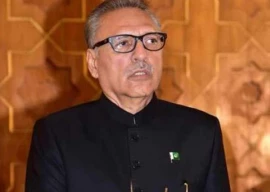

President Dr Arif Alvi on Thursday reprimanded the Federal Board of Revenue (FBR) for harassing a taxpayer who had filed a complaint with the Federal Tax Ombudsman (FTO) against the revenue authority on the non-issuance of a genuine refund.

The president rejected the representation by the FBR against the order of the FTO after observing that the case had repeatedly been mishandled and that the conduct of the officers amounted to harassment.

He regretted observing that the refund application filed in 2015, which by law was required to be disposed of within 60 days, remained pending due to the inaction by the tax authority for almost five years and was taken up only after the complaint was filed with FTO, and that too in a vindictive manner.

The FBR, he noted, once again charged the complainant on the same issue under another section of the Income Tax Ordinance.

When the FTO reprimanded the board on account of harassing the taxpayer, the latter, instead of implementing the decision, once again filed the representation.

President Alvi, while rejecting the representation, observed that the conduct of FBR officers was tantamount to maladministration, adding that neglect, inattention, incompetence, inefficiency, ineptitude, arbitrariness and administrative excess in the discharge of duties were also the acts of maladministration.

Also read: FBR likely to get more powers

He regretted that due care had not been taken in processing the case, and asked the authority to deal with the matter in accordance with the law and take a holistic view without any prejudice, bias or personal grudges.

Ms Rukhsana Kanwal, the complainant, had filed complaints with the FTO for tax years 2015 to 2019 against the non-issuance of tax refund. The mohtasib, through its consolidated order dated March 20, 2020, had recommended disposing of the applications for all the years as per law after providing her with the opportunity of hearing.

The tax officers, instead of issuing the refund, first charged the complainant arbitrarily without giving her the opportunity of being heard with turnover tax under section 113 of the Income Tax Ordinance.

When this charge was annulled by the Commissioner Inland Revenue-CIR (Appeals), the officer again charged the complainant disregarding the order of CIR (Appeal) under section 122(5A) on the ground that a gift was received through a non-banking channel while deliberately ignoring the irrefutable evidence filed by the complainant of her banking transaction.

President Alvi upheld the order of the FTO wherein the FBR was ordered to hold an internal inquiry into the glaring incidence of maladministration by the concerned officers on account of creating problems for those who seek justice at the forum of the FTO.

He further directed the tax authority to ensure cooperation and discourage such typical vindictive reactions by its officers.

1731914690-0/trump-(26)1731914690-0-405x300.webp)

1731929357-0/Express-Tribune-(6)1731929357-0-270x192.webp)

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ