More than a dozen heads of state and government, from Jordan to Azerbaijan, Kenya and the Czech Republic, have used offshore tax havens to hide assets worth hundreds of millions of dollars, according to a far-reaching new investigation by the ICIJ media consortium.

The so-called "Pandora Papers" investigation -- involving some 600 journalists from media including The Washington Post, the BBC and The Guardian -- is based on the leak of some 11.9 million documents from 14 financial services companies around the world.

Some 35 current and former leaders are featured in the latest vast trove of documents analyzed by the International Consortium of Investigative Journalists (ICIJ) -- facing allegations ranging from corruption to money laundering and global tax avoidance.

Read more: Nearly 700 Pakistanis named in 'Pandora Papers'

In most countries, the ICIJ stresses, it is not illegal to have assets offshore or to use shell companies to do business across national borders.

But such revelations are no less of an embarrassment for leaders who may have campaigned publicly against tax avoidance and corruption, or advocated austerity measures at home.

The documents notably expose how Jordan's King Abdullah II created a network of offshore companies and tax havens to amass a $100 million property empire from Malibu, California to Washington and London.

The Jordanian embassy in Washington declined to comment, but the BBC cited lawyers for the king saying all the properties were bought with personal wealth, and that it was common practice for high profile individuals to purchase properties via offshore companies for privacy and security reasons.

Family and associates of Azerbaijani President Ilham Aliyev -- long accused of corruption in the central Asian nation -- are alleged to have been secretly involved in property deals in Britain worth hundreds of millions.

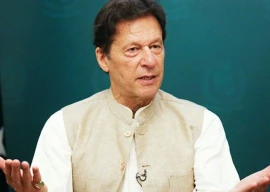

Also read: PM Imran vows to probe all Pakistanis named in Pandora Papers

And the documents also show how Czech Prime minister Andrej Babis -- who faces an election later this week -- failed to declare an offshore investment company used to purchase a chateau worth $22 million in the south of France.

In total, the ICIJ found links between almost 1,000 companies in offshore havens and 336 high-level politicians and public officials, including more than a dozen serving heads of state and government, country leaders, cabinet ministers, ambassadors and others.

More than two-thirds of the companies were set up in the British Virgin Islands.

The former British prime minister Tony Blair -- who has been critical of tax loopholes -- also appears in the files which detail how he and his wife Cherie legally avoided paying stamp duty on a multi-million pound property in London, by buying the offshore company that owned it.

As well as politicians, the public figures exposed included the Colombian singer Shakira, the German supermodel Claudia Schiffer and the Indian cricket legend Sachin Tendulkar.

Among the other revelations from the ICIJ investigation:

-- Russian President Vladimir Putin is not directly named in the files, but he is linked via associates to secret assets in Monaco.

-- Kenyan President Uhuru Kenyatta -- who has campaigned against corruption and for financial transparency -- is alleged along with several family members of secretly owning a network of offshore companies.

-- Ukraine's President Volodymyr Zelensky allegedly transferred his stake in a secret offshore company just before he won the 2019 election.

-- And the former head of the International Monetary Fund, Dominique Strauss-Kahn, apparently channelled several million dollars in consulting fees to a tax-exempt Moroccan company.

The "Pandora Papers" are the latest in a series of mass ICIJ leaks of financial documents, from LuxLeaks in 2014, to the 2016 Panama Papers -- which triggered the resignation of the prime minister of Iceland and paved the way for the leader of Pakistan to be ousted.

They were followed by the Paradise Papers in 2017 and FinCen files in 2020.

The documents behind the latest investigation are drawn from financial services companies in countries including the British Virgin Islands, Panama, Belize, Cyprus, the United Arab Emirates, Singapore and Switzerland.

1730884134-0/BeFunky-collage-(26)1730884134-0-165x106.webp)

1730979821-0/Copy-of-Untitled-(20)1730979821-0-270x192.webp)

1730980693-0/Untitled-design-(44)1730980693-0-270x192.webp)

1730974944-0/BeFunk_§_]-(48)1730974944-0.jpg)

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ