PSX surges in short trading week

Pakistan-IMF talks continued to influence investor interest at PSX

The Pakistan Stock Exchange experienced a tumultuous trading week, marked by uncertainty about the outcome of talks between Pakistan and the International Monetary Fund (IMF) coupled with Financial Action Task Force’s (FATF) review of Islamabad.

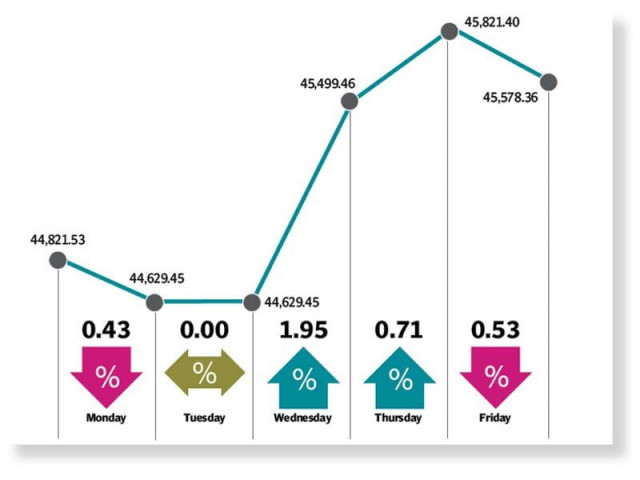

The market traded on both sides of the fence in the wake of a combination of positive and negative news flow during the short trading week that ended on October 22.

Bulls emerged dominant as they pushed the benchmark KSE-100 index up by 757 points, or 1.7%, to 45,578 points.

“Apart from attractive valuations, a spike in secondary market yields and some decrease in coal prices triggered bullish trend during the week,” said JS Global analyst Amreen Soorani.

The week commenced on a negative note on the back of uncertainty about the conclusion of Pakistan-IMF talks and following a massive surge in petroleum product prices, which raised concerns of inflation among investors.

Moreover, the weakening of macroeconomic cues further pushed the market down.

Market sentiment got better as trading resumed after a one-day holiday and the KSE-100 index skyrocketed in the next two sessions due to upbeat current account data.

Figures released by the State Bank of Pakistan (SBP), depicting a month-on-month recovery in the current account deficit in September 2021, painted a positive picture of the economy and aided the buying momentum at the bourse.

Encouraging progress in talks between Pakistan and the global lender, as hinted by the SBP governor and Adviser to Prime Minister on Finance Shaukat Tarin, revived hopes for a swift resumption of IMF loan programme and fuelled stock buying.

The last session of the week saw the market shed some of the gains after FATF kept Pakistan in its grey list, which shattered investor hopes. Market participants had pinned hopes on removal of the country from the grey list following implementation of a majority of points in the action plan laid down by the anti-money laundering and terror financing watchdog.

Fuelling the market’s fall, the rupee maintained its downtrend throughout the week and closed at Rs174 against the US dollar on Friday, sparking fears of a high inflation reading.

“We expect the market to remain positive in the upcoming week. As the IMF and Pakistan are expected to reach an agreement soon, the investor sentiment is anticipated to remain buoyant,” stated Arif Habib Limited in a report.

Average daily traded volumes fell 13% week-on-week to 299 million shares while average daily traded value declined 10% week-on-week to $64 million.

In terms of sectors, positive contribution came from commercial banks (463 points), cement (184 points), oil and gas exploration companies (137 points), fertiliser (107 points) and insurance (42 points).

On the flip side, sectors that contributed negatively were technology and communication (-155 points) and food and personal care products (-31 points).

Stock-wise positive contributors were HBL (187 points), UBL (150 points), Engro (99 points), Lucky Cement (72 points) and MCB (64 points).

Among individual stocks, negative contribution came from TRG Pakistan (-113 points), PSO (-27 points) and Systems Limited (-26 points).

Foreign selling continued during the week under review, standing at $7.3 million compared to net selling of $13.3 million last week. Major selling was witnessed in fertiliser firms ($4.5 million) and commercial banks ($3.8 million).

On the domestic front, buying was reported by insurance companies ($4.6 million), followed by other investors ($2.5 million).

Other major news of the week included OGDC discovering gas reserves in Balochistan’s Kohlu district, the government securing LNG from Qatar to meet winter demand and auto financing reaching a record high in September.

Published in The Express Tribune, October 24th, 2021.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ