Bears take centre stage, erase 1,089 points

Super tax of 10% on company earnings largely dented investor interest

The Pakistan Stock Exchange (PSX) witnessed a roller-coaster trading week as a combination of buying interest and selling pressure made the benchmark index swing on both sides, but eventually the bears prevailed.

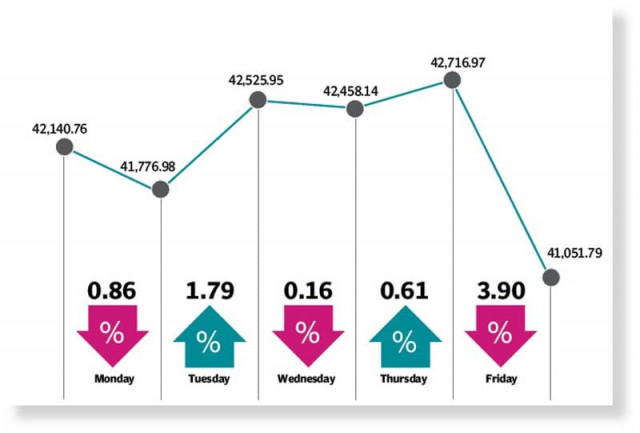

The KSE-100 index dived 1,089 points to close the week at 41,052 points.

The week commenced on a negative note as stocks dived due to the persistently falling rupee, which fuelled bearish sentiment coupled with the uncertainty about the International Monetary Fund (IMF) loan programme, pulling the stocks below the 42,000-point mark.

However, the stocks rallied next day over positive hints regarding the resumption of IMF programme. Finance Minister Miftah Ismail expressed hope that a deal would be sealed in a day with the IMF, which boosted the investors’ sentiment and the market closed in the green.

The investor interest was dented again due to the government’s plan to raise the tax collection target by Rs436 billion for FY23 to pave the way for the resumption of IMF loan programme.

The announcement by the finance minister about the receipt of Chinese consortium loan of RMB 15 billion ($2.3 billion) lifted the KSE-100 index, however, news concerning the levy of 10% super tax on the FY22 earnings of companies with over Rs300 million annual profit hammered the investor confidence in the last trading session. Resultantly, the market closed the week on a negative note.

“Bloodshed was witnessed after the prime minister’s announcement of 10% incremental tax on certain sectors during the last trading session, wiping out the gains made during the week,” said JS Global analyst Amreen Soorani in a report.

The unexpected announcement pushed the market down by 1,089 points (-2.6% WoW) by the close of the week. The news came with some uncertainty about the tax year, however, the named sectors accounted for a significant portion of the listed space.

The bourse witnessed an increase of 576 points in the first four trading sessions as positive developments emerged in talks with the IMF.

Along with that, Pakistani rupee got some respite from the persistent depreciation, gaining Rs4 against the dollar, after touching an all-time low at Rs211.7.

Among the outperformers, the refinery sector increased 0.8% week-on-week on anticipation of improvement in profits, led by the escalation in gross margins.

The power sector was also among the outperformers, closing up 3% week-on-week, on news of approval of the second instalment of payments to the IPPs under the 2002 policy.

The revival of confidence was also reflected in the higher market participation with average daily traded volumes going up 73% week-on-week, the analyst added.

Arif Habib Limited, in its report, said that the market commenced on a negative note during the week over uncertainty about the IMF programme, as the index shed 300 points day-on-day.

However, the sentiment turned positive when a Chinese consortium of banks signed a $2.3 billion loan facility, and the ECC approved the second instalment of Rs96 billion for payment to the IPPs of the 2002 power policy. Furthermore, the finance minister announced that an IMF deal was imminent, which also helped boost investor sentiment. However, during the last trading session, the government announced a 10% super tax on 13 major sectors as well as 4% additional levy on banks, which caused the market to plunge and hit an intra-day low at 40,555 points.

The market closed at 41,052 points, down 1,089 points (2.58%) week-on-week.

In terms of sectors, positive contribution came from tobacco (12 points), insurance (12 points), and paper and board (8 points).

On the flip side, sectors which contributed negatively included banks (296 points), E&P (194 points), cement (194 points), fertiliser (120 points) and textile composite (61 points).

Meanwhile, stock-wise positive contributors were EFU General Insurance (20 points), K-Electric (18 points), Kot Addu Power Company (13 points), Pakistan Tobacco Company (12 points) and Packages Limited (8 points).

However, negative contribution came from United Bank (97 points), Pakistan Oilfields (88 points), Engro Corporation (83 points), Lucky Cement (79 points) and Hub Power Company (75 points).

Foreign selling was witnessed during the week, which came in at $2.39 million compared to net selling of $1.91 million last week. Major selling was witnessed in other sectors ($3.5 million) and banks ($1.9 million).

On the local front, buying was reported by individuals ($7 million) followed by other organisations ($3.4 million).

Average daily volumes came in at 301 million shares (up 73% WoW) while average daily traded value settled at $44 million (up 72% WoW).

Published in The Express Tribune, June 26th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ