The Pakistan Stock Exchange (PSX) witnessed a turbulent week as economic and political developments kept the bourse under pressure and as a result it remained in the red zone for most of the week.

At the beginning of the week, trading kicked off on a negative note following postponement of Saudi crown prince’s visit to Pakistan. Delay in talks with the International Monetary Fund (IMF) also played its part, hitting investor interest and restricting activity in the market.

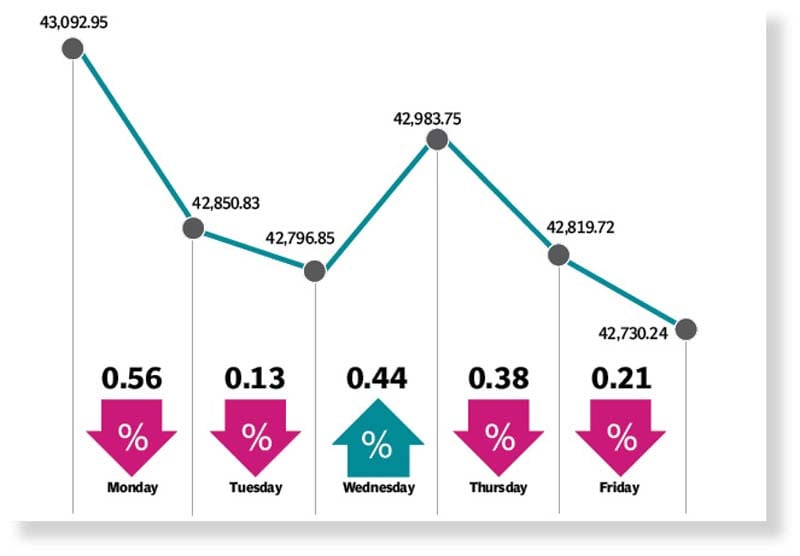

The benchmark KSE-100 index continued to drop owing to political uncertainty that turned investors sceptical.

The bearish pressure eased on Wednesday as the market turned around and raced towards the 43,000-point mark despite a rise in Pakistan’s credit default swap (CDS) ratio. The CDS index spiked 4.2 percentage points to a new high at 64.2%, suggesting that the country lacked resources to meet the growing import payments and foreign debt repayment on time.

However, bears staged a comeback, taking advantage of caution over the delayed ninth review of the IMF loan programme. Moreover, the absence of positive triggers further dented the investors’ mood.

The index also dropped on the last trading day of the week as political chaos fuelled selling pressure coupled with an unsuccessful meeting between Pakistan and the IMF, indicating a delay in the ninth review. The KSE-100 index closed the week down by 363 points, or 0.84%, at 42,730 compared to the previous week.

“KSE-100 faced downward pressure during the week, dropping 0.8% week-on-week to close at 42,730 points,” said JS Global analyst Wasil Zaman in a report.

Among the sectors, textile (-3.5%), oil and gas (-2.8%) and food (-1.8%) were the key underperformers whereas chemical (2.7%) and fertiliser (1.8%) featured among the top performers.

On the news front, the IMF asked Pakistan for a revision in the fiscal framework to propose measures for an additional revenue collection of Rs800 billion to bridge the potential shortfall, it added.

The inflow of remittances dropped 9% month-on-month to $2.2 billion in October 2022. On the other hand, auto sales rebounded and came in at 12,800 units, up 29% month-on-month due to higher operating days. The default risk for Pakistan, as measured by the five-year Credit Default Swap (CDS) spread, rose sharply during the week from 56% to 75% amid political uncertainty and delay in talks with the IMF.

“SBP’s reserves increased marginally by $3 million to $7.9 billion during the previous week whereas the SBP governor claimed that the country has sufficient forex reserves and that around 100,000 cases of pending LCs will be cleared by the end of the week,” the JS analyst said.

Arif Habib Limited, in its report, said that the market commenced on a negative note owing to the delay in Pakistan-IMF talks for the ninth review.

Furthermore, the postponement of Saudi crown prince’s visit added fuel to the negative sentiment, it said. Additionally, Pakistani rupee remained under pressure, depreciating by Rs1.53, or 0.69% week-on-week, at Rs223.17. Meanwhile, the large-scale manufacturing (LSM) data showed a 0.4% year-on-year dip in 1QFY23.

The market closed at 42,730, shedding 363 points (or 0.84%) week-on-week. In terms of sectors, positive contribution came from fertiliser (140 points), technology and communications (65 points) and chemical (17 points).

Negative contribution came from oil and gas exploration (124 points), commercial banks (119 points), miscellaneous (58 points), cement (57 points) and food and personal care products (57 points).

Stock-wise, positive contributors were Engro Corporation (104 points), TRG Pakistan (56 points), Systems Limited (26 points), Lotte Chemical (19 points) and Dawood Hercules (18 points).

Negative contribution came from Oil and Gas Development Company (61 points), Pakistan Services Limited (53 points), Unity Foods (45 points), Pakistan State Oil (42 points) and Pakistan Petroleum (35 points).

Foreigners’ selling continued during the week, which came in at $2.06 million compared to net selling of $4.65 million last week.

Major selling was witnessed in OMCs ($0.75 million) and technology and communications ($0.45 million).

On the domestic front, buying was reported by brokers’ proprietary ($2.90 million), followed by mutual funds ($1.96 million).

Average volumes came in at 186 million shares, down by 26% week-on-week, while average value settled at $28 million, down by 14%.

Published in The Express Tribune, November 20th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1730464111-0/raygun-(1)1730464111-0-165x106.webp)

1730967569-0/BeFunky-collage-(28)1730967569-0-165x106.webp)

1730967164-0/trump-(21)1730967164-0-165x106.webp)

1730963708-0/Express-Tribune-Web-(27)1730963708-0-270x192.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ