Four commercial banks – two of them owned by the government – have submitted bids to give a maximum of Rs30 billion in loans under the Kamyab Pakistan Programme over the next three months. Till the expiry of deadline for the submission of bids, National Bank of Pakistan, the Bank of Punjab, Askari Bank and Habib Bank Limited submitted their quotations to the Ministry of Finance. The participation of these banks had been anticipated due to the involvement of their management in designing the programme.

The bids will be opened today (Thursday). The Ministry of Finance had sought bids from commercial banks, Pakistan Mortgage Refinance Company (PMRC) and development finance institutions (DFIs) regulated by the State Bank of Pakistan (SBP) to act as wholesale lenders. However, no Islamic bank or DFI submitted bids for extending loans for a threemonth period. The banks offering the lowest interest rate above or below three-month Karachi Interbank Offered Rate (Kibor) will be declared as successful bidders. The government has also set the maximum cap on interest rate to be paid to these banks at three-month Kibor plus 9% per annum.

The financial sector faces an uncertain situation after the central bank increased the interest rate to 7.25% last month and also hinted at a further increase in November 2021. The Ministry of Finance on Wednesday wanted to borrow Rs100 billion through the fixed-rate Pakistan Investment Bonds (PIBs), however, the banks offered quite high rates, resulting in rejection of all bids for three, five and 10-year papers. Under the Kamyab Pakistan Programme, the Ministry of Finance arranged the first bidding for only a threemonth period.

READ Over 0.6m applications in Kamyab Jawan Programme rejected

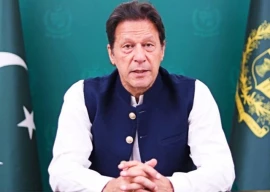

Under an agreement with the IMF, the government can give a maximum monthly guarantee of Rs5 billion and monthly loan disbursement can only be Rs10 billion, far lower than the Rs43 billion initially considered by the government. Earlier this month, Prime Minister Imran Khan launched the Kamyab Pakistan Programme to disburse interest-free or highly concessionary loans amounting to Rs228 billion among 738,000 borrowers for the remaining period of the government’s tenure. The programme – a brainchild of Finance Adviser Shaukat Tarin – promises to lift people out of poverty and low-income cycles by providing them interest-free loans of up to Rs500,000 for doing business and procuring inputs and machinery.

A subsidy of Rs37 billion will be given from the budget to pick the 15% interest cost. The cost of housing loans is estimated at 15%, of which 2% will be borne by the borrower and the remaining 13% will be picked by the government, according to a decision of the cabinet. Earlier, the government wanted to pay around 7.5% of the cost to banks and another 8% to microfinance institutions. Now, the commercial banks will bear the cost of microfinance out of the cost that they will collect from the government. The government will pick 50% of the losses sustained by the banks, which is half of what the cabinet had initially approved, but the limit has been reduced due to the IMF’s objections.

A major chunk – Rs152 billion, or 67% of the total loans – will go to 152,100 people to enable them to buy lowcost housing units during fiscal years 2021-22 and 2022- 23 – the last two years of the Pakistan Tehreek-e-Insaf (PTI) government. Under the programme, the government will disburse Rs52.3 billion, or 23% of the loans, among 348,480 beneficiaries in the remaining two years. Loans of up to Rs500,000 will be given. Similarly, Rs23.8 billion, or one-tenth of the total loans, will be disbursed among 237,000 farmers in the two years. With regard to loans of Rs228 billion, the PTI government will give Rs37 billion in subsidies to pick the interest cost.

COMMENTS (7)

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ

1732274008-0/Ariana-Grande-and-Kristin-Chenoweth-(1)1732274008-0-165x106.webp)

The statement However no Islamic bank or DFI submitted bids for extending loans for a threemonth period is incorrect because DFI has indeed submitted bid in the program