Rs952b to be added to circular debt

Govt prepares plan on unrealistic rupee-dollar exchange rate of Rs232 per dollar and 16.84% KIBOR

A revised Circular Debt Management Plan (CDMP) has revealed that a staggering Rs952 billion more will be added to the country’s circular debt in a ‘business as usual’ move – a hole that the government now wishes to plug by increasing the price of electricity and - Rs675 billion in additional subsidies.

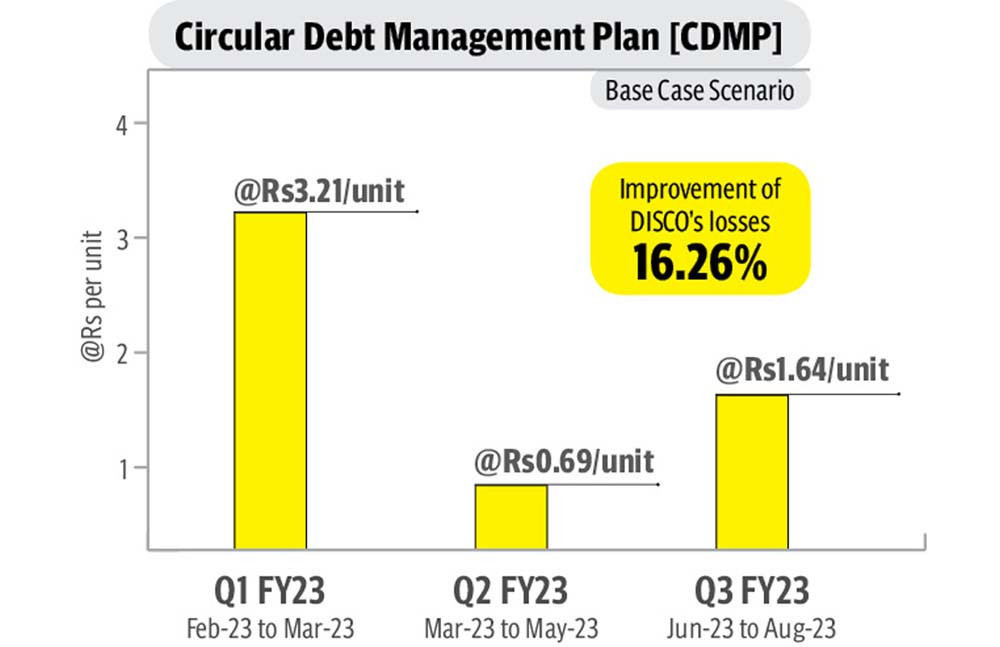

The government has proposed the imposition of three separate quarterly tariff adjustments, ranging from 69 paisas per unit to Rs3.21 per unit from February to May this year to reduce a gap of Rs73 billion, showed details.

In addition to that, in order to meet two more conditions agreed with the International Monetary Fund (IMF) in the past, the government has also decided to slap a Rs2.93 per unit debt surcharge apart from giving effect to the pending fuel cost adjustments (FCA).

The plan, however, appears to be unrealistic, as it has been made on the assumption that the rupee-dollar exchange rate is Rs232 per dollar and 16.84% Karachi Interbank Offered (KIBOR) rate. The current exchange rate stands at Rs268 and KIBOR is close to 18%.

In any given time from now till June, there will be an additional Rs3.62 per unit to Rs6.14 per unit surge in the cost of electricity, excluding the impact of the pending FCAs. Similarly, this figure can go up further, if there is no agreement between Pakistan and the IMF about the extent of the Rs675 billion additional subsidies that the Ministry of Energy has planned to get to fill the Rs952 billion hole, according to the sources.

They added that the revised plan has been shared with the IMF and discussions will now take place within this week. The plan, like the previous one that talked about zero increase in circular debt, seems ambitious to the least and may invite some serious grilling from the IMF.

Earlier, the government had planned that circular debt will be lowered to Rs1.526 trillion through a blend of reductions - Rs284 billion in the old stock and further reducing the flows. The sources, however, said that about Rs952 billion could be added to circular debt in the current fiscal year and bringing it down to Rs75 billion will require a host of measures. The major reduction is sought through Rs675 billion additional subsidies from the government, a step that appears over ambitious given the fact there is no such space in the budget.

The secretary of power did not respond to a question about whether he has gotten assurances for the Rs675 billion worth subsidies from the government.

Under the IMF condition, Pakistan was supposed to retire Rs284 billion stock of circular debt. However, the sources said that the government was not in the mood to reduce the stock and instead, was keen to use the allocated funds for other purposes.

In order to address the IMF’s concerns, it has proposed that the Rs284 billion worth of repayments should be deferred for a period of two years. The details showed that the Power Division has worked out a Rs3.21 per unit quarterly tariff surcharge for the February-March period that will lower the debt accumulation by Rs40 billion. After the end of this surcharge, the government may slap another surcharge of 69 paisas per unit for the March to May period to cut the accumulation by another Rs17 billion. The third surcharge is being worked out at Rs1.64 per unit for the June-August period to cut the debt flow by another Rs16 billion.

Compared to these surcharges, the reduction through reducing line losses has been shown at only Rs12 billion. In order to cut the flow of another Rs68 billion on account of pending FCAs for the period of June-July 2022, the government has proposed recovering Rs22 billion in this fiscal year by charging Rs1 to Rs1.65 per unit from these consumers. The remaining Rs33 billion is planned to be recovered from July to December 2023.

In its defence about deviation from the earlier approved plan, the Power Division stated that there were uncertainties about the assumptions developed for the formulation of the previous plan. These include fuel price volatility, economic parameter variation, resource availability and change in commercial operations Date (COD) of upcoming power plants.

The government has used a 16.84% KIBOR and Rs232 to a dollar price. Although these assumptions are still unrealistic, they are better than those used a month ago. Earlier, the Power Division had assumed KIBOR at 10.50% per year for the current fiscal year, while the three months KIBOR remained above 14%.

Similarly, when the country closed the last fiscal year at Rs204 to a dollar exchange rate, the Power Division had the audacity to use the Rs195 rate for the last fiscal year.

Published in The Express Tribune, February 1st, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ