Bears take centre stage at PSX

Market ends all five sessions in loss due to rupee fall, absence of positive news flow

Bears held complete dominance at the Pakistan Stock Exchange in the outgoing week as the market recorded declines in all five trading days owing to ambiguity over the resumption of the $6 billion International Monetary Fund (IMF) loan programme.

Market players were observed taking a cautious approach as economic uncertainty loomed following clarity on the political front and a new government set up in place.

After a brief respite, rupee again started losing value against the US dollar in the week under review, which further accelerated the worries of investors and restrained them from assuming fresh positions.

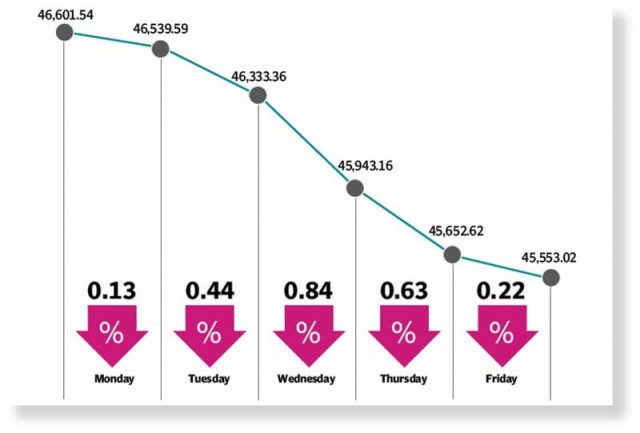

Consequently, the benchmark KSE-100 index closed the week with a plunge of 1,048.52 points or 2.25% at 45,553 point level.

“The negativity in the market can be attributed to the news flow suggesting that the International Monetary Fund (IMF) is demanding reversal of subsidy on petroleum products, along with other tough measures such as increase in electricity tariff, cut in development expenditure,” a report from Topline Securities stated. “T-Bill auction also contributed to the negative sentiment as cut-off yields rose in the range of 55-70 basis points, indicating further monetary tightening going forward.”

Bearish sentiments persisted throughout the outgoing week as investors struggled to find any positive cues and resultantly, they preferred to stay on the sidelines, refraining from making new purchases.

Profit-booking became evident as soon as the week started primarily driven by depreciation of the local currency against the US dollar.

Moreover, speculations regarding the fate of the IMF loan programme also instilled fears among the market players and kept the trading environment dull at the local bourse.

Adding further to the woes of investors, surging energy prices and World Bank’s decision to cut global growth forecast during the week took a toll at the bourse and kept the trading activity lacklustre.

On Thursday, investors rushed to offload their holdings at the bourse as they panicked after the global lender (IMF) called for reversing fuel subsidy, withdrawal of tax amnesty and imposition of higher tariffs and taxes in order to resume the bailout package.

The effect of IMF’s demands was seen on the last trading day as well, where the investors mainly stayed on the sidelines and opted for profit-taking to close the bearish week in the red.

“The market is expected to be range-bound in the upcoming week,” stated a report from Arif Habib Limited.

Read PSX to add more companies to GEM board

“Moreover, the new government is in talks with the IMF for revival of the programme,” the report said. “Any breakthrough in this regard is likely to generate activity in the market.”

During the week under review, average daily traded volume decreased 53% week-on-week to 225 million shares, while average daily value traded declined 39% week-on-week to $41 million.

In terms of sectors, positive contributions came from oil and gas exploration companies (88 points), chemical (31 points), fertiliser (10 points), glass and ceramics (3 points), and textile spinning (1 point).

On the flipside, sectors which contributed negatively included commercial banks (396 points), cement (221 points), technology and communication (99 points), power generation and distribution (74 points), and miscellaneous (72 points).

Meanwhile, scrip-wise positive contributors were Oil and Gas Development Company (56 points), Fauji Fertiliser Company (45 points), Pakistan Petroleum Limited (43 points), Lotte Chemical Pakistan (28 points), and Engro Fertilizers Limited (27 points).

However, negative contributions came from Habib Bank Limited (90 points), Bank AL Habib (85 points), Lucky Cement (70 points), Systems Limited (66 points) and Pakistan Services Limited (66 points).

Foreign selling was witnessed this week, clocking-in at $0.97 million as compared to a net buy of $1.29 million the previous week. Major selling was witnessed in commercial banks ($1.74 million) and food and personal care products ($0.14 million).

On the local front, buying was reported by individuals ($7.03 million), followed by companies ($0.87 million).

Other major news included, China Power Hub Generation Company warned National Electric Power Regulatory Authority of closure of power complex, the State Bank of Pakistan’s reserves increased $36 million, K-Electric sought Rs5.27 per unit tariff raise for March.

Published in The Express Tribune, April 24th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ