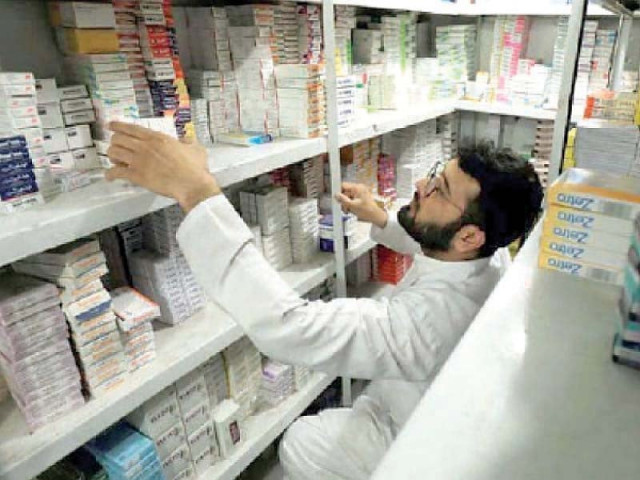

Only two-day inventory left: PPMA

Warns medicines will not be available in the market, urges parliament to act

Pakistan has only two days’ worth of raw material left for the production of medicines – an office bearer of the manufacturers’ association warned on Thursday, lambasting the governor of the central bank and finance minister for their callous attitude towards the grave situation.

In a Senate Standing Committee meeting on finance, Arshad Malik, who represented the Pakistan Pharmaceutical Manufacturers Association (PPMA), said that the industry had a two-month inventory stock that is now almost finished.

After the pharmaceutical industry failed to get any support from the central bank, finance ministry and commercial banks, in opening new letters of credit (LC) for the import of raw material, the officials sought urgent help from parliamentarians to stop the breakup of the supply chain of medicines.

“The pharmaceutical industry is worth $6 billion and its reliance on import is around 93%,” said Malik, adding that several national banks have refused to issue LCs to the industry.

“I was surprised to hear the response of the SBP Governor Jameel Ahmad who, the other day, asked us to provide a list of import items stuck without realising that it is routine function to import goods for the manufacturing of medicines,” said Malik.

“The biggest tragedy is that we wrote a letter to Finance Minister Ishaq Dar but it seems he was too busy and interested in saving his politics rather than solving serious matters,” he lamented.

The PPMA representative highlighted that his company has a Rs1 billion credit limit for the import of raw material from India and that it paid Rs100 million 45 days ago. So far, however, the bank has been unable to make payments to India.

“Do not take it for granted, soon medicines will not be available in the market,” said Malik.

The pharmaceutical sector, however, isn’t the only one facing this existential threat. The government’s policies have increased the prospect of a shortage of goods in many other fields as well.

Senator Mohsin Aziz of the Pakistan Tehreek-i-Insaaf (PTI) said that banks were even hesitant opening LCs worth $5000. He further added that the difference in dollar value between the open market and central bank was a major reason behind the decline of the inflow of remittances and the increased smuggling of dollars.

State Minister for Finance and Revenue, Dr Aisha Ghaus Pasha said, “This is an extraordinary situation and the country is facing a severe crisis.”

Senator Aziz, however, responded that, “It takes 25 years to build a business, which the government is destroying with one stroke of the pen.”

“We are in the middle of a perfect storm. Please do not expect business as usual,” replied Dr Pasha.

“Everyone is trying to save the political constituency and nobody is thinking about the country,” said Dr Pasha, adding that control over dollar outflow was the need of the hour.

“Who did not manage the crisis? The business community or the government?” asked Senator Aziz, tacitly highlighting the indecisiveness of the government. “Pakistan has already defaulted on hundreds of LCs and the government was in a state of denial,” he said.

The SBP official, however, said that non creation of obligation by not initiating a transaction does not tantamount to a default.

“Dollars have been provided only for the import of wheat, fertiliser, defence equipment and petroleum products,” said Senator Aziz.

Dr Aisha Ghaus, however, also ruled out the possibility of a default, reiterating that the government is aware of the current situation and is working vigorously to cope with it.

When the country is in desperate need to enhance exports the Ministry of Finance’s business-as-usual approach was delaying the functionality of the Export-Import (Exim) Bank. The finance ministry has yet to make the Exim Bank operational and handle the issue.

Dr Pasha stated that the bank could not start operations mainly because the notification from the cabinet is awaited, equity worth Rs1 billion had not been released and clearance from the Public Procurement Regulatory Authority (PPRA) was still pending as well.

“Government after government has failed to make the Exim bank operational and, unfortunately, the committee had to take notice of the situation,” said Senator Saleem Mandviwalla.

A senior official of the EXIM Bank said that the bank had received five requests for a $90 million loan, which can support $250 million worth of exports.

Senator Mandviwalla directed the ministry to speed up the process of notification to be issued by cabinet, provide Rs1 billion to the Exim bank in lieu of equity and also decided to call PPRA in the next meeting to address the ambiguous issue of the required clearance.

Published in The Express Tribune, January 20th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ