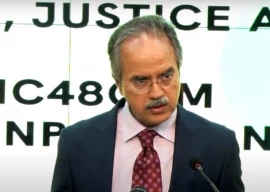

Finance Minister Miftah Ismail on Saturday said the government was in the process of bringing “millions of shops into the tax net” as he vowed to expand the tax base further over the next few months through “consultations” with stakeholders.

In its anxiety to meet the conditions set by the International Monetary Fund (IMF) and generate revenue, the PML-N-led coalition government had a day earlier announced a 'super tax', netting undertaxed segments of the economy, such as the corporate sector.

In response to a tweet calling out the government for letting the retailers off the hook with a “small fixed tax” and going after salaried individuals instead to generate more revenue, Miftah said he had brought jewellers into the tax net and will bring designers, lawyers, and doctors into the tax net.

He added that the government was also in talks to bring small shopkeepers into the tax-paying category.

To bring small shopkeepers & jewellers into the net I talked to their associations & did so with their agreements. Now I will bring in real estate brokers, builders, housing society developers, car dealers, restaurants, salons etc in the net. But nothing forced. With consultation

— Miftah Ismail (@MiftahIsmail) June 25, 2022

He said he would bring real estate brokers, builders, housing society developers, car dealers, restaurants, salons etc into the tax net. “But nothing forced. With consultation,” Miftah said as he revealed the government’s approach to increasing the country's tax base.

‘More people on PM’s list’

Retweeting Ismail's tweet, Salman Sufi, the prime minister's adviser on reforms, confirmed that real estate, builders, housing society developers "and more" were next on the list to be brought under the tax net.

"Gradually and with the consultation of their representatives with Miftah Ismail," he added.

A day earlier, PM Shehbaz Sharif announced a 10 per cent super tax on large-scale industries to boost revenue and provide relief to the lower economic segments. While announcing the increased tax rates, PM Shehbaz stated that the “rich would have to do their part” to alleviate the burden of inflation on the poorer segments of society.

The prime minister had stated that the revenue generated from the “super tax” would be beneficial for “poverty alleviation” in order to support the burden of inflation on the masses.

Sectors which will be subject to the tax include; steel, sugar, cement, oil, gas, fertilisers, LNG terminals, banking, textile, automobile, cigarettes, chemicals and beverages.

Shehbaz had further said that cross-subsidy would be used to strengthen public services in the education and the health sector and elaborated that such policies were necessary to reduce the country’s reliance on foreign loans.

Read Finance Minister Miftah Ismail's budget speech

“That is what we call economic freedom; that is what we call coming out of the shackles of slavery of borrowing money,” he had furthered.

The premier had also announced the imposition of another tax on those citizens who earn an annual income of Rs150 million or higher.

According to the prime minister, those earning Rs150 million will have their tax rate increased by 1%. Those earning Rs200 million will have their tax rate increased by 2%. Those individuals earning more than Rs250 million will have their tax rate increased by 3% and those earning more than Rs300 million will have their tax rate increased by 4%.

Rs80b burden on salaried class

In its push to meet all demands and conditions set by the IMF, the government has also passed on the burden of Rs80 billion on the salaried class by increasing their tax rates and withdrawing the relief announced hardly three weeks ago.

It has set the minimum income tax rate of 2.5% for those earning up to Rs100,000 a month as well as a maximum of 35% on the monthly income of over Rs1 million, according to the proposed amendments to the Finance Bill 2022.

The coalition government has reversed its two earlier decisions to exempt up to those earning Rs100,000 a month from income tax and rolled back its move to reduce the highest income tax rate from 35% to 32.5% after the IMF refused to budge on its demand.

The government has not only withdrawn the relief but also imposed Rs33 billion in net additional taxes in comparison with June 2021 for the salaried class, throwing a burden of Rs80 billion on them.

COMMENTS (5)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ