‘Bolster financial sector, judiciary and education’

“Today’s Pakistan faces a number of challenges but there should be some point to start with and these three institutions should be the first target,” said Husain.

Husain was delivering a speech on ‘Pakistan’s social and economic agenda for 21st century’ here on Friday, which was organised by the Marketing Association of Pakistan.

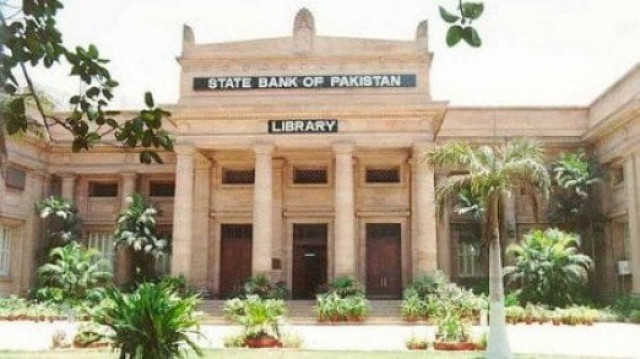

The last decade has been one of the worst decades as the performance of all major institutions has deteriorated, said Ishrat, a former SBP governor.

“Unfortunately, the country which was created for unity, faith and discipline is now an epitome of disunity and indiscipline,” Husain said.

“Judiciary should be on top of the list because unless people believe that they are equal before the law, they cannot perform their duties properly.

“Second is education, unless we provide latest skills and education to our youth which comprises 50 per cent of our population, we are bound to face a social explosion.

“Third area is financial services, which will integrate our wealth and provide our citizens with a chance through which they can benefit from microfinance banking and Islamic banking,” he elaborated.

“Nothing has changed since 1999, the time I took over as the governor of the State Bank of Pakistan, things have only deteriorated, the only positive development we see is freedom of expression and awareness,” said Husain.

“Two decades ago, Pakistan was far ahead of India and Bangladesh in economic reforms but the equation is just the opposite of what was in the early 1990s,” a dismayed Husain said.

He added that only 12 per cent Pakistanis have access to banks but with mobile phone users crossing the 98 million mark, the future of tele-banking in Pakistan is very bright.

“Owing to our banking reforms, we have provided access for over 1.8 million people to microfinance loans which is still very low compared with 21 million people in Bangladesh,” he said. With over 50 per cent of the population younger than 19, Pakistan has immense potential of economic growth but the future still seems very distant, he added

Published in The Express Tribune, June 26th, 2010.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ