Framing viable trade strategy in national interest

Govt must facilitate exports, ensure its policies result in sustainable growth

Recent global events, which include not only the RussiaUkraine conflict but also the withdrawal of US troops from Afghanistan and the Covid-19 pandemic, have led to several discussions on the level of diversification in export products of Pakistan as well as in its export markets. Exports from Pakistan have shown an upward trajectory over the last couple of years, with a substantial growth in exports of textile and IT sectors.

Although the former is traditionally an export-oriented sector, which generates a significant proportion of the total export revenue for Pakistan, the recent growth spurt in the IT sector reveals its true potential. Furthermore, imports have also risen along with exports and that too at a relatively faster rate. This leads to a burgeoning negative balance of trade.

The foreign exchange reserves held by the State Bank of Pakistan, which had peaked at $20 billion in August 2021, were at $14.96 billion on March 18, 2022. Although this amount is above $7.2 billion reported in 2018-19, when the economy was facing a balance of payments crisis, the management of foreign exchange reserves continues to be ever so important. During the previous crisis, the government adopted policies to inhibit demand in order to reduce imports.

However, with prices of global commodities likely to fluctuate due to political uncertainties and domestic politics adding to the uncertainties, it is increasingly important to focus on enhancing the capabilities and productivity of exporters rather than curtailing imports through measures that reduce demand and dampen economic growth. Exports of goods increased by 26% year-on-year in the first eight months of FY22, while imports of goods increased by 55%. With exports surpassing $20 billion in the first eight months, they are likely to be approximately $30 billion at the end of current fiscal year. More importantly, exports of services, at $4 billion, have increased by 18.8% year-on-year in the first seven months of FY22.

This is crucial given that exports of services have hovered around $5.5 billion for the past few fiscal years and have remained stagnant in terms of growth rate. It is important to emphasise that the growth is driven by the telecommunication, computer and information technology services sector, which not only comprises high-skilled workers but also freelancers and young entrepreneurs. On the other hand, rising imports of essential goods such as oil and related commodities are driven by their prices, with the dollar value of imports rising more than 100% year-on-year for petroleum products and LNG in the current fiscal year. Imports of transportation group have also shown similar growth levels, with CKD/ SKD units contributing the most to the import growth in value terms.

Furthermore, various types of machinery and equipment have also recorded significant growth rates. In essence, imports of nonessential goods are unlikely to be a major factor in the growth of imports, which is primarily being driven by rising prices of essential commodities and increasing demand for intermediate and capital goods used to produce domestic goods as well as export products. The government must ensure improvement in productivity that leads to a more efficient mix of output rather than focus on curtailing imports as a stopgap temporary measure.

Major export markets

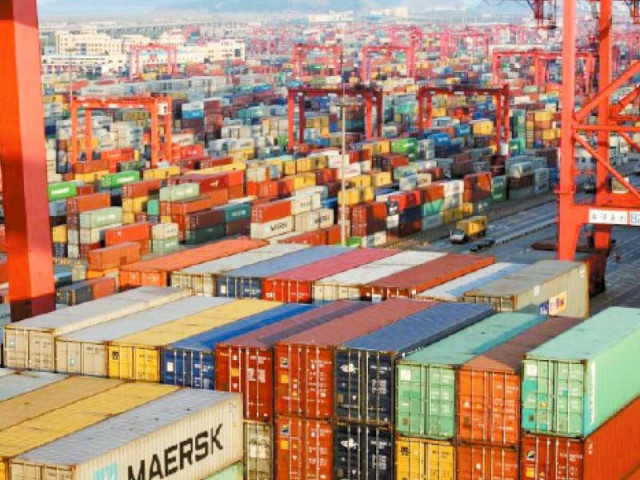

Exports from Pakistan are primarily destined to the United States and the European Union. According to statistics extracted from the International Trade Centre’s Trademap.org, exports to the US were at $4.1 billion in 2020, the second highest since 2006, when they were reported at $4.3 billion.

Exports to the 27 EU countries were reported to be $6.2 billion and exports to the UK stood at $1.7 billion. More than 50% of exports from Pakistan are destined to the US, EU and UK. Exports to the EU increased from $3.3 billion in 2009, which is approximately 90% growth in 11 years. Pakistan exported $5.7 billion worth of articles of clothing in 2020, with more than $5 billion worth of goods destined to the US, EU-27 and the UK.

Considering exports of the textile industry, $9.6 billion, out of $13.1 billion, worth of goods were exported to the aforementioned destinations. Although China and Bangladesh rank amongst the top 10 export destinations for textile products from Pakistan, they import mainly either cotton yarn or woven fabrics, unlike the advanced countries that import finished consumer goods. In essence, Pakistan is highly reliant on western markets for its exports of value-added consumer goods. Even exports of intermediate goods and raw material are likely to be driven by the presence of value chains that involve buyers in the developed world.

The recent conflict between Russia and Ukraine is likely to have consequences for global trade, particularly as the two countries are large suppliers of several agricultural and mineral products. Russia is the third largest exporter of mineral fuels and cereals in the world and the largest exporter of fertilisers. Ukraine is the second largest exporter of cereals and the third largest exporter of animal and vegetable fats and oils. Unctad recently published “The Impact on Trade and Development of the War in Ukraine”, highlighting the rising prices of agricultural commodities and freight costs due to the conflict. Freight costs are expected to increase by 5-8%, with developing countries likely to bear the brunt of the increase. Agriculture, commodity and grains spot indices have all reacted sharply to the conflict.

Furthermore, approximately a quarter of Turkey’s and 22% of China’s agro-food commodities are imported from the Russian Federation and Ukraine. For Pakistan, it is 4.5%, with majority flowing in from the Russian Federation. The government must facilitate exports from Pakistan and ensure that its policies result in a sustainable export growth.

This should include but not limited to negotiations over free trade agreements across different regions and geopolitical blocs, more efficient trade missions in important markets abroad promoting Pakistani goods and services and encouraging domestic firms to participate in global value chains. A viable trade strategy is in the national interest.

THE WRITER IS THE ASSISTANT PROFESSOR OF ECONOMICS AND RESEARCH FELLOW AT CBER, INSTITUTE OF BUSINESS ADMINISTRATION, KARACHI

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ