Remittances hit new low at $1.89b

Inflows through official channels slip below the $2b mark in Jan

The flow of workers’ remittances sent home by overseas Pakistanis hit a 32-month low, slipping below the $2 billion mark through official channels in January 2023.

According to data released by the State Bank of Pakistan (SBP) on Monday, “The remittances were recorded at $1.89 billion in the month.” Remittances are 13% lower than the same month last year (January 2022) and down 10% compared to December 2022.

The low-level inflow has increased the country’s reliance on foreign debt which has already mounted beyond affordability.

Cumulatively in the first seven-months (July-January) of the FY2023, remittances dropped 11% to $16 billion compared to $18 billion in the same period last year.

A major drop of 25-30% was recorded mainly from Saudi Arabia and the United Arab Emirates (UAE), where a majority of Pakistanis (almost 70% of the total of 10 million abroad) are working. Remittance inflow from European countries also witnessed a drop, but saw an improvement from two leading Western countries – the United States and the United Kingdom.

Surprisingly, the inflows dropped from Middle Eastern countries despite the regional economies being on the rise. Similarly, the inflows improved from Western countries, currently facing recession-like situations. The only difference between the two regions is that Western countries operate strictly in compliance with international laws to send and receive funds.

Experts have anticipated that the inflows will improve in the months to come. The rupee has devalued by 16% in the past two weeks to around Rs270 against the US dollar in the interbank market.

Until January 24, the rupee hovered at around Rs225-230/$. Once the government ended its control over the rupee-dollar exchange rate, on the recommendation of the IMF, however, the rupee nosedived. Now market forces are determining the rate considering the US dollar’s demand and supply situation in the market.

With the month of Ramzan around the corner, it is expected that overseas Pakistanis will send a higher amount to their relatives in Pakistan to cope with the high inflation levels. Historical trends suggest that remittances usually grow in the fasting month of Ramzan and Eid festivals. Ismail Iqbal Securities Head of Research, Fahd Rauf, said in a commentary that “(The remittances) should improve from February.”

design: mohsin alam

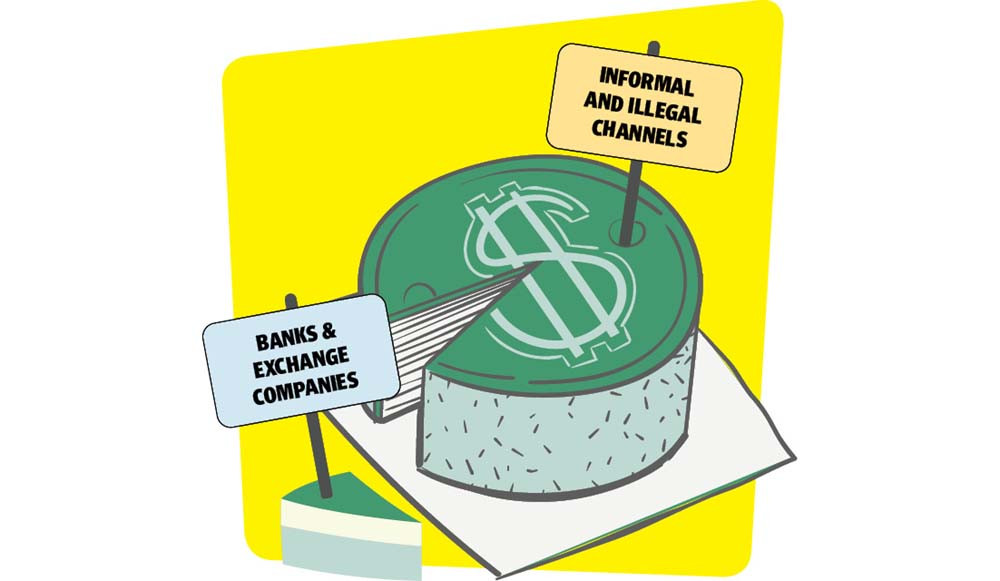

Experts believe the significant drop of inflows through official channels (banks and exchange companies) was noted following a section of overseas Pakistanis opting to send funds through informal and illegal channels (hawala-hundi). Until the government let up control, the informal channels were offering a significantly higher price of Rs250-260/$ compared to Rs225-230/$ being offered by formal channels.

“The black market impacted the remittances flow in January 2023 but $1.89 billion in January is still not a bad number, given the huge gap between the official and black-market rates,” Rauf added. The remittances inflow may total around $27-28 billion in the full current fiscal year 2023, considering the inflows average around $2.2-2.3 billion in each of the five remaining months.

Remittances stood at $30 billion in the previous fiscal year ended June 30, 2022.

Region-wise remittances

Pakistanis living in Saudi Arabia sent remittances worth $408 million in January 2023, down 26% as compared to the $549 million sent in the same month of the previous year. Inflows from the UAE dropped 35% to $269 million compared to $382 million in the same month of the last year.

They, however, improved by 2% to $330 million from the UK in January 2023 compared to $324 million in January 2022 and enhanced by 1% from the US to $214 million compared to $212 million last year.

The inflows from European countries (excluding the UK) remained stagnant at $240 million in the month. Remittances, however, fell by a notable 9% to $433 million from other countries in January compared to $474 million in January 2022.

Rupee stabilises

The rupee stabilised around Rs270 against the US dollar in the interbank market ahead of the extended talks with IMF to resume its $6.5 billion loan programme. The local currency witnessed a downtick of 0.06% (or Rs0.16) to Rs269.44 against the greenback in the interbank market on Monday.

Published in The Express Tribune, February 14th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ