PSX gains 505 points on upbeat outlook

Market oscillates between red and green zones due to mix of positive, negative news

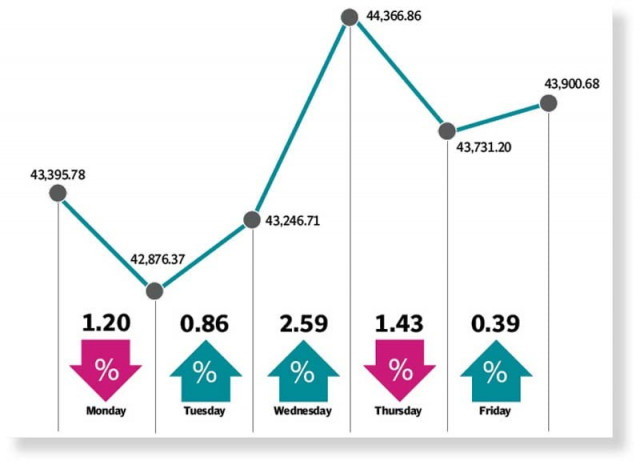

The Pakistan Stock Exchange endured a tumultuous trading week as the benchmark KSE-100 index swung between green and red zones because of a blend of positive and negative news reports.

Bulls emerged victorious in the end and the index closed the week with a gain of 505 points, or 1.2%, at 43,901.

The week started with a dismal performance as the market awaited clarity about the monetary policy action. Investors expected a big increase in the policy rate and as a result, the KSE-100 index shed over 500 points on the first day of the week.

Moreover, the market players were in a sombre mood due to the macroeconomic concerns.

On Tuesday, however, the investors brushed aside the policy rate concerns with the index reversing trend and marching upwards for the next two sessions.

A modest growth in automobile sales in November rejuvenated the interest of investors, who made fresh investment in the bourse. Moreover, market participants resorted to value hunting and purchased stocks that had fallen to attractive valuations on the back of a bearish spell earlier in the week.

The market rallied despite a 100-basis-point hike in the benchmark interest rate by the State Bank of Pakistan (SBP) and powered past the 44,000-point barrier primarily in the wake of an optimistic outlook of Pakistan’s economy issued by the central bank alongside the policy rate announcement. The SBP’s Monetary Policy Committee expected monetary settings of the country to remain broadly unchanged, citing that the end-goal of mildly positive real interest rate on a forward-looking basis was close to being met.

Bears took over control of the bourse on Thursday and pulled the benchmark index lower after yields in the secondary market remained largely stable against market expectations. With the increase in policy rate, players in the stock market had expected the yields to fall, however, the status quo dampened their interest, triggering a sell-off.

Read PSX likely to reach 50,000 by end-2022

Moreover, a slight decline in remittances in November 2021 signaled further weakening of the rupee, which pushed the market down.

The rupee-dollar parity worsened as it dropped to a new low of Rs178.04 against the greenback in the inter-bank market by the end of the week.

Buoyed by news of liquidity injection by the State Bank, the last day of the week saw the market regain confidence and enter the green zone to close the week on a positive note. During the week under review, average daily traded volumes surged 30% week-on-week to 265 million shares while average daily traded value climbed 13% week-on-week to $84 million.

In terms of sectors, positive contribution came from cement (282 points), technology and communication (173 points), textile composite (74 points), engineering (70 points) and refinery (50 points).

On the flip side, sectors which contributed negatively were commercial banks (208 points) and fertiliser (17 points).

Stock-wise positive contributors were TRG Pakistan (112 points), Lucky Cement (111 points), Maple Leaf Cement (45 points), Systems Limited (43 points) and Cherat Cement (36 points).

Meanwhile, stock-wise negative contribution came from MCB Bank (71 points), UBL (63 points) and Meezan Bank (29 points). Foreign selling continued during the week, which came in at $3.5 million compared to net selling of $0.99 million last week. Major selling was witnessed in cement firms ($1.9 million) and technology and communication companies ($1.9 million).

On the domestic front, buying was reported by companies ($5.1 million), followed by individuals ($2.7 million).

Published in The Express Tribune, December 19th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ