KSE-100 rebounds on Saudi aid

Investor optimism helps equity market make V-shaped recovery

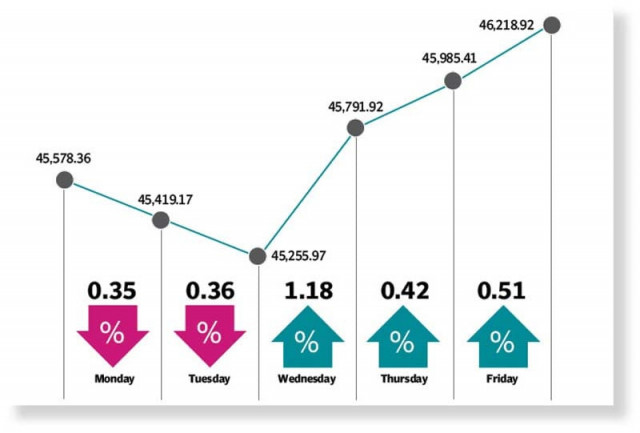

A V-shaped recovery was reflected at the Pakistan Stock Exchange in the tumultuous outgoing week as Saudi Arabia’s assistance for Pakistan revived investor interest and pushed the market upwards.

An overall optimism in later trading sessions of the week tossed the benchmark KSE-100 index skywards, which rose 641 points, or 1.4%, week-on-week to close at 46,184.71 points. “The overall sentiment was backed by a number of positive news reports,” stated JS Global analyst Waqas Ghani in a report. “A major trigger was the commitment of Saudi Arabia to provide a support package of $4.2 billion to Pakistan.”

The week began on a negative note and the market offloaded 350 points in a two-day bear run owing to speculation and the lack of developments about the resumption of International Monetary Fund’s (IMF) $6 billion loan programme.

Investor interest was dented as they expected the revival of the loan package with stringent conditions, which would further hurt the economy.

A faltering rupee renewed fears of a hike in petroleum product prices and kept market participants at bay. The currency nosedived to an all-time low of Rs175.27 against the US dollar as the delay in agreement between Pakistan and the IMF dented spirits in the foreign exchange market.

Saudi Arabia came to Pakistan’s aid midweek and announced a cash deposit of $3 billion in the State Bank of Pakistan to support the foreign exchange reserves in addition to a $1.2 billion oil supply facility on deferred payments. This news, in particular, proved a lifeline for the market and triggered a rebound as investors took the much-needed sigh of relief.

The index made a significant recovery in the final three sessions as investors got encouraged by the upbeat development.

However, technical glitches in the new trading system deployed by the bourse dampened the rally. Due to the malfunctioning of JADE Trading Terminal, market activity remained suspended for 2.5 hours on Wednesday while minor issues were faced throughout the week.

Besides, the stability in international commodity prices eased looming fears of an increase in imported inflation in Pakistan, which motivated market participants to take fresh positions.

Fuelling the rally, the rupee reversed its fall and recovered handsomely after the announcement of Saudi Arabian assistance.

“We expect the market to show positivity in the upcoming week attributable to the conclusion of talks with the IMF for the loan tranche,” stated a report of Arif Habib Limited.

“Moreover, support from Saudi Arabia in terms of cash deposit, IMF tranche and the upcoming Sukuk issue (which is expected to raise $1 billion) alongside suspension of debt repayment will ease the pressure off the country’s foreign exchange reserves.”

Average daily traded volumes fell 32% week-on-week to 203 million shares while average daily traded value declined 37% week-on-week to $40 million.

In terms of sectors, positive contribution came from engineering (8.9%), cement (7.6%), automobile (3%), oil and gas marketing companies (1.5%) and chemical (1.4%).

On the flip side, sectors that contributed negatively were refinery (-2.9%), exploration and production (-1%) and banks (-0.8%).

Stock-wise positive contributors were Mughal Iron and Steel Industries (16.8%), Packages Limited (14.6%), Shifa International Hospitals (12.5%), Shakarganj Limited (12.4%) and Pioneer Cement (10.8%).

Among individual stocks, negative contribution came from Searle (-22%), Lotte Chemical (-8.3%) and Avanceon (-7.6%).

Foreign selling continued during the week under review, which came in at $2.7 million compared to net selling of $7.3 million last week. Major selling was witnessed in commercial banks ($2.5 million) and fertiliser sector ($1.7 million).

Published in The Express Tribune, October 31st, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ