The Federal Board of Revenue (FBR) has extended the deadline for filing income tax returns to October 31 amid low filing of tax returns.

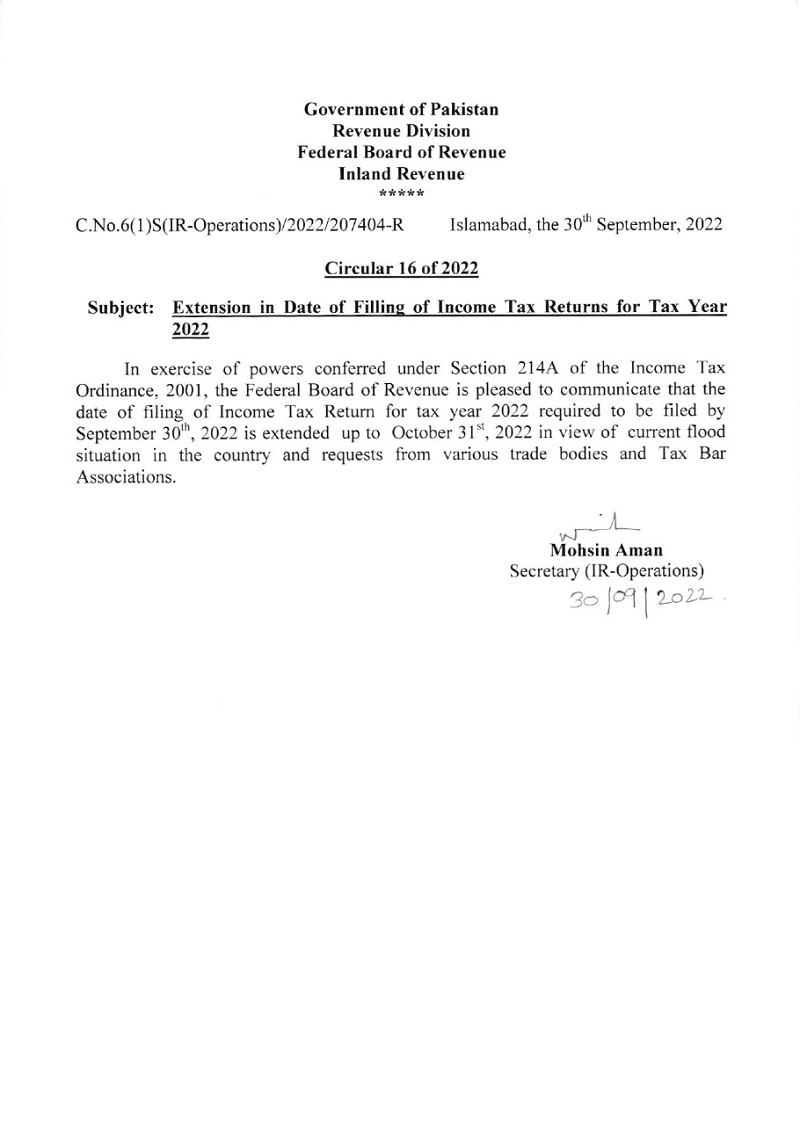

The FBR in a notification announced late Friday night that September 30 deadline has been extended up to October 31 “in view of floods and requests of various trade bodies and tax bar associations”.

So far less than 1.5 million tax returns have been filed and nearly one-third of these have made no tax payment.

While this time around the return filing largely remained smooth due to better functioning of the technology arm of FBR, confusion over policy actions taken in the budget coupled with the situation arising out of floods held back taxpayers from fulfilling their obligation.

Sources said that so far about 1.45 million individuals, Associations of Persons (AOPs) and companies had filed annual tax returns, constituting hardly 40% of the taxpayers who submitted the returns during the last tax year – 2021.

In the three categories, the companies, which should have been more compliant, turned out to be less enthusiastic about the filing of returns.

Also read: FBR asked to extend tax date

Data compiled by the FBR showed that so far about 4,600 companies had filed annual returns. Of those, 3,750 filed nil returns. Nil returns mean that the companies did not do any business throughout the year.

One of the reasons for the lower number of returns filed by the companies is said to be that the fiscal year of many companies ends in December, unlike the normal July-June cycle.

However, the number of companies filing returns has significantly decreased compared to the previous tax year when over 67,000 firms submitted their tax returns. The ratio of return-filing companies this year was less than 7% compared to the previous tax year.

1719660634-1/BeFunky-collage-nicole-(1)1719660634-1-405x300.webp)

1732276540-0/kim-(10)1732276540-0-165x106.webp)

1732274008-0/Ariana-Grande-and-Kristin-Chenoweth-(1)1732274008-0-165x106.webp)

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ