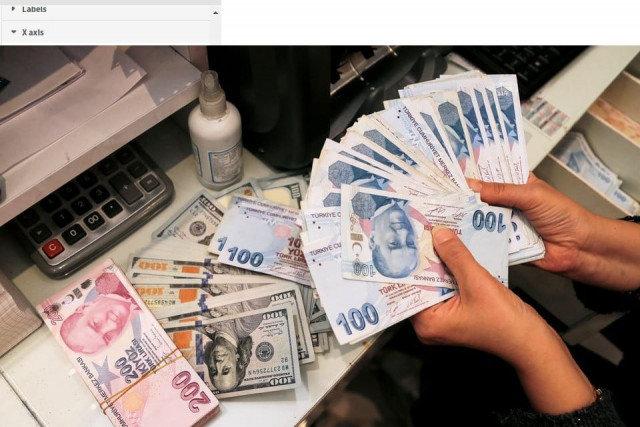

Turkish lira falls further by 2%

Worries about country’s monetary policy weigh on sentiment

Turkey’s lira weakened by as much as 2% on Tuesday, extending sharp losses seen a day earlier and eroding massive gains made last week, as worries about the country’s monetary policy weighed on sentiment.

By 1125 GMT, the lira pared its losses to trade at 11.8 against the dollar, off a morning low of 11.949. Despite last week’s rebound, it has lost 37% of its value against the US currency so far this year.

The lira surged more than 50% last week following billions of dollars worth of state-backed market interventions and a government move to cover foreign exchange losses on certain deposits, bringing the currency back to its mid-November levels.

President Tayyip Erdogan announced last week an incentive for savers to convert forex deposits into lira, under which the treasury and central bank will reimburse losses incurred due to erosion in lira value during the deposit period.

According to a central bank document sent to banks on Monday, it will support these forex-protected lira deposit accounts by not applying required reserve ratios on them. It will impose a higher commission on banks when the transfer from forex accounts to lira accounts does not exceed a certain level.

The lira hit an all-time low of 18.4 to the dollar before Erdogan’s announcement, after a months-long slide prompted by fears of spiralling inflation following a series of interest rate cuts that the president had sought.

Sovereign dollar-denominated bonds came under pressure on Tuesday with many issues snapping multi-day winning streaks in thin trade and the 2030 bond slipping more than $0.01 in the dollar, Tradeweb data showed.

Annual Turkish inflation is forecast to have hit 30.6% in December, a Reuters poll found, breaching the 30% level for the first time since May 2003 – six months after Erdogan’s AK Party first came to power.

In December alone, prices are expected to have surged 9%, the poll showed, with the effect of lira weakness likely to be felt in the coming month too.

“Inflation could follow a rising trend with the delayed impact of the forex rates after January,” said Gedik Yatirim economist Serkan Gonencler. The December data will be released on January 3.

According to traders’ calculations, the central bank’s net forex reserves, excluding swaps, fell some $8 billion last week, with most of the fall in the first two days of the week.

They were down $17-18 billion as of last Friday since the start of the month, when the bank began its direct interventions.

1733130350-0/Untitled-design-(76)1733130350-0-208x130.webp)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ