Stocks fall amid flood damage assessment

Benchmark KSE-100 index drops 361 points to settle at 41,948

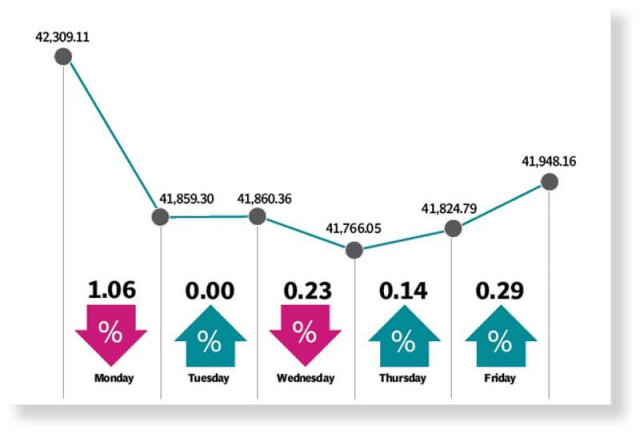

Pakistan Stock Exchange witnessed a bearish trend for most of the outgoing week as the benchmark KSE-100 index took a beating following assessment of flood damage, which pulled the index down by 361 points (or 0.9%) week-on-week.

The week kicked off on a negative note that dragged the index below the 42,000-point mark amid inflation fears owing to flood crisis and estimated damage assessment of $10 billion. Furthermore, political uncertainty exacerbated the market’s decline.

After a flat session, the market came under a bearish spell mid-week as the KSE-100 index fluctuated between red and green zones while volumes stood low in the absence of positive triggers. Trading volumes dipped to 92.9 million shares, down 50% day-on-day.

On the other hand, rupee depreciation during the week continued to put pressure on the bourse as despite the disbursement of IMF loan tranche of $1.17 billion, the currency weakened against the greenback to settle at Rs228.18 (down Rs9.2, or 4% week-on-week).

Later, the table turned and the bourse turned bullish with a marginal gain of 59 points, which came on the back of a decline in international commodities’ prices amid global recession fears.

Bulls extended gains on Friday as sector-specific developments helped the KSE-100 index rise over 100 points while chasing the 42,000-point mark.

However, the week closed at 41,948, down 361 points from the previous week.

“Pakistan equities closed the week on a negative note at 41,948, down 361 points,” said JS Global analyst Faisal Irfan.

Flood damage assessment and recent round of rupee devaluation (4% week-on-week) led to profit-taking during the week, he said.

The week started with initial assessment of damages, which suggested losses of $10 billion to $18 billion with 80% of cotton crop in Sindh and 25% of the country’s total cotton crop wiped off.

“It is estimated that Pakistan will need to import around 2.5 million bales of cotton to meet demand,” the analyst added.

Average daily volumes dropped 34% to 138 million shares during the week. Key underperformers were autos (-3%), power firms (-3%) and refineries (-2%) while textile weaving (3%), tobacco (2%), and oil marketing companies (1%) outperformed the benchmark index.

During the week, Brent crude oil prices fell 3.6% to $90.88 per barrel over fears of a global recession. Moreover, Pakistan may get an additional loan of $2.57 billion from the IMF.

An FATF team concluded its visit and a decision was expected by October while State Bank’s foreign currency reserves increased to $8.8 billion on the back of inflows from the IMF, the report added.

Arif Habib Limited, in its report, said that the stock market commenced trading on a negative note on account of concerns over inflation and GDP growth post-flood crisis in the country.

Despite the disbursement of IMF loan of $1.17 billion, Pakistani rupee continued to weaken against the greenback and settled at Rs228.18 (down Rs9.2, or 4% week-on-week).

Moreover, cement sector dispatches declined 24% year-on-year in August 2022, which further dampened investor sentiment at the bourse, it said.

“Urea and DAP sales fell 16% and 87% year-on-year respectively due to floods. Hence, the stock market remained lacklustre.”

The market closed at 41,948 points, losing 361 points (or 0.9%) week-on-week. In terms of sectors, positive contribution came from technology and communication (14 points), and oil and gas marketing companies (11 points), Arif Habib Limited said.

Negative contribution came from fertiliser (78 points), commercial banks (77 points), power generation and distribution (54 points), food and personal care products (45 points) and oil and gas exploration companies (40 points).

Meanwhile, stock-wise positive contributors were TRG Pakistan (47 points), Cherat Cement (24 points), Pakistan Oilfields (19 points), Dawood Hercules (15 points) and Lotte Chemical (12 points).

Negative contribution came from Engro Corporation (57 points), Hub Power (51 points), Habib Bank (44 points), Engro Fertilisers (40 points) and Systems Limited (30 points).

Foreigners continued selling stocks during the week under review, which came in at $2.82 million compared to net selling of $0.74 million in the previous week. Major selling was witnessed in technology firms ($1.4 million) and cement companies ($0.6 million).

On the domestic front, buying was reported by companies ($3.2 million), followed by banks/ DFIs ($2.6 million).

Average daily volumes clocked in at 139 million shares (down 35% week-on-week) while average traded value settled at $21 million (down 34%).

Published in The Express Tribune, September 11th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ