PTI govt gave Rs5.2tr tax breaks in four years

In FY22 alone, country offered Rs1.7tr tax exemptions to affluent, foreign investors

The previous government of Pakistan Tehreek-e-Insaf (PTI) gave away a record Rs1.76 trillion in tax exemptions to the affluent and foreign investors during the outgoing fiscal year, taking the total cost of such exemptions in four years to a whopping Rs5.2 trillion.

The Pakistan Economic Survey 2021-22 revealed that there was a 34%, or Rs443 billion, surge in the cost of tax exemptions in just one year despite the fact that the PTI government also withdrew around Rs300 billion in exemptions in January this year. It was the highest amount of concessions given in any fiscal year.

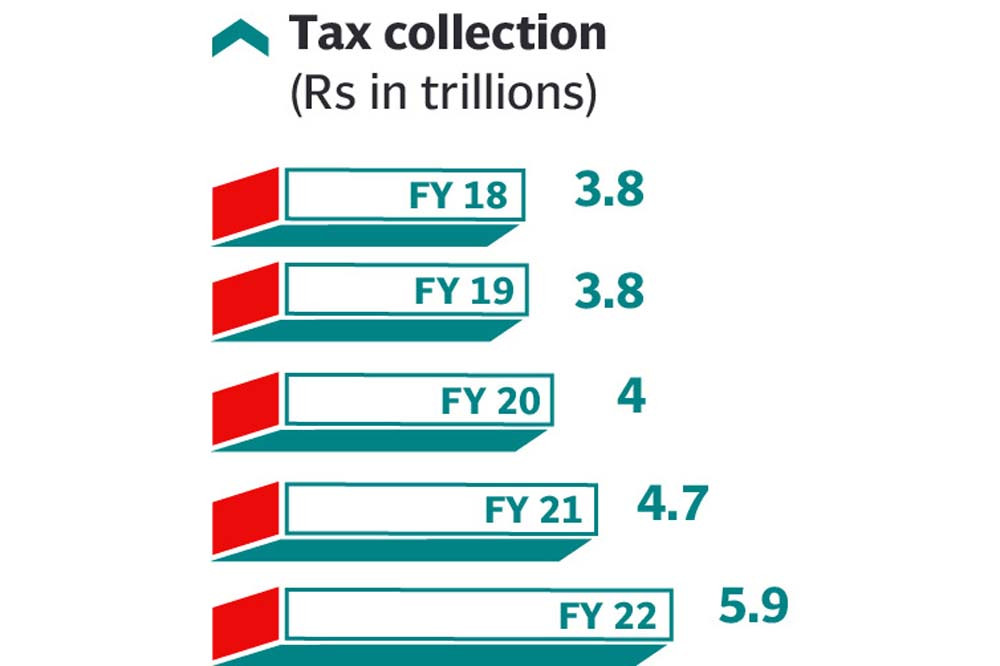

Cumulatively, the previous government gave Rs5.2 trillion in tax exemptions during four years, which was equal to 87% of the estimated tax collection by the Federal Board of Revenue (FBR) in the outgoing fiscal year.

The last government also provided tax exemptions to the military’s commercial ventures.

These tax exemptions have been approved over the years and are protected under the tax laws. But no government, including the PTI, has been able to curtail the exemptions.

“The tax expenditure for fiscal year 2022 has been estimated at Rs1.757 trillion” on account of income tax, sales tax and customs duty concessions, the Economic Survey, which Finance Minister Miftah Ismail presented on Thursday, showed.

Responding to a question, Ismail said that he would on Friday announce the withdrawal of some of those exemptions in his budget speech.

The government may unveil a Rs9.45 trillion budget, which will be financed by taking Rs4.5 trillion in new debt.

The withdrawal of tax exemptions has remained part of every programme that Pakistan signed with the International Monetary Fund (IMF). Still, every successive government has not only managed to protect the affluent class but also added more names to the list of beneficiaries.

Under the IMF condition, the PTI government phased out corporate and sales tax exemptions but some of those were again introduced in the last budget when the IMF programme was stalled, showing the deceptive nature of policymakers.

The FBR is expected to collect Rs6 trillion in taxes in the current fiscal year and assuming that the government can recover the entire Rs1.76 trillion, the tax collection will reach Rs7.76 trillion. This would have reduced the borrowing requirement by the same amount.

Income tax

As against Rs448 billion worth of income tax exemptions given in the previous fiscal year, the FBR has estimated the cost of income tax exemptions this year at nearly Rs400 billion, according to the survey.

The Rs400 billion exemptions were equal to 23% of the total cost of exemptions given in the current fiscal year.

Around Rs10.6 billion worth of income tax exemptions were given on account of various allowances, Rs66 billion was given in tax credit and Rs233 billion exemptions were given on total income, according to the Economic Survey.

An amount of Rs3.3 billion was lost due to the reduction in tax liabilities while Rs61 billion was lost on account of exemptions from “specific provisions”. The FBR did not explain the specific provisions, as there was Rs58 billion, or 2,173%, increase under the head.

About Rs26 billion worth of income tax exemptions were given on account of miscellaneous exemptions, which the FBR also did not explain.

These income tax exemptions were also availed by the judges of superior courts, president of Pakistan, military generals, on the allowance of federal bureaucracy, income of pensioners and by the Fauji Foundation and Army Welfare Trust.

The IMF has demanded that Pakistan should withdraw the pension-related exemptions.

Sales tax

There was 75% increase in sales tax exemptions that grew from Rs578.5 billion a year ago to over Rs1 trillion. The constant increase in the sales tax exemptions despite withdrawing many of those raises questions over these calculations.

The share of sales tax exemptions was 48% in the total tax exemptions.

An amount of Rs11.3 billion was lost on account of exemptions on products which were protected under the Fifth Schedule of the Sales Tax Act. The Fifth Schedule relates to the zero-rated tax system.

There was a massive jump in exemptions given to importers that increased from Rs174 billion to Rs527 billion. In addition to that, Rs234 billion exemptions were given on local supplies, which was 50% more than the previous year.

The government charges reduced sales tax rates on various goods, which cost Rs169 billion in this fiscal year. These exemptions are given under the Eighth Schedule of the Sales Tax Act, which allows the imposition of lower than standard 17% sales tax.

Another Rs50 billion was lost due to low GST collection rates on mobile phone sales, showing 84% increase in just one year.

Customs duty

The cost of customs duty exemption increased to Rs343 billion against Rs288 billion in the previous year. There was an increase of Rs55 billion or nearly one-fifth over the previous year, according to the survey.

The government sustained Rs61 billion tax losses due to the concessions given to the automobile sector, oil and gas exploration sectors and the China-Pakistan Economic Corridor, up Rs6 billion or one-tenth.

Around Rs169 billion duties were lost under the Fifth Schedule of the Customs Act, which deals with the goods exempted from customs duties. This cost of exemptions was Rs31 billion more than the last year.

The Rs46 billion customs duty exemptions were given on account of low rates applicable to various bilateral free trade and preferential trade agreements. The amount was Rs12 billion higher than the previous year.

Similarly, Rs16 billion worth of concessions were given under Chapter 99 of the Customs Act and Rs51 billion exemptions were given on exports, according to the economic survey.

Published in The Express Tribune, June 10th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ