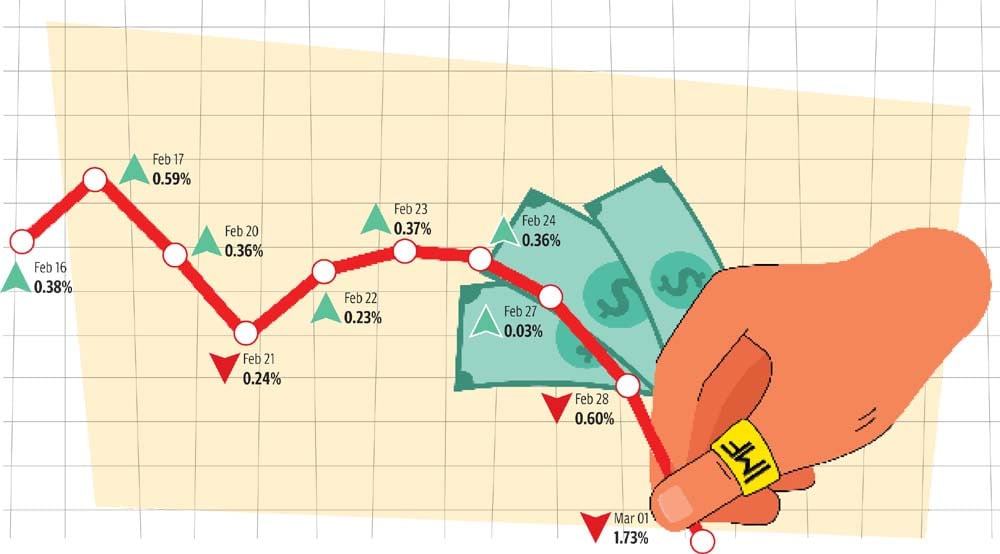

Rupee dives 1.73% to Rs266.11

Depreciated to Rs285/$ in Pakistan’s black market, Rs295/$ in Afghanistan

Bowing to the International Monetary Fund’s (IMF) condition to truly allow market forces to determine the rupee-dollar exchange rate, the Pakistani currency nosedived 1.73% (or Rs4.61) in one day to a two-week low at Rs266.11 against the US dollar in the interbank market on Wednesday.

The domestic currency had closed at Rs261.50/$ on Tuesday, according to the State Bank of Pakistan (SBP).

In the open market, the domestic currency plunged 2.56%, or Rs7, to close at Rs274 against the greenback on Wednesday, the Exchange Companies Association of Pakistan (ECAP) reported.

The IMF recently expressed concerns about the government still controlling the rupee-dollar exchange rate in the interbank market. This was evident from the fact that the black currency market was gaining strength once again.

Traders, who failed to purchase dollars from the interbank market, due to limited availability, reverted to the black market to meet their requirements. Accordingly, the local currency took a quick plunge in the illegal market compared to the appreciation it had witnessed in the interbank market over the past few days and weeks.

Over the past four weeks, in the interbank market, the rupee had appreciated by 6.5% (or almost Rs17) to a one-month high at Rs259.92/$ on Monday.

On the contrary, however, the rupee depreciated to Rs285/$ in the black market in Pakistan and Rs295/$ in Afghanistan, according to ECAP Secretary General Zafar Paracha.

Market reports suggest that the IMF wants the value of the rupee in the interbank market to match the one in the black market.

Effective January 25, 2023, the government ended its control over the rupee-dollar exchange rate and let market forces determine it parity. This resulted in a sharp depreciation of 16.5% (or Rs45.69) in 10 days to a record low of Rs276.58/$ on February 3, 2023.

Arif Habib Limited Head of Research Tahir Abbas said “Appreciation in the rupee in the interbank market was recorded after the government curbed imports to manage with low foreign exchange reserves amid a high risk of default.”

“Curtailing import demand through administrative controls to manage with low reserves is, however, tantamount to… controlling the rupee in the interbank market,” he said.

Pakistan’s foreign exchange reserves stand at around $4 billion at present which barely provide an import cover for less than a month.

design: mohsin alam

Moreover, Pakistan requires around $11 billion to finance its current account deficit and repay foreign debt, Moody’s Investors Service said on Tuesday.

The rupee also took a battering following Moody’s Investors Service anticipating a higher risk of default for country ‘with little chance of recovery’.

At the moment, Pakistan is negotiating terms with the IMF in order to revive its $6.5 billion loan programme to shield itself from a sovereign default.

The rating agency downgraded the government’s local and foreign credit ratings to Caa3 from Caa1 – the second time in four months.

The foreign exchange reserves stood at $20 billion in August 2021, according to the central bank’s data.

An expert, however, said the value of the currency in the interbank market may not match the one in the black market. The size of the black market is estimated at around $300-350 million a month, significantly smaller when compared to around $6 billion in the interbank market, it was learnt.

“Pakistan will soon achieve a staff-level agreement with the IMF given that it has taken several tough decisions to win back the lender’s loan programme,” predicted Abbas. Apart from that, the government is hoping to unlock multibillion dollars in financing from other multilateral and bilateral creditors after the IMF programme is revived.

Abbas predicts that the foreign exchange reserves will improve to about $6-7 billion by the end of FY23 compared to the IMF’s expectation of around $10 billion.

Pakistan’s central bank has preponed its monetary policy meeting to Thursday (today) to hike its key policy rate by an estimated 200 basis points to fulfil another condition imposed by the global lender.

Published in The Express Tribune, March 2nd, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ