Stocks end positive, but uncertainty looms

IMF policy draft, $2.3b Chinese loan rollover boosted investor confidence

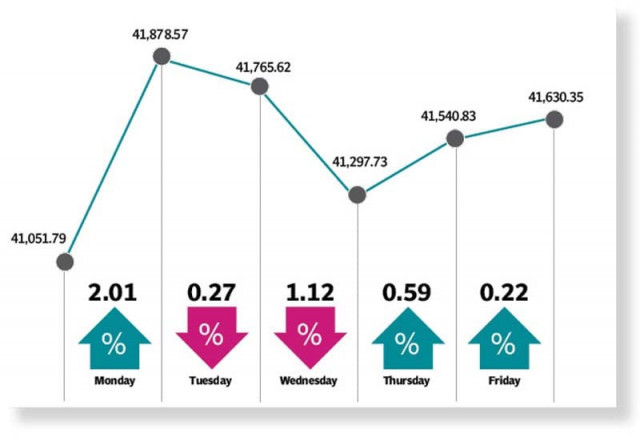

The Pakistan Stock Exchange (PSX) ended the week on a positive note as the benchmark KSE-100 index gained 579 points to settle at 41,630 points despite a gloomy economic situation.

Investor sentiment at the bourse showed some signs of improvement as the KSE-100 index opened the week on a positive note with bulls dominating the proceedings.

The week commenced on a bullish note as the investors cheered the sending of a draft of the Memorandum of Economic and Financial Policies (MEFP) by the International Monetary Fund (IMF) to Pakistan, which reflected progress in talks between the two sides. Moreover, the rollover of $2.3 billion Chinese loan gave a boost to the positive sentiment.

However, many investors were concerned over the economic gloom caused by the uncertainty about the IMF loan programme and the market failed to sustain gains over the next two days.

Volumes remained low in the absence of positive triggers with investors remaining on the sidelines.

The bulls took over control of the market again by the end of the week following the approval of Rs9.6 trillion federal budget by the National Assembly and continuous appreciation of Pakistani rupee, resulting in a positive close on the last day of FY22.

The bullish trend continued and the KSE-100 index gained a few points to start FY23 on a positive note on Friday.

Pakistan equities closed the week at 41,630, reporting an increase of 1.4% week-on-week, said JS Global analyst Muhammad Waqas Ghani. The week started on an optimistic note as the investors brushed off the pessimism after the announcement of super tax last week.

Positive news regarding the receipt of MEFP from the IMF and the inflow of Chinese loan of $2.3 billion supported the market during the week, said the analyst.

Pakistani rupee continued to extend gains against the greenback whereas the cut-off yields on three-month and six-month treasury bills in the recent auction fell 2 basis points and 15 basis points respectively compared to the previous auction. Volumes remained dull during the week with average daily traded volume declining 34% week-on-week.

On the news front, the FBR collected net revenue of Rs6.125 trillion during FY22, comfortably meeting the target of Rs6.10 trillion. Moreover, the government further increased prices of petrol and diesel by Rs14.85 and Rs13.23 per litre respectively because of the imposition of petroleum levy to help meet the revenue target of FY23 under the IMF programme, said the analyst.

On the external front, the current account deficit for May 2022 rose two times month-on-month, primarily due to lower remittances. Arif Habib Limited, in its report, said that the market commenced on a positive note amid the receipt of $2.3 billion loan from China, which took the State Bank’s reserves to $10 billion.

Resultantly, the rupee strengthened against the greenback, settling at Rs204.85 on June 30, 2022.

Moreover, Pakistan received the Memorandum of Economic and Financial Policies from the IMF, which signalled that the government was inching closer to an agreement with the fund.

In addition, the National Assembly approved the amendments made in the Finance Bill 2022, which brought clarity to the market, especially to the banking sector. Furthermore, the independent power producers (IPPs) of the 2002 power policy received the second instalment of Rs96 billion.

However, the sentiment was adversely affected by the fiscal measures undertaken by the government (including the hike in prices of motor spirit and high-speed diesel) to solidify the ground for approval of the IMF’s seventh and eighth review.

Moreover, the inflation came in at 21.32% for June 2022 and the current account deficit widened to $1.4 billion in May 2022, which dampened the overall sentiment.

The market closed at 41,630 points, gaining 579 points (or 1.41%) week-on-week.

In terms of sectors, positive contribution came from cement (92 points), power (74 points), E&P (69 points), fertiliser (68 points) and banks (55 points). On the flip side, the sectors which contributed negatively included refinery (6 points) and cable and electrical goods (4 points).

Meanwhile, stock-wise positive contributors were Hub Power Company (83 points), Pakistan Oilfields (64 points), Lucky Cement (47 points), Engro Fertilisers (39 points) and Mari Petroleum (36 points).

However, negative contribution came from Habib Bank (32 points), Engro Polymer and Chemicals (22 points), Oil and Gas Development Company (22 points), Kot Addu Power Company (13 points) and Dawood Hercules (11 points).

Foreign selling was witnessed during the week under review, which came in at $1.52m compared to net selling of $2.39m last week.

Major selling was witnessed in fertiliser ($0.3m) and other sectors ($0.2m).

On the local front, buying was reported by banks ($6.8m), followed by individuals ($4.1m).

Average volumes came in at 199m shares (down 34% WoW) while average traded value settled at $30m (down 31% WoW).

Published in The Express Tribune, July 3rd, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ