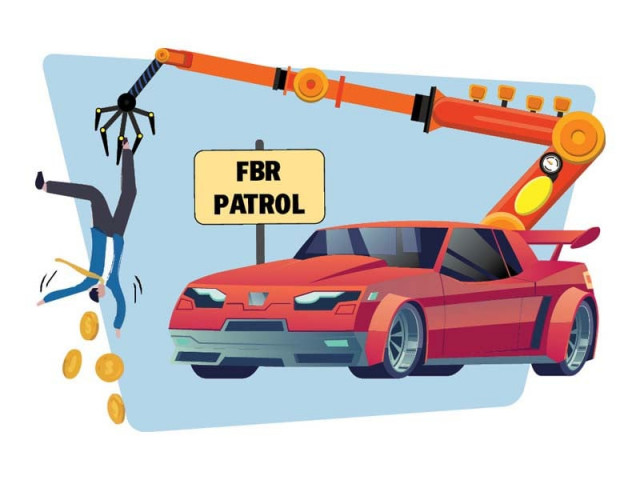

FBR aims to buy 155 luxury vehicles

Plans to make purchase from World Bank’s $400m revenue raising project

Disregarding the prime minister’s austerity policy, the Federal Board of Revenue (FBR) has planned to buy 155 luxury vehicles, at a cost of over Rs1.6 billion, in the name of taxpayers’ facilitation out of a foreign loan meant to upgrade its obsolete information technology system.

The estimated cost of Rs1.63 billion for the purchase of vehicles is equal to 8.6% of the funds that the FBR had secured for the upgradation of its obsolete hardware and software, showed official documents. The more glaring aspect of the plan is that a World Bank loan will be used to buy these vehicles in the name of taxpayers’ facilitation.

A couple of years ago, the FBR suffered one of the worst-ever data hacking incidents in its history – and yet, it has not been able to upgrade its data network.

Details show that the FBR has submitted documents to the Ministry of Planning for the Investment Project Financing (IPF) component, worth Rs19.6 billion, under the World Bank’s $400 million Pakistan Raises Revenue project.

A deeper dive into these documents revealed that the FBR is going to procure 155 vehicles of 1,500 cc to 3,000 cc – the engine capacity that the FBR itself has described as ‘a luxury’ and being subject to heavy taxation. The FBR has not explained the make of the vehicles in the documents.

According to details, of the Rs19.6 billion that the FBR has demanded, a big chunk of Rs1.63 billion or 8.6% will be spent on buying these vehicles. In a meeting held recently, however, the planning ministry opposed the purchase. Another meeting to acquire the ministry’s approval ahead of the Central Development Working Party (CDWP) meeting will take place today (Thursday).

The FBR has estimated each vehicle to cost about $47,000 or Rs10.3 million, at the old exchange rate of Rs220 to a dollar. After the rupee devaluation, and recent increase in prices by car assemblers, the total cost of the purchase might exceed much more than even Rs1.63 billion.

Prime Minister Shehbaz Sharif has announced plans to implement an austerity policy due to the pressing economic conditions in the country. While Finance Minister Ishaq Dar, on Wednesday, announced a Rs170 billion mini-budget, his revenue arm seems to be keen on purchasing cars and using taxpayer money for its personal benefits.

Dar has already stopped the FBR from misusing the Point of Sale (PoS) funds for personal benefits after a story appeared in The Express Tribune.

Last week, a national austerity committee also recommended the prime minister ban the purchase of all types of vehicles until June 2024.

The FBR follows the Universal Self-Assessment scheme where the taxpayer has the freedom to declare its income. The FBR charges higher income tax rates from non-filers, but despite having their data, the FBR does not often go after them – with or without a car.

The replies of the FBR spokesperson were awaited till the filing of this story.

The details showed that the vehicles will be distributed among all the field formations. The maximum number of vehicles, nine each, are planned to be given to the regional tax offices situated in Faisalabad, Gujranwala, Islamabad, Lahore and Karachi.

Some regional offices, like Peshawar, Quetta and Rawalpindi will get eight vehicles.

The FBR stated in its documents that it plans to launch tax compliance initiatives, including behavioural nudges and facilitate registration, filing, and payment of taxes by reaching out taxpayers in selected areas in phases, where digital access to services is weak or other geographical, social, or cultural aspects restrict traditional ways of facilitating the taxpayers.

These reasons, however, do not seem to justify the purchase of 155 luxury vehicles.

In its technical appraiser, the planning ministry has also raised objections to the FBR’s move to buy these vehicles, asking the FBR about the “need” and the cost. The ministry recommended that instead of buying these vehicles “it would be more appropriate that tax facilitation facilities be outsourced.”

The planning ministry also objected to the allocation of $3 million for training, workshops, and staff capacity building. An amount of Rs320.4 million has been proposed for the operational cost of project management (i.e., Rs30 million for the hiring of vehicles, Rs18 million for fuel, and Rs30 million for project contract staff).

The World Bank had approved the project to expand the tax base and upgrade the obsolete data networks, but the Planning Commission has observed that these goals might not be achieved within the due date – which is June 2024.

“The sponsors, after a lapse of two years, have submitted the revised PC-I with new requirements of equipment and with enhanced costs. Only Rs92 million (i.e., less than 1% of the original cost) has been utilised within two years i.e., up to June 30, 2022, therefore, the sponsors may clarify whether they will be able to utilise the remaining cost of the project Rs19.5 billion up to June 2025,” according to the ministry.

Many had opposed the Pakistan Tehreek-e-Insaaf (PTI) government’s move to take the $400 million WB loan in the name of the tax reforms, fearing that it might also cause a wastage of foreign loans, as had happened in the case of the failed $149 million Tax Administration and Reform Project (TARP). The TARP funds had been utilised to buy cars, computers and to upgrade offices.

The Pakistan Raises Revenue money now may also be used to buy cars, computers and laptops. The Rs9.6 billion cost includes spending of Rs596 million on 1,300 desktops and 600 laptops.

Published in The Express Tribune, February 16th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ