The Pakistan Stock Exchange witnessed a range-bound trading week as the benchmark KSE-100 index experienced both bullish and bearish pressures, stemming from many encouraging and dismal developments.

On the one hand, market participants cheered the status quo in monetary policy and the approval of SBP Amendment Bill by the Senate, but on the other hand, mounting Covid-19 infections and caution over upcoming review of Pakistan’s case by the International Monetary Fund (IMF) kept stock trading muted.

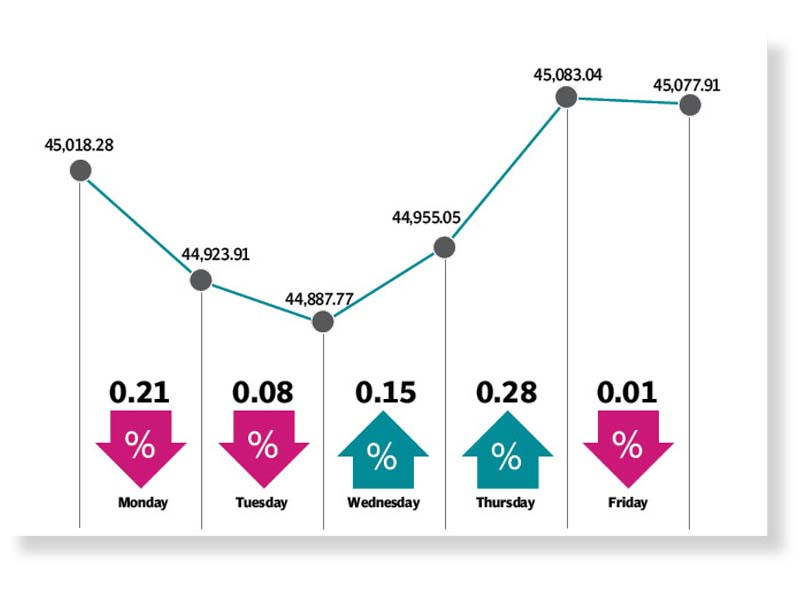

In the week ended on January 28, the benchmark KSE-100 index inched up 60 points, or 0.13%, to close at 45,077.91.

“Rising Covid-19 cases and postponement of IMF’s review kept the market range bound,” stated Arif Habib Limited in its report.

Earlier, the week kicked off with a decline and the KSE-100 index dipped in the first two sessions in the backdrop of monetary policy committee (MPC) meeting. Some of the investors had expected no change in monetary policy while others anticipated a hike.

Moreover, the unsustainable current account number, released over the previous weekend, shattered investor confidence in the economy, who rushed to safeguard their positions.

The market also came under pressure due to persistent increase in energy and commodity prices in the global market. A surge in international crude oil price above $90 per barrel sparked panic at the bourse as investors expected further increase in the country’s import bill, which was already at unsustainable levels.

A spike in Covid-19 cases triggered fears of imposition of a lockdown and suspension of business activities in the country, which discouraged investors from making fresh buying. Investor interest was also dampened by a slowdown in large-scale manufacturing growth as they offloaded their stockholdings.

The benchmark KSE-100 index staged a comeback midweek, advancing for two days in a row as the market cheered the drop in yields of T-bills and PIBs, which signaled a drop in policy rate in the next monetary policy announcement.

The final session of the week ended on a flat note as upside and downside pressures influenced the direction of the market. While the bourse welcomed the approval of SBP Amendment Bill in the Senate, fears of a further jump in inflation in January 2022 triggered a sell-off and erased the gains.

“With the IMF’s sixth review of Pakistan’s economy scheduled for February 2, any positive outcome could be a key trigger for the bourse,” stated the Arif Habib Limited’s report.

“Moreover, with the ongoing results season, certain sectors and stocks are expected to be in the limelight.”

During the week under review, average daily traded volumes dropped 7% week-on-week to 187 million shares while average daily traded value fell 9% week-on-week to $38 million.

Sector-wise positive contribution came from cement (55 points), power generation and distribution (45 points), food and personal care products (30 points), fertiliser (26 points) and commercial banks (24 points).

On the other hand, sectors which contributed negatively were technology and communication (52 points), oil and gas exploration companies (50 points) and automobile assemblers (14 points).

Stock-wise positive contributors were Hubco (50 points), Bank Alfalah (38 points), Lucky Cement (36 points), Fauji Fertiliser Company (32 points) and TRG Pakistan (30 points).

Meanwhile, stock-wise negative contribution came from Kapco (30 points), Mari Petroleum (24 points) and Bank AL Habib (23 points).

Foreign selling continued during the week, which came in at $4 million compared to net selling of $2.09 million in the previous week.

Major selling was witnessed in technology and communication companies ($2.4 million) and cement firms ($1.3 million).

On the domestic front, buying was reported by companies ($19.5 million), followed by mutual funds ($4.8 million).

Other major news of the week included the launch of Ehsaas Petrol Card for bikers, State Life signing a memorandum of understanding with UBL, foreign currency reserves declining $867 million, the Bank of Punjab planning to raise Rs13 billion in debt financing for Lucky Electric and Pakistan Refinery sharing plans to start export of furnace oil from next month.

Published in The Express Tribune, January 30th, 2022.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

1722596924-0/BeFunky-collage-(25)1722596924-0-270x192.webp)

COMMENTS (1)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ