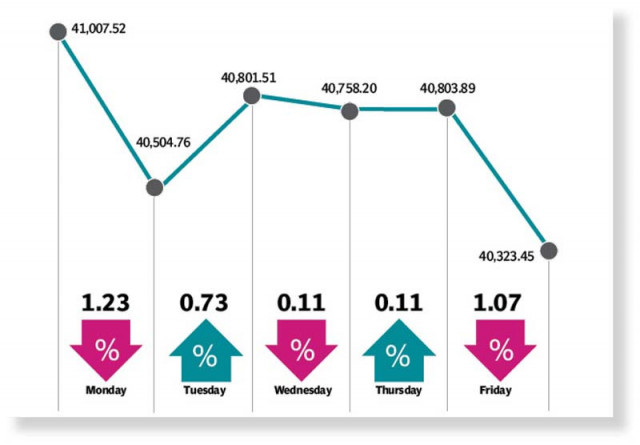

Stocks turn bearish, dip below 41,000 mark

KSE-100 index drops by 684 points to settle at 40,323

Pakistan Stock Exchange (PSX) remained under pressure throughout the outgoing week as economic and political tensions intensified, which played on investors’ mind and pushed the benchmark KSE-100 index into the red.

The trading week kicked off on a negative note on the back of falling forex reserves and delay in funds flow from Saud Arabia. Political instability hammered investor confidence and as a result bears took over.

However, Tuesday witnessed a positive session, following news of securing $10 billion in pledges at Geneva climate conference.

Despite the uptrend, investors remained cautious due to the rising political temperature and economic headwinds. Trading remained dull on Wednesday in the absence of major positive triggers but the market managed to close with minor gains.

The KSE-100 index lost ground on Thursday despite updates about the rollover of an existing $2 billion loan of the UAE and an additional $1 billion after a meeting between Prime Minister Shehbaz Sharif and UAE President Sheikh Mohamed bin Zayed in Abu Dhabi.

The bourse succumbed to the increasing political noise on Friday as Punjab Chief Minister Chaudhry Pervaiz Elahi’s advice to Governor Balighur Rehman to dissolve the provincial assembly sparked panic. As a result, sceptical investors rushed to offload their stockholdings, pulling the index down by nearly 500 points.

The benchmark KSE-100 index closed the week down by 684 points, or 1.7%, at 40,323 compared to the previous week.

“In a turnabout from the previous trend, the market closed negative, losing a total of 684 points,” said JS Global analyst Muhammad Waqas Ghani.

It came despite the index’s recovery during the week over commitments of $10 billion (3% of GDP) secured at the International Conference on Climate Resilient Pakistan for the rehabilitation of flood-hit areas, he said.

On the political front, temperature remained high in Punjab where Chief Minister Chaudhry Pervaiz Elahi received the vote of confidence and subsequently signed a summary to dissolve the Punjab Assembly.

“Investor participation inched up by 4% week-on-week,” Ghani said, adding that the exploration and production (E&P) sector was in the limelight after finance minister indicated the settlement of gas sector’s circular debt by partially adjusting receivables of state-owned E&P companies against their dividends.

Several financing commitments from friendly countries also came true in the week under review. The UAE consented to provide an extra $1 billion and roll over an existing $2 billion loan after PM Shehbaz’s visit to the Gulf emirate.

In addition, Pakistan and Saudi Arabia inked a new deal to finance oil futures worth $1 billion. SBP’s reserves dropped again, falling to their lowest level since February 2014 at $4.3 billion.

Arif Habib Limited, in its report, said that the market commenced trading on a positive note in the outgoing week with news of progress on the circular debt.

Additionally, it remained in the green zone since Pakistan secured over $10 billion in pledges from international financial institutions and the UAE agreed to lend $1 billion and roll over an existing $2 billion loan.

“However, uncertainty prevailed due to political concerns,” it added.

Pakistani rupee depreciated by Rs1.01, or 0.4% week-on-week, against the US dollar, closing at 228.14.

In terms of sectors, positive contribution to the bourse came from miscellaneous (68 points), automobile assemblers (39 points), insurance (6 points), automobile parts and accessories (3 points) and paper and board (3 points).

Negative contribution came from commercial banks (222 points), fertiliser (132 points), technology and communication (132 points), pharmaceuticals (59 points) and oil and gas exploration (35 points).

Foreigners’ buying continued, which came in at $1.2 million compared to net buying of $0.3 million last week.

Published in The Express Tribune, January 15th, 2023.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ