Stock market tumbles in lacklustre week

Depleting forex reserves, dwindling rupee kept investors at bay

The Pakistan Stock Exchange witnessed a lacklustre trading week as jittery investors struggled to find positive cues amid continuously deteriorating macroeconomic indicators.

Continuously falling rupee that hit record lows against the US dollar and depleting foreign exchange reserves haunted the trading environment in the outgoing week, thus keeping market participants at bay.

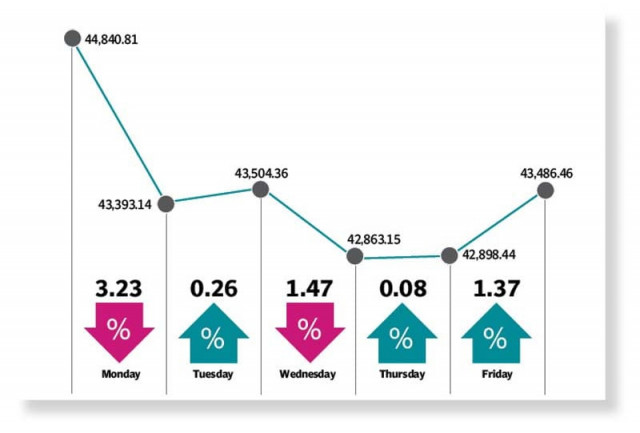

Consequently, the benchmark KSE-100 index closed the week with a plunge of 1,354 points, or 3.02%, at 43,486 points.

“The decline can largely be attributed to the depleting foreign exchange reserves and the lack of clarity on the government’s intent of implementing the International Monetary Fund’s (IMF) demand on which the revival of the Extended Fund Facility (EFF) depends,” a report of Topline Securities stated.

Moreover, “lukewarm response from Saudi Arabia to an official delegation from Pakistan, where the kingdom reportedly tied a $3 billion additional support to the revival of the IMF programme, further dampened investors’ sentiment,” it added.

The outgoing week commenced on a bearish note, as the benchmark KSE-100 index nosedived around 1,448 points on the very first day of trading.

Investors were observed rushing to offload their positions across the board due to the persistently worsening macroeconomic cues.

However, the next session witnessed some recovery, though in range-bound trading activity. Market players were observed value hunting the stocks that had fallen to attractive valuations due to the “bloodbath” witnessed the previous day.

Resultantly, the KSE-100 index managed to add around 111 points on Tuesday.

The recovery trend, however, reversed again on Wednesday, as sceptical investors tried to find positive cues amid the domestic political turbulence.

The falling rupee, which was hovering around all-time lows, continued to dent the market participants’ interest, thus the benchmark index dipped by another 641 points.

The last two trading days witnessed some recovery on the back of value hunting of attractive stocks, besides the news of highest-ever remittances during April 2022.

The record remittances rejuvenated investors’ interest, as they were continuously looking for some positivity on the economic front.

Read PSX bleeds over 1,000 points amid political, economic uncertainty

They even downplayed the fresh depreciation of the local currency that stood at an all-time low against the US dollar on Friday, and resumed the cherry-picking of stocks.

The last two days of the outgoing week cumulatively added 623 points, helping the index to recoup some of the losses.

“We believe clarity should emerge next week on certain economic policies, which should aid the sentiment at the bourse,” stated a report of Arif Habib Limited.

“It appears that the government plans to remove the subsidy on fuel and electricity to win IMF’s approval, which will be a positive sign for the market,” the report said, adding “once the package comes through, other sources of foreign exchange should also open up such as support from friendly states as well as the Asian Development Bank (ADB).”

During the week under review, average daily traded volumes increased 13% week-on-week to 274 million shares, while average daily traded value rose 21% week-on-week to $43 million.

In terms of sectors, positive contribution came from sugar and allied industries (9 points) and miscellaneous (1 point).

On the flipside, the sectors which contributed negatively included banks (351 points), cement (211 points), fertiliser (179 points), technology and communication (68 points) and power generation (63 points).

Meanwhile, stock-wise positive contributors were Pakistan Oilfields Limited (38 points), Millat Tractors (20 points) and Lotte Chemical Pakistan Limited (11 points).

However, negative contribution came from Systems Limited (121 points), Lucky Cement (105 points), Habib Bank Limited (78 points), Engro Fertilisers (64 points) and United Bank Limited (64 points).

Foreign selling was witnessed during the outgoing week, which came in at $1.88 million as compared to net buying of $2.01 million in the previous five sessions. Major selling was witnessed in commercial banks ($1.6 million) and cement companies ($1.4 million).

On the local front, buying was reported by banks ($16.3 million), followed by other organisations ($1.5 million).

Among other major news urea off-take surged 45% to 448,000 tonnes in April 2022, Central Development Working Party (CDWP) cleared four projects worth Rs136.74 billion, Systems Limited would acquire NdcTech, Pak Suzuki Motor jacked up vehicle prices again and National Savings profit rates were increased up to 250 basis points.

Published in The Express Tribune, May 15th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ